Casual Info About Foreign Exchange Gains And Losses Accounting Treatment Unadjusted Trial Balance Worksheet

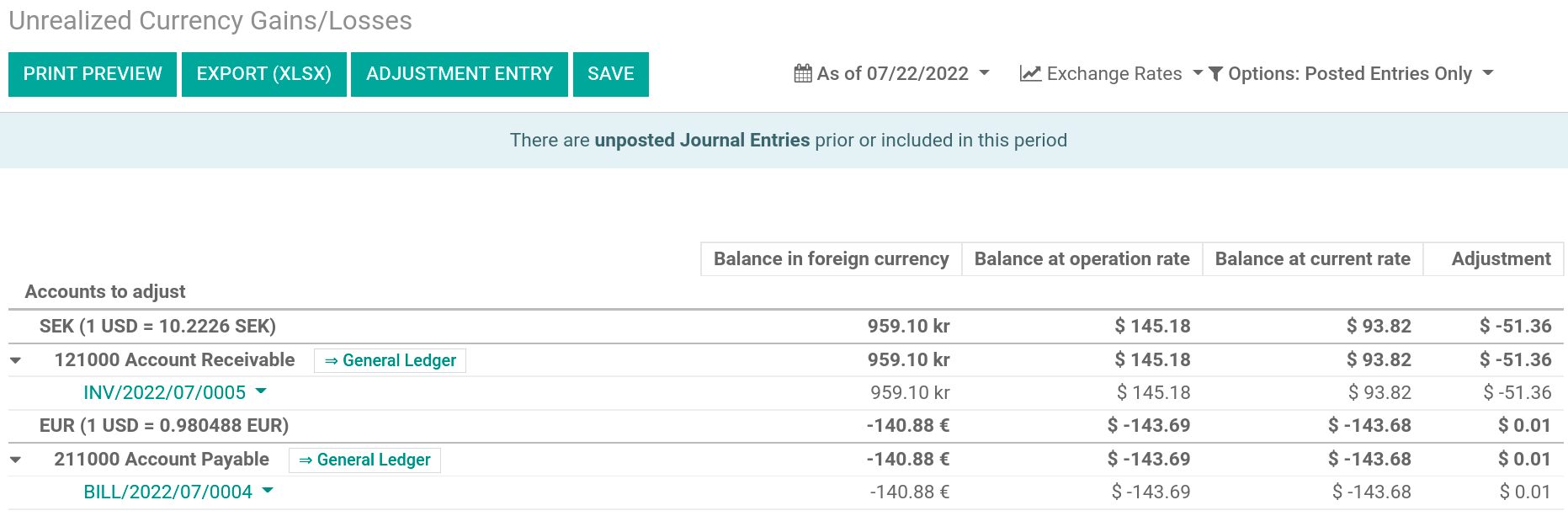

At every balance sheet date:

Foreign exchange gains and losses accounting treatment. Overview ias 21 the effects of changes in foreign exchange rates outlines how to account for foreign currency transactions and operations in financial statements, and also how to translate financial statements into a presentation currency. The revised ias 21 also incorporated the guidance contained in three related interpretations (sic‑11 foreign exchange—capitalisation of losses resulting from severe currency devaluations, sic‑19 reporting currency—measurement and presentation of financial statements under ias 21 and ias 29 and sic‑30 reporting currency—translation. Realized gains or losses are the gains or losses on transactions that.

Ias 21 does not specify where exchange gains and losses should be shown in the statement of comprehensive income. Foreign exchange gains and losses are referred to as losses that are incurred when a company purchases goods and services in foreign currency. It sells the subsidiary on 31 december 2008 for €45m.

