Sensational Info About Closing Entry For Retained Earnings Required Financial Statements Under Gaap

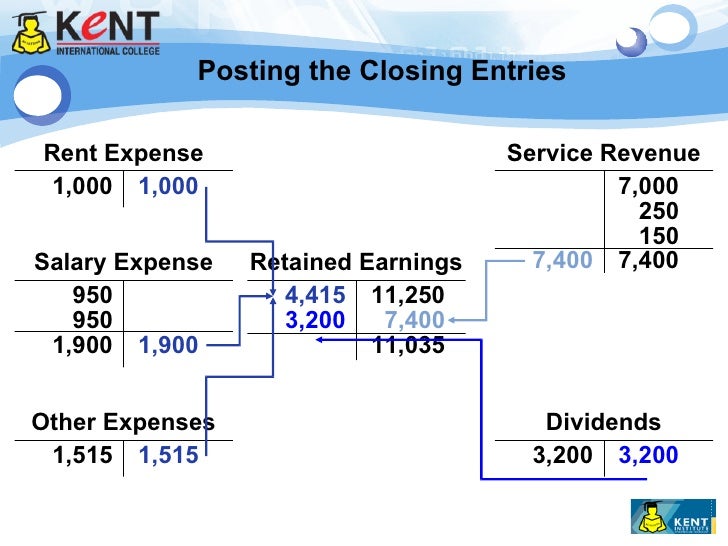

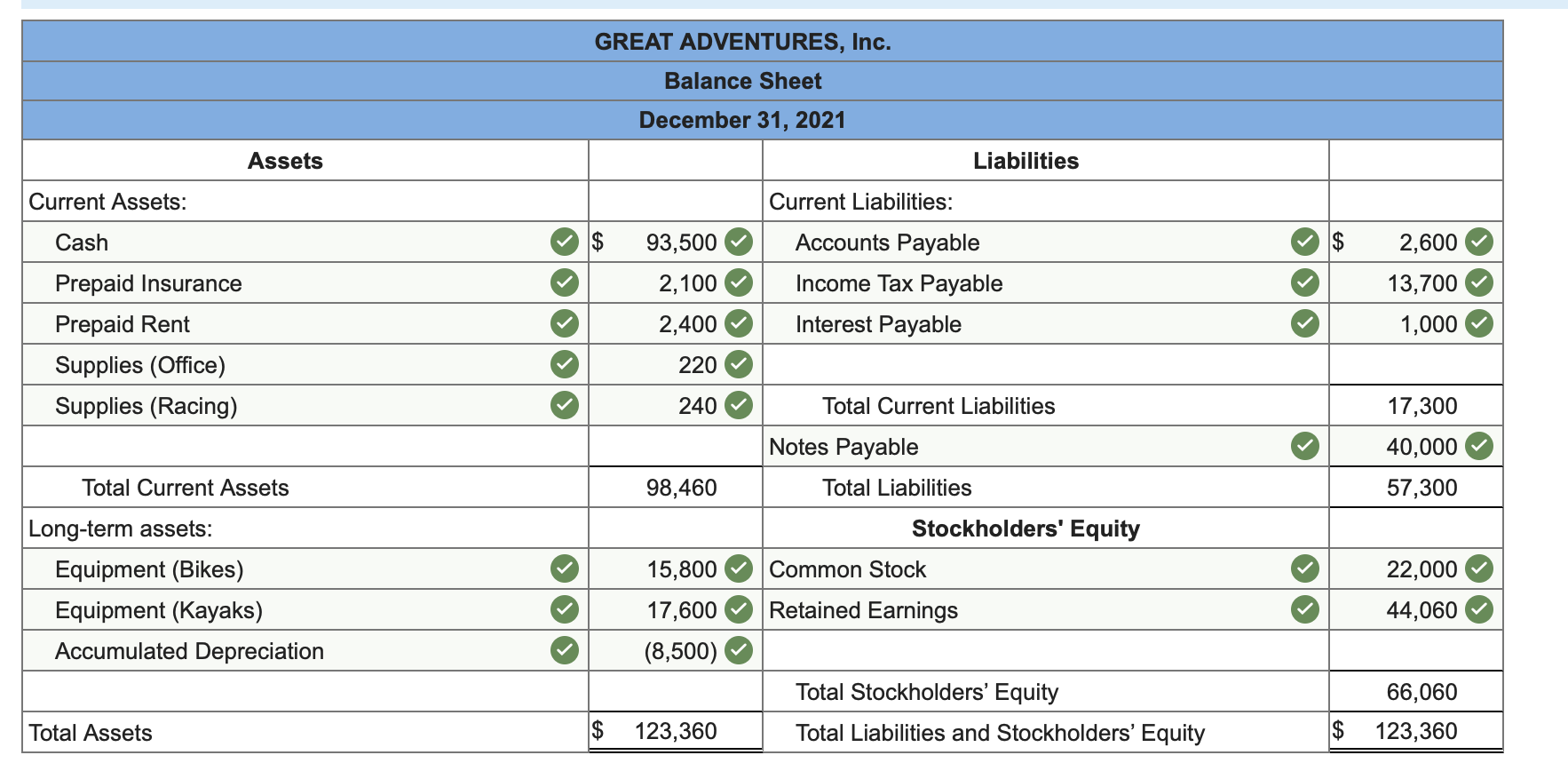

The retained earnings account is updated from the statement of change in equity accounts.

