Wonderful Info About Accounting For Cash And Equivalents Certificate Of Deposit On Balance Sheet

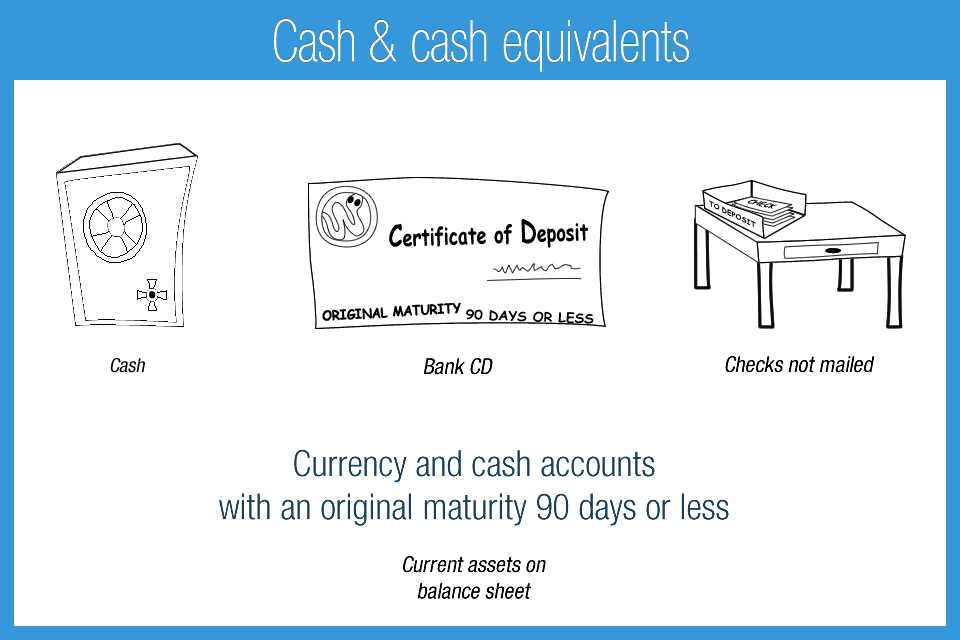

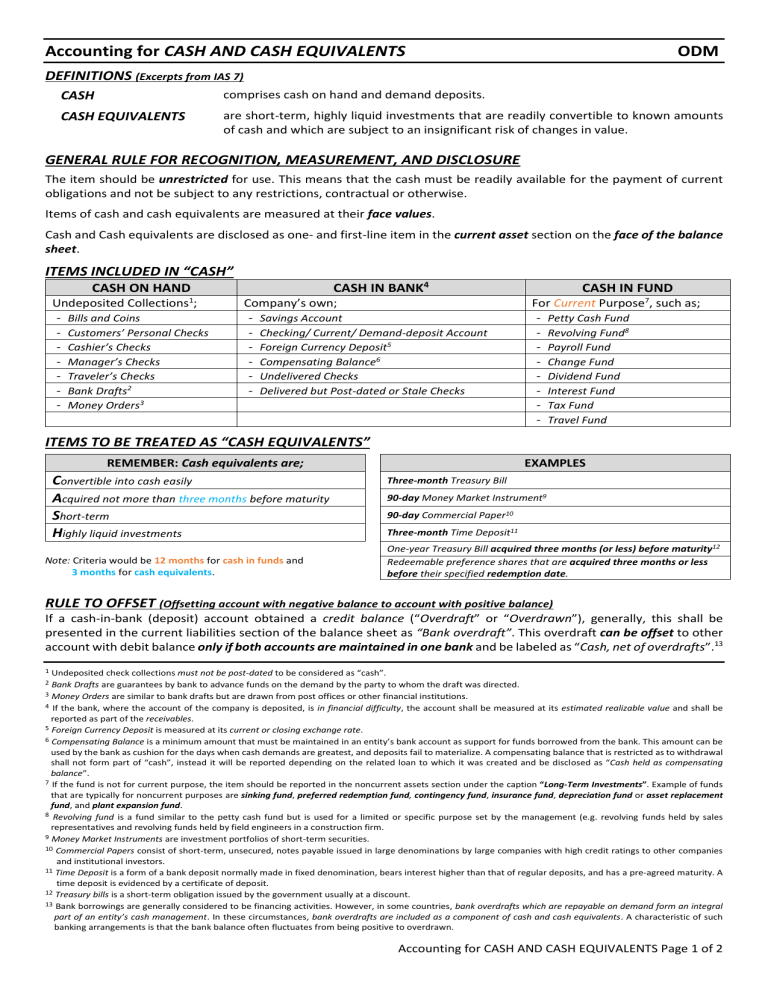

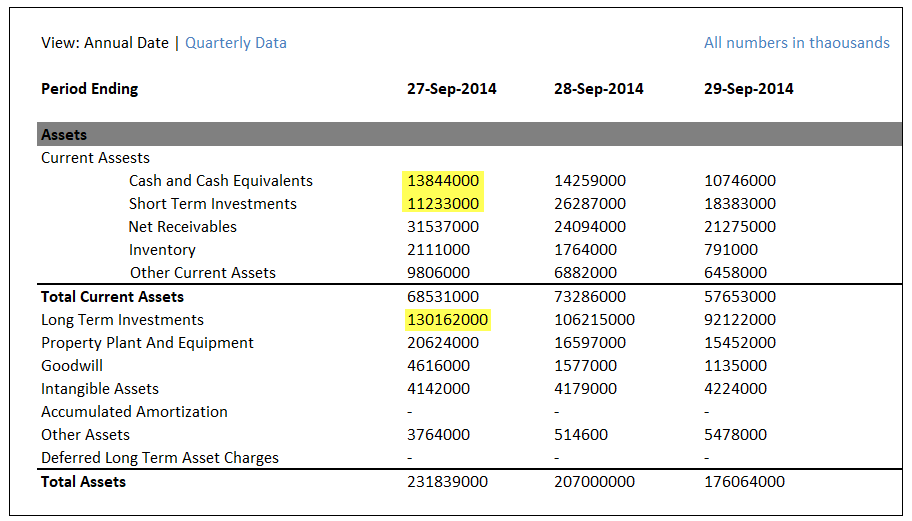