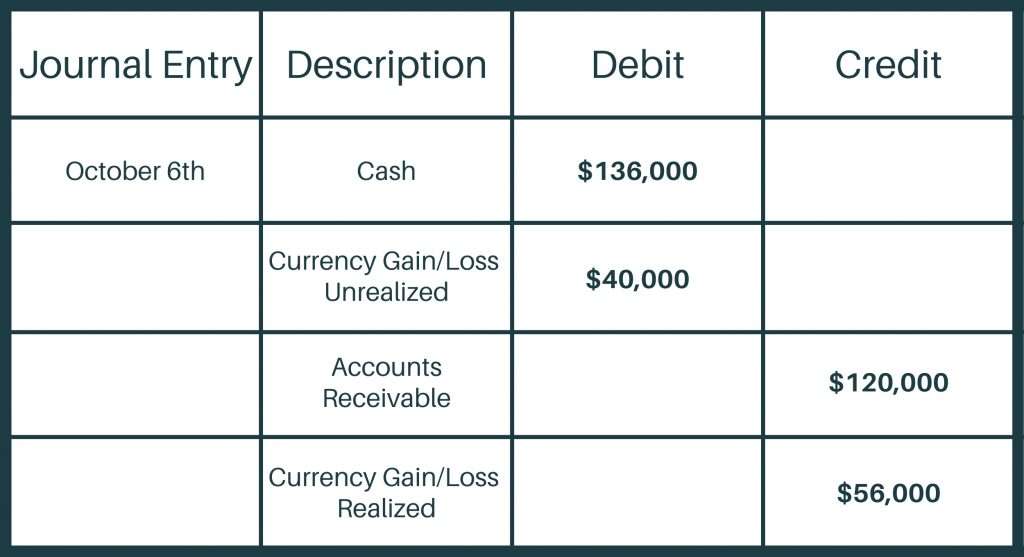

Realized transactions impact income statements within the accounting period. When a foreign currency transaction is designed to be an economic hedge of a net investment in a foreign entity, and is effective as such; The word ‘profits’ connotes actual or realised and not potential or anticipated.

Accounting policies, changes in accounting estimates and errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance. Tax treatment of foreign exchange gains or losses in the sotravic case, the arc reproduced the following two cardinal principles of tax law: Though, in specific circumstances, the closing rate might not exhibit with reasonable accuracy amount in the reporting currency which is.

Read our posts accumulated other comprehensive income: Overview ias 21 the effects of changes in foreign exchange rates outlines how to account for foreign currency transactions and operations in financial statements, and also how to translate financial statements into a presentation currency. Definition, example, format, calculation realized gains/losses

History prior to fa 1993 there were no special tax rules to deal with exchange gains and losses on debts and currency contracts. Realized and unrealized foreign exchange gain/loss. The two situations in which you should not recognize a gain or loss on a foreign currency transaction are:

Asc 830 defines transaction gains and losses. A change in the fair value of securities available for sale is recognised on equity accounts in accounting group 41. A chapter on foreign currency accounting issues, in this title providing accountants and auditors with easy to follow guidance on the preparation of group accounts in line with uk gaap.

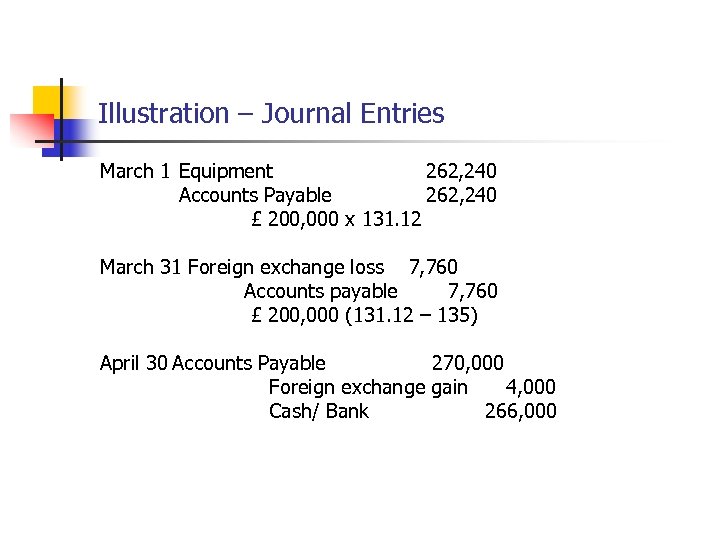

Other topics not addressed include f/x issues regarding The accounting treatment of the effects of changes in foreign exchange rates has been outlined in mfrs 121 which is equivalent to ias 21. The accounting treatment for both of these is as below.

Unrealized transactions spanning periods affect equity on balance sheets; Realized and unrealized gains or losses from foreign currency transactions differ depending on whether or not the transaction has been completed by the end of the accounting period. Foreign currency transaction gains and losses reported on the income statement should be reflected as a reconciling item from net income to cash flows from operating activities

The currency fluctuation exists on a normal basis, and as a result of this fluctuation, there is a difference in monetary assets and liabilities, which. Foreign currency accounting. Accounting treatment under frs 102 frs 102 requires entities to initially translate foreign currency transactions in an entity’s functional currency using the spot exchange rate, although an average rate for a week or month may be used if the exchange rate does not fluctuate significantly.