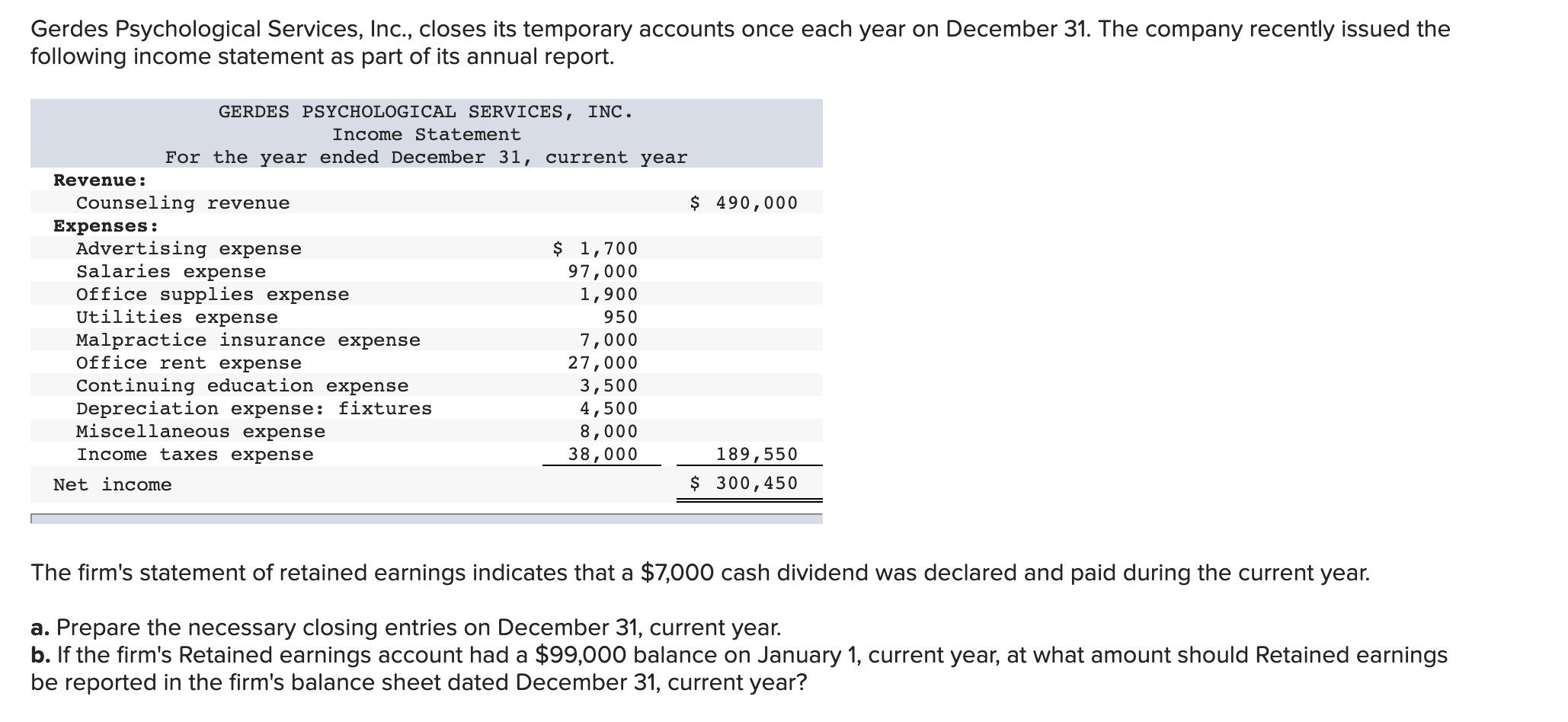

Closing entry for retained earnings. Find out the four steps, the temporary accounts, and the example of closing. The purpose of closing entries. The last entry is to close out dividends.