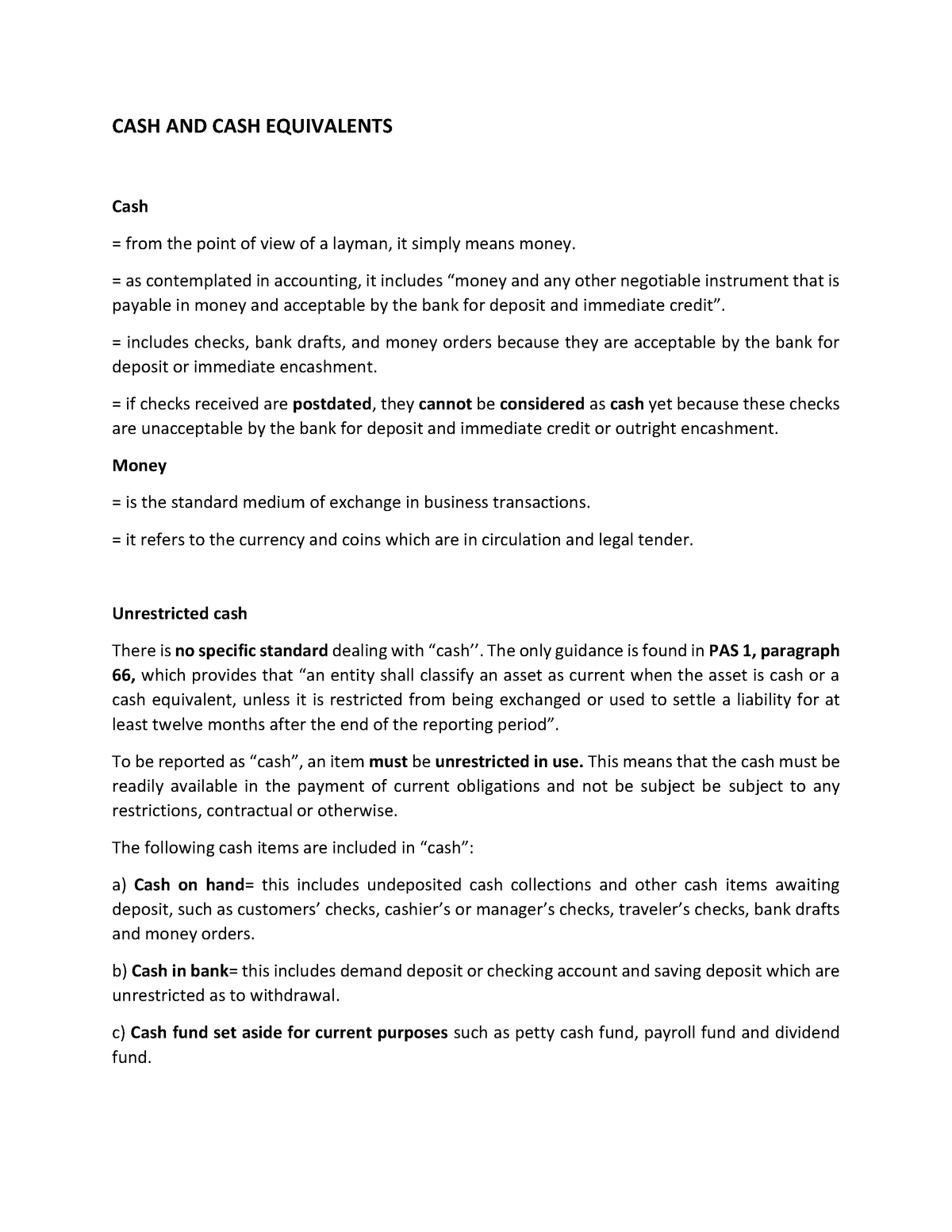

Cash and cash equivalents refers to the line item on the balance sheetthat