Fantastic Tips About Contents Of Profit And Loss Account Operating Activities Definition

The report is split between the top half of the p&l or above the line.

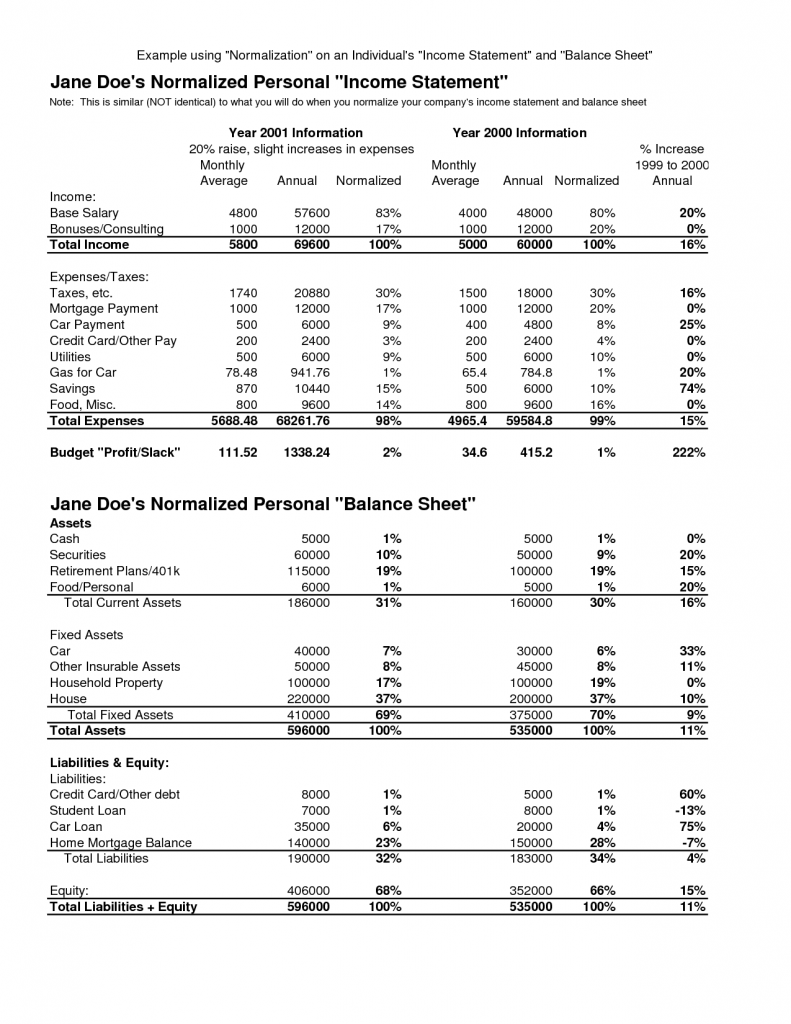

Contents of profit and loss account. The segregated view of the financial inflows and outflows enables organizations to track their financial performance and implement ways to keep up the same or improve it. A profit and loss account will include your credits (which includes turnover and other income) and deduct your debits (which includes allowances, cost of sales and overheads). To ensure compliance with external and internal accounting reporting requirements in a timely and accurate manner.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. Create the report either annually, quarterly, monthly or even weekly. The profit and loss account is compiled to show the income of your business over a given period of time.