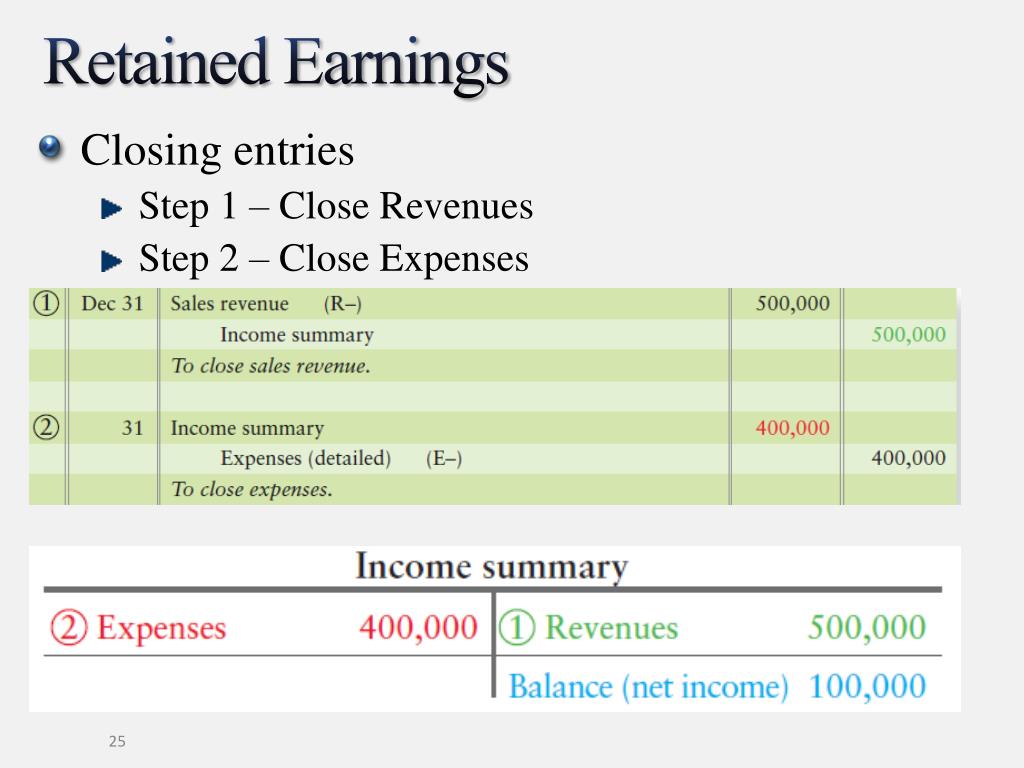

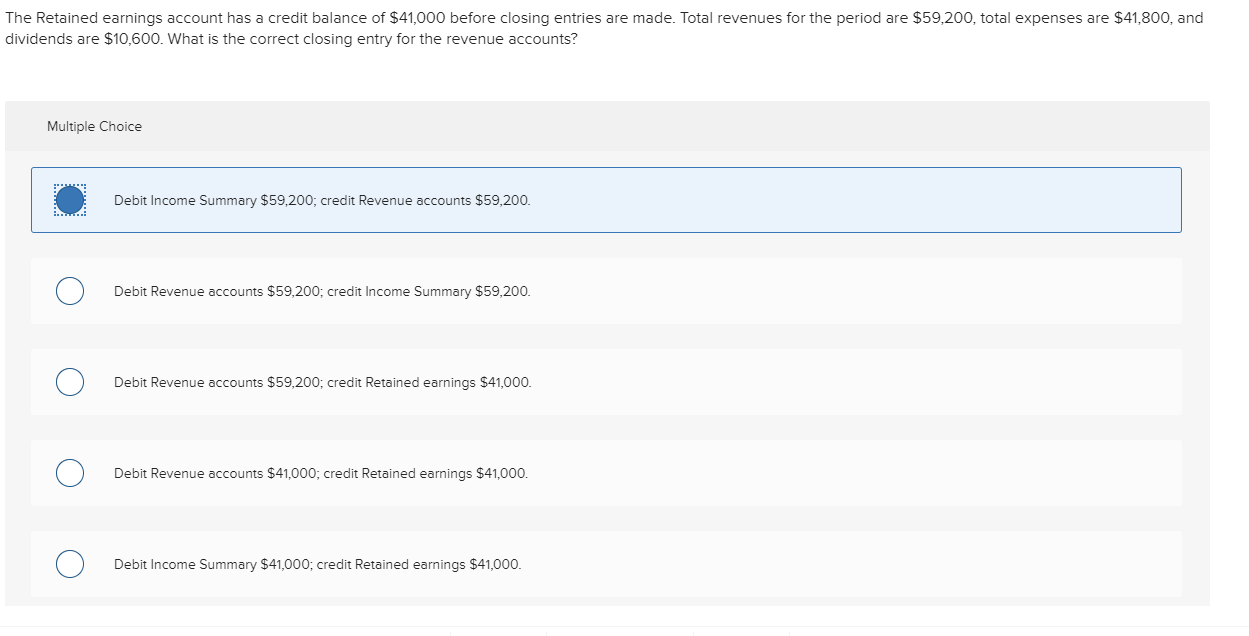

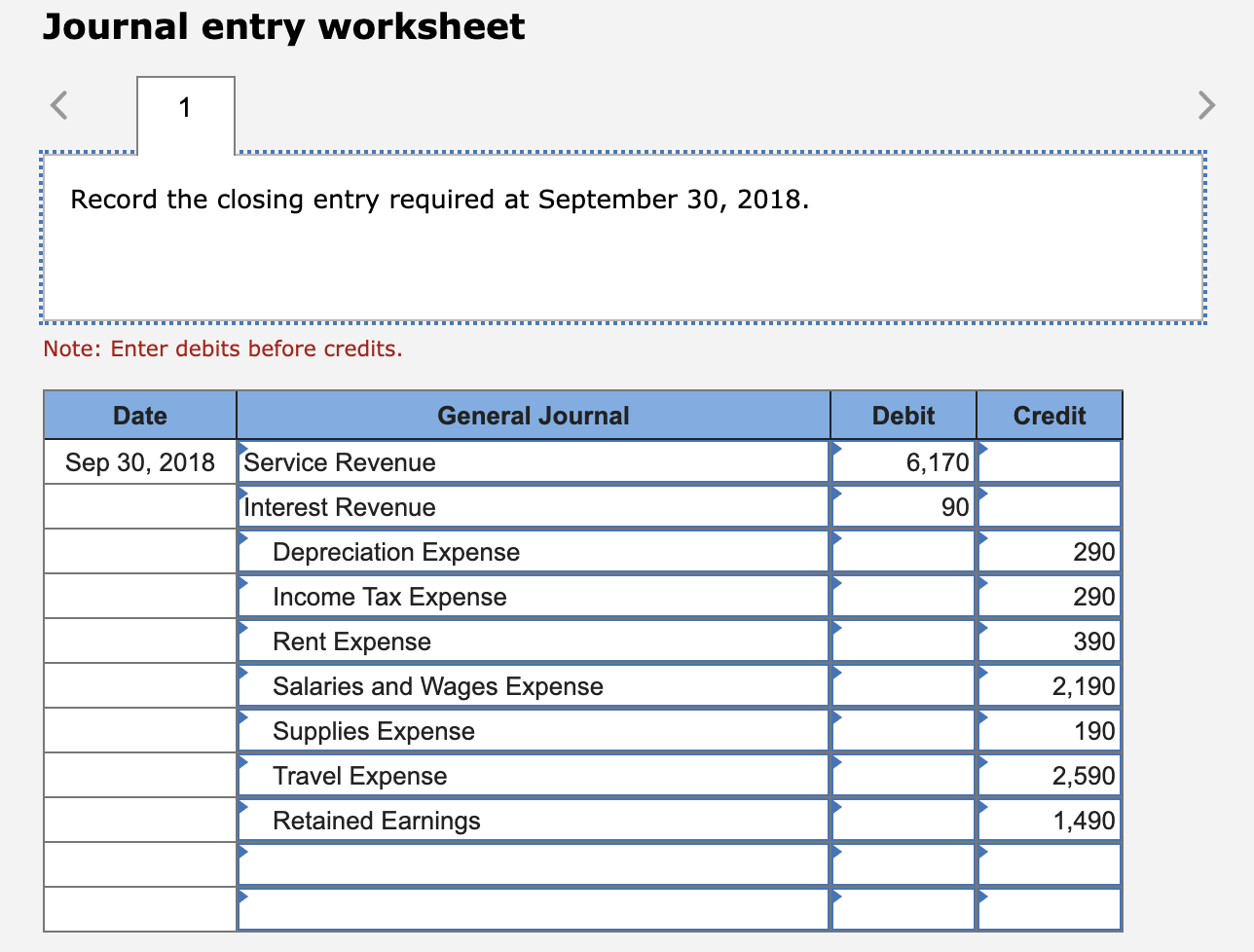

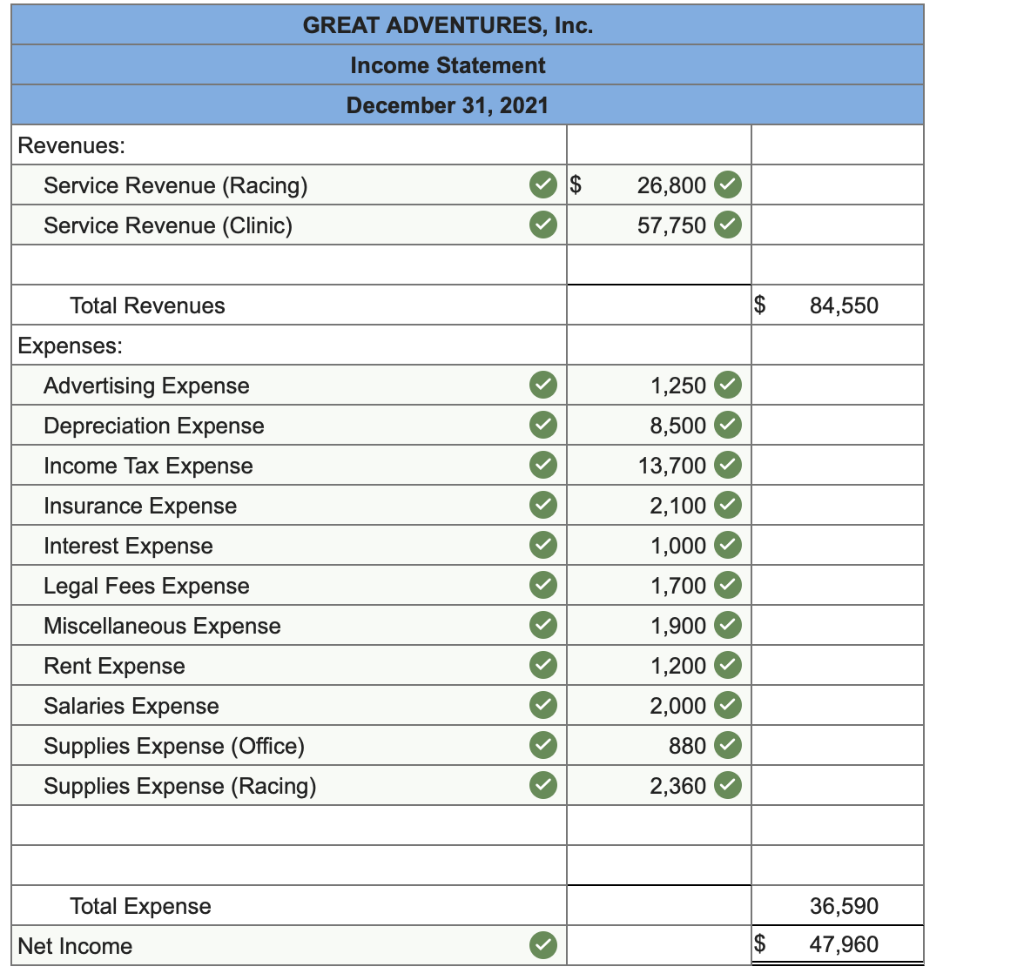

If your company doesn’t have dividends then you won’t need to do this step. Close revenue accounts clear the balance of the