reports the value of a company's assets that are cash or can be converted into cash immediately.

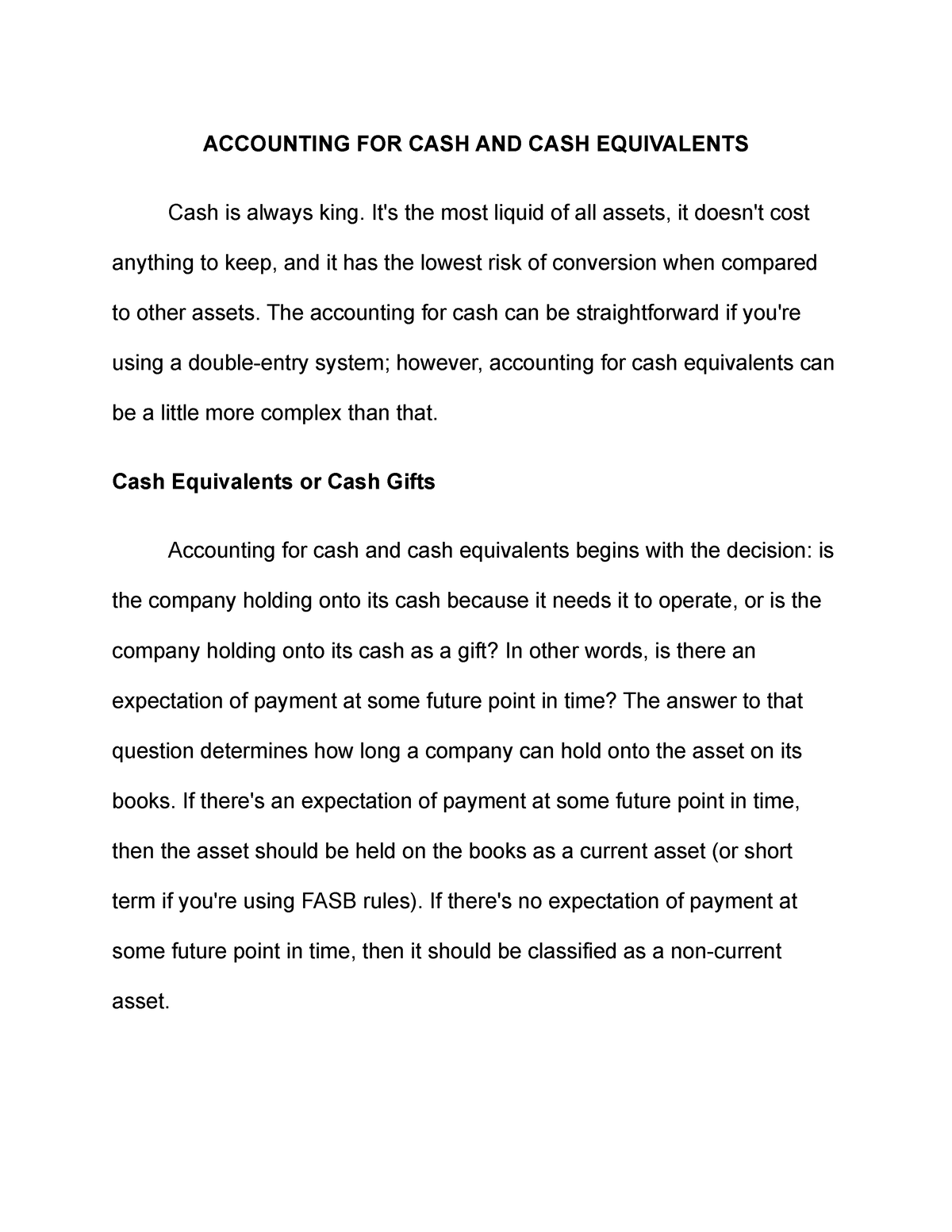

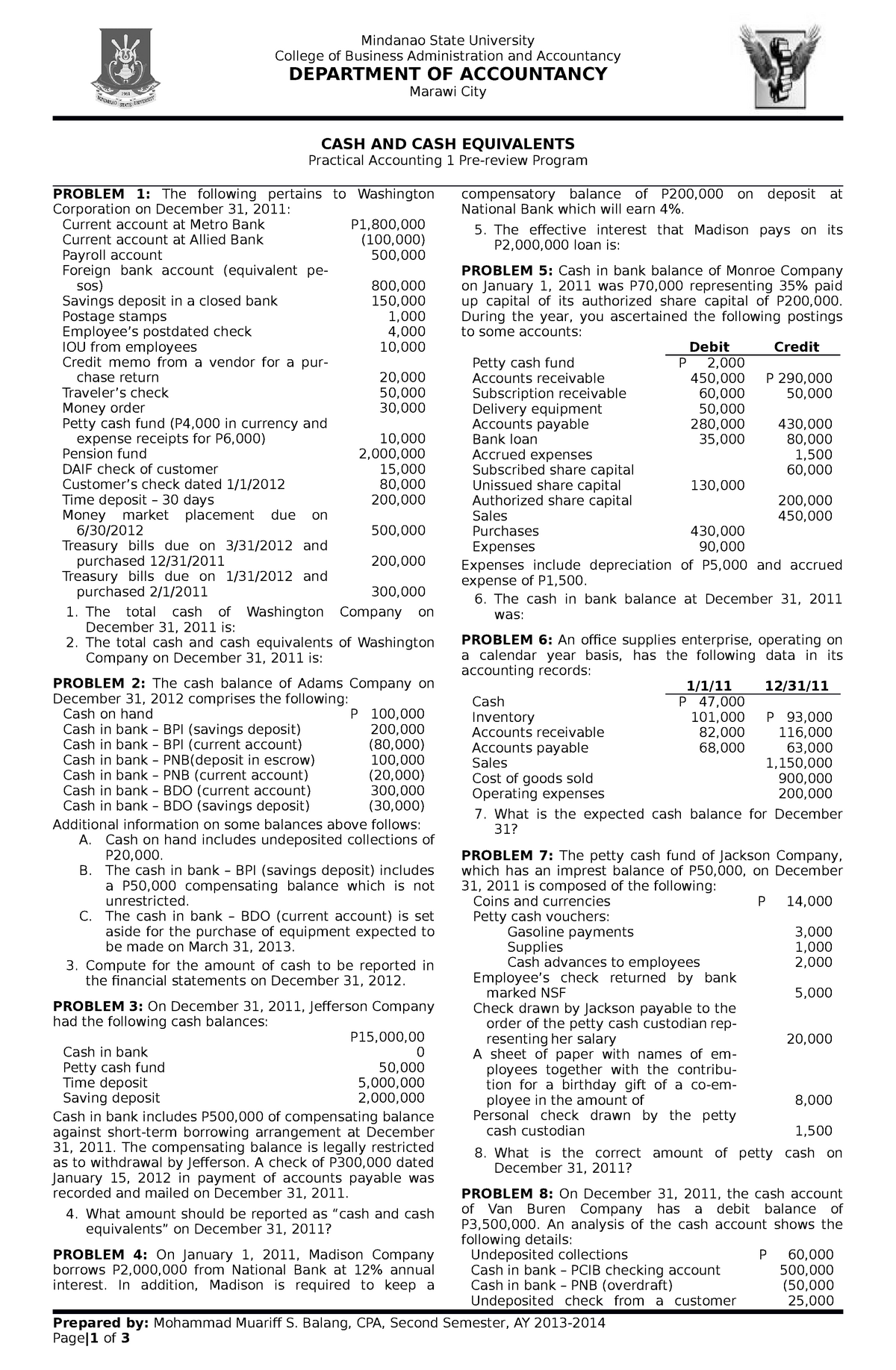

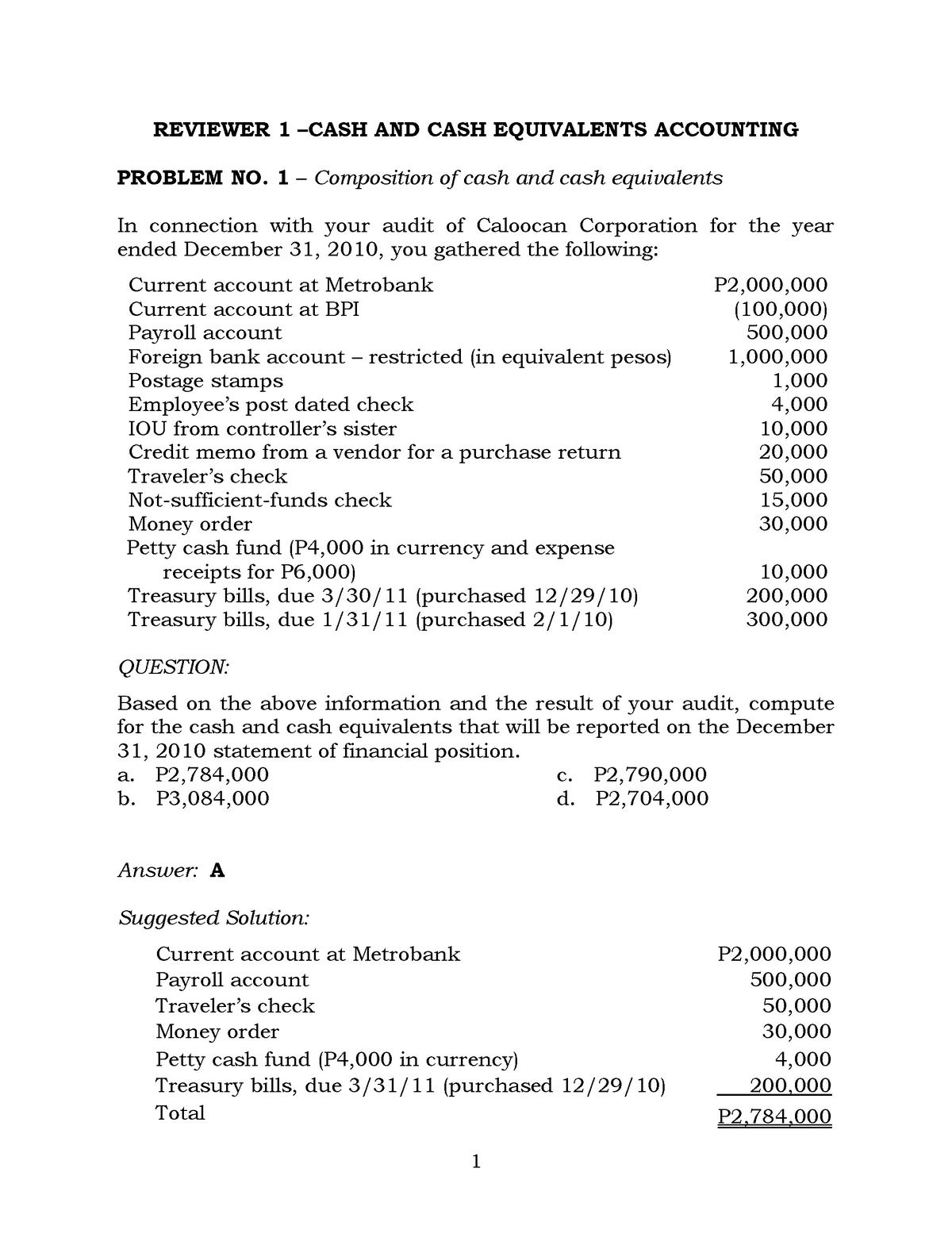