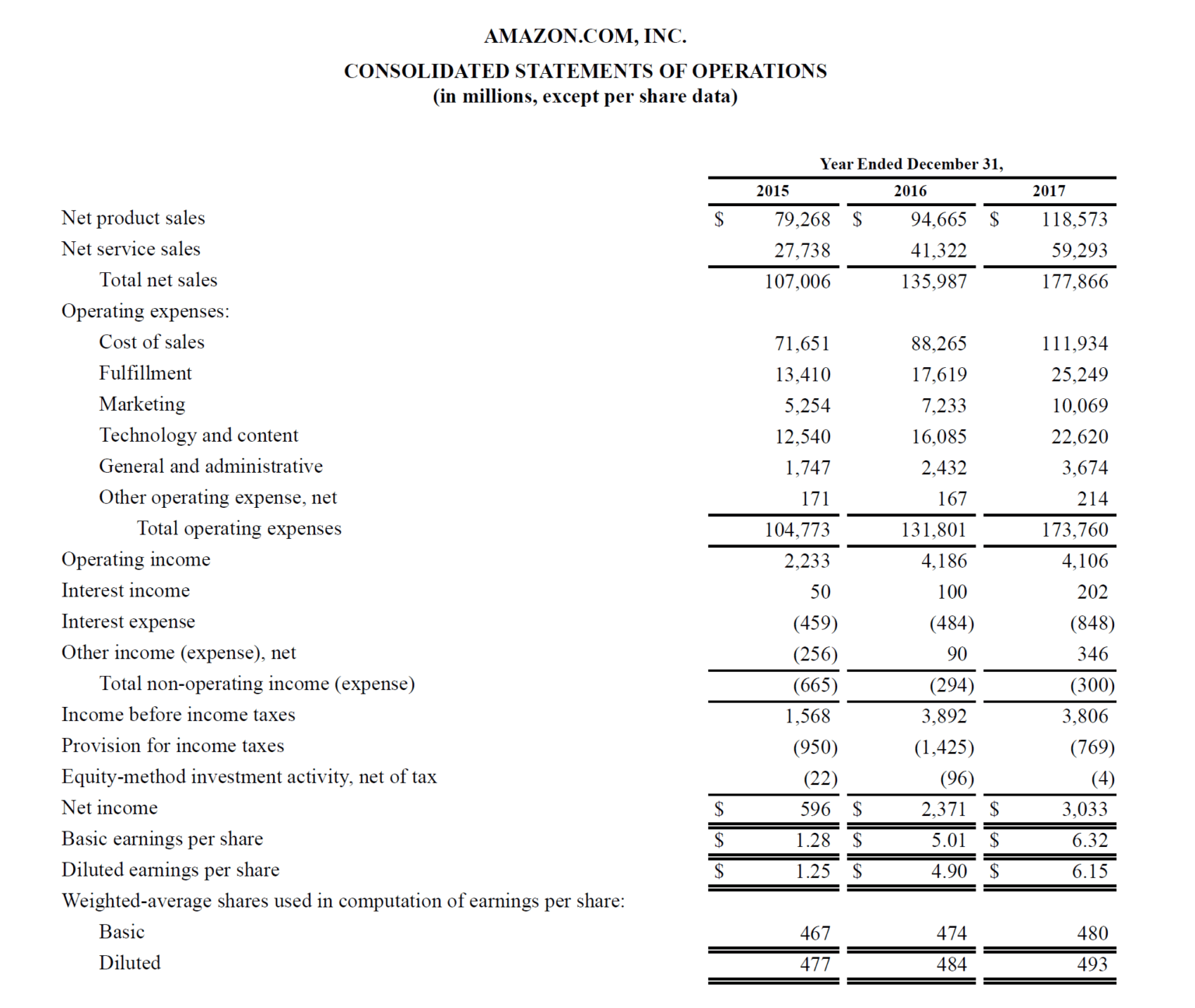

Basic income statements contain the following elements: Revenue, expenses, and net income. A profit and loss account (also referred to as p&l or a profit and loss statement) provides you with an overview of your company’s revenue and expenses over a given period of time.

Feb 22, 202406:31 pst. It shows all the company’s income and expenses incurred over a given period. Overview profit and loss account quick reference 1 an account in the books of an organization showing the profits (or losses) made on its business activities with the deduction of the appropriate expenses.