revenue account by debiting revenue and crediting income summary. Closing the net income to retained earnings if the company makes a profit during the year, it can make the closing entry for net income by debiting the income summary account.

That is the closing balance of the retained earnings account as in the previous accounting period. Closing entries, with examples. There may be a scenario where a business’s revenues are greater.

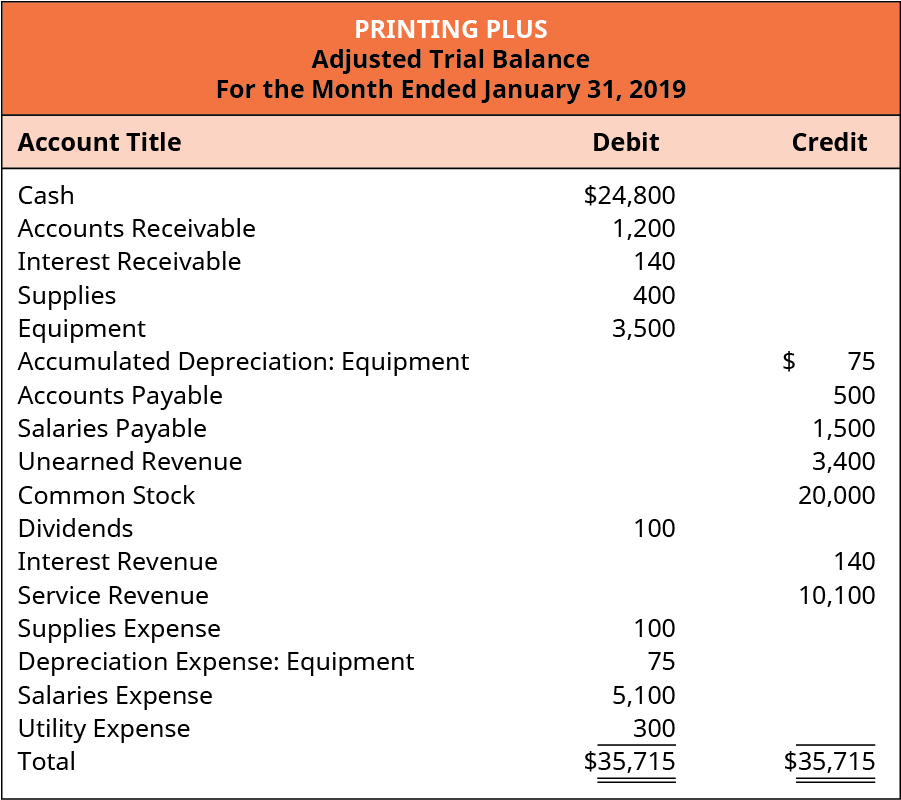

Having a zero balance in these accounts is important so a company can compare performance. Learn how to close the books at the end of a reporting period using closing entries, journal entries that empty temporary accounts and transfer their balances into. The income summary cannot be found as it is a temporary account created during the closing entry process to hold the balances of both the revenue and.

For instance, if you prepare a yearly balance sheet, the. The revenue and expense accounts and the dividend account impact. Closing, or clearing the balances, means returning the account to a zero balance.

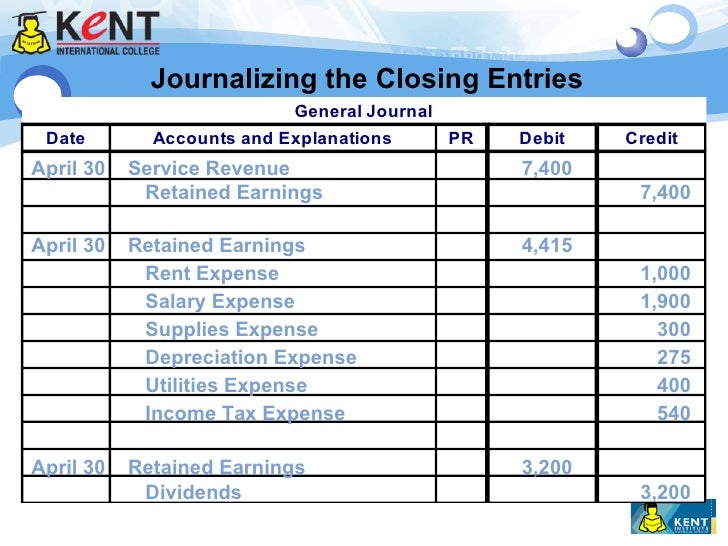

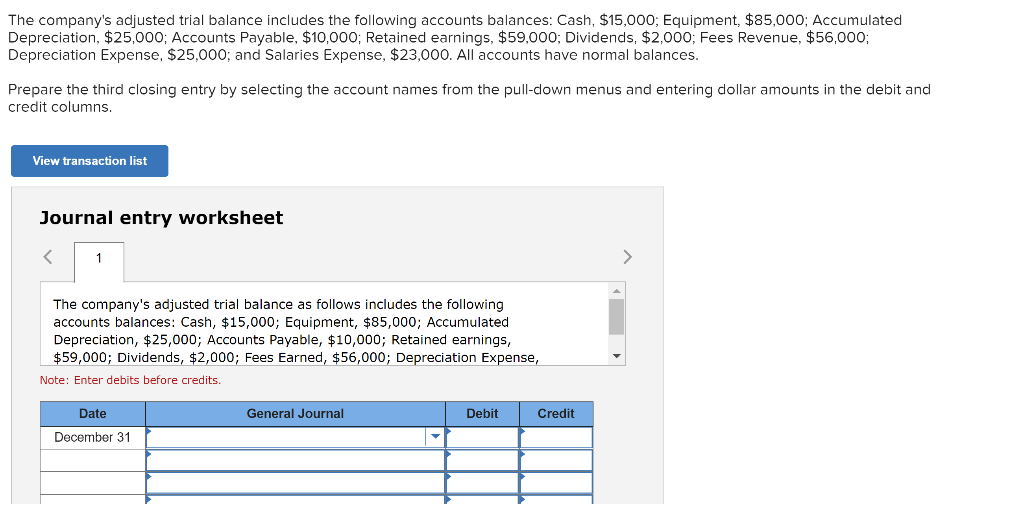

Example of a closing entry 1. Learn how to prepare closing entries for retained earnings at the end of an accounting period. A business will use closing entries in order to reset the balance of temporary accounts to zero.

Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. For example, if a business made $20,000 in. At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be.

Sum of revenues and sum of expenses can also be found on the business's ledger as two of its major closing entries. See examples of journal entries, adjusted trial balance, and closing trial balance. Closing entries are journal entries posted at the end of an accounting period to reset temporary accounts to zero and transfer their balances to a permanent.