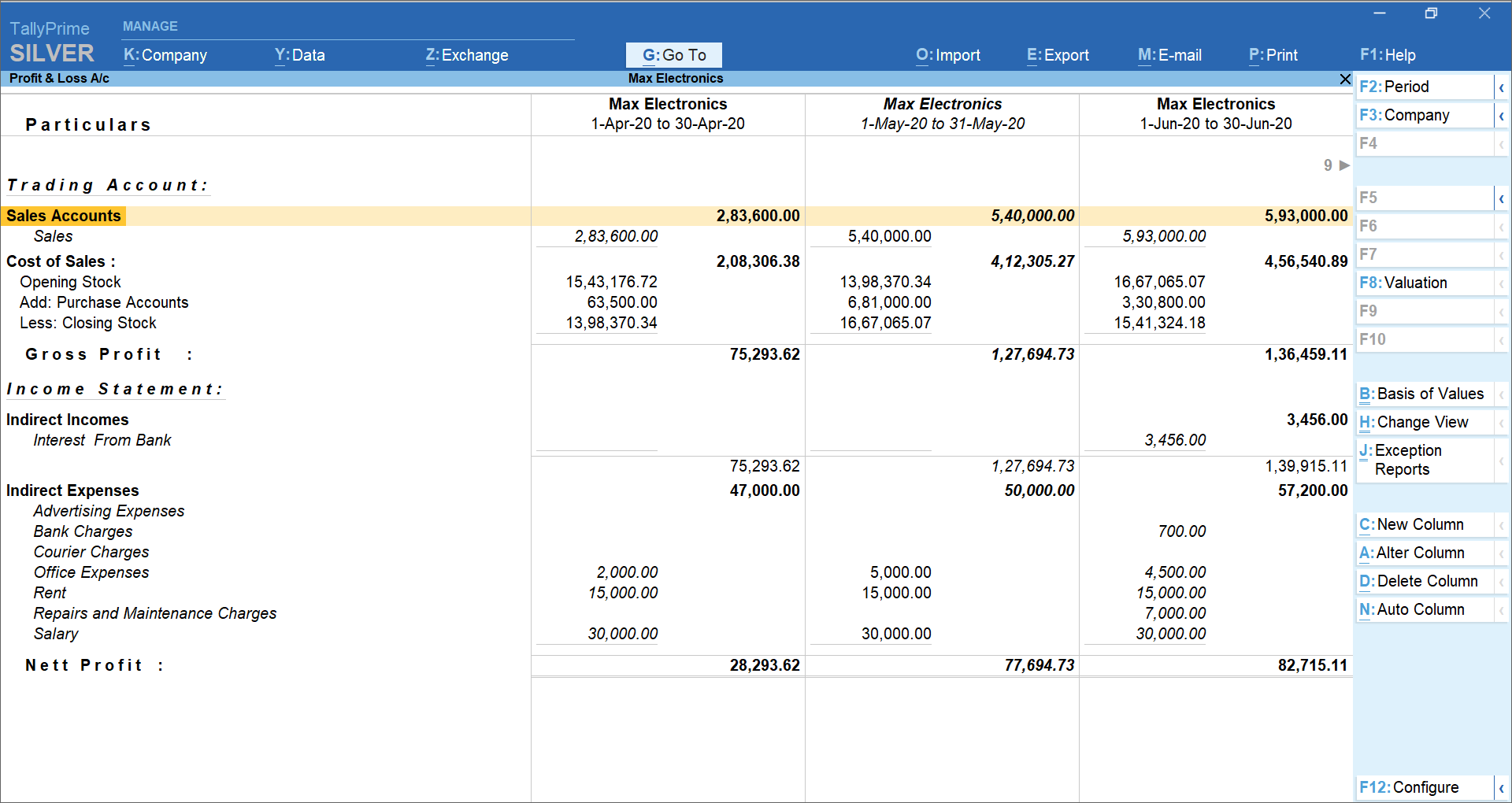

A p&l statement provides information about whether a company can. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). The above is an example shows the contents of a profit and loss account.

The p&l statement is one of three financial. In other words, from what your goods cost you, take away what you managed to sell them for. Balance sheet vs profit & loss account

What is a profit and loss statement? It is a snapshot of the company’s overall performance during the financial. On that basic level, profit and loss is derived from taking your costs away from your sales.

What is a profit and loss account? Your key responsibilities:your responsibilities include, but are not. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

Categorising costs between cost of sales and operating costs.a profit and loss account starts with the trading account and then takes into account all the other. It's a straightforward presentation of a. The p&l account is a component of final accounts.

Only indirect expenses are shown in this account. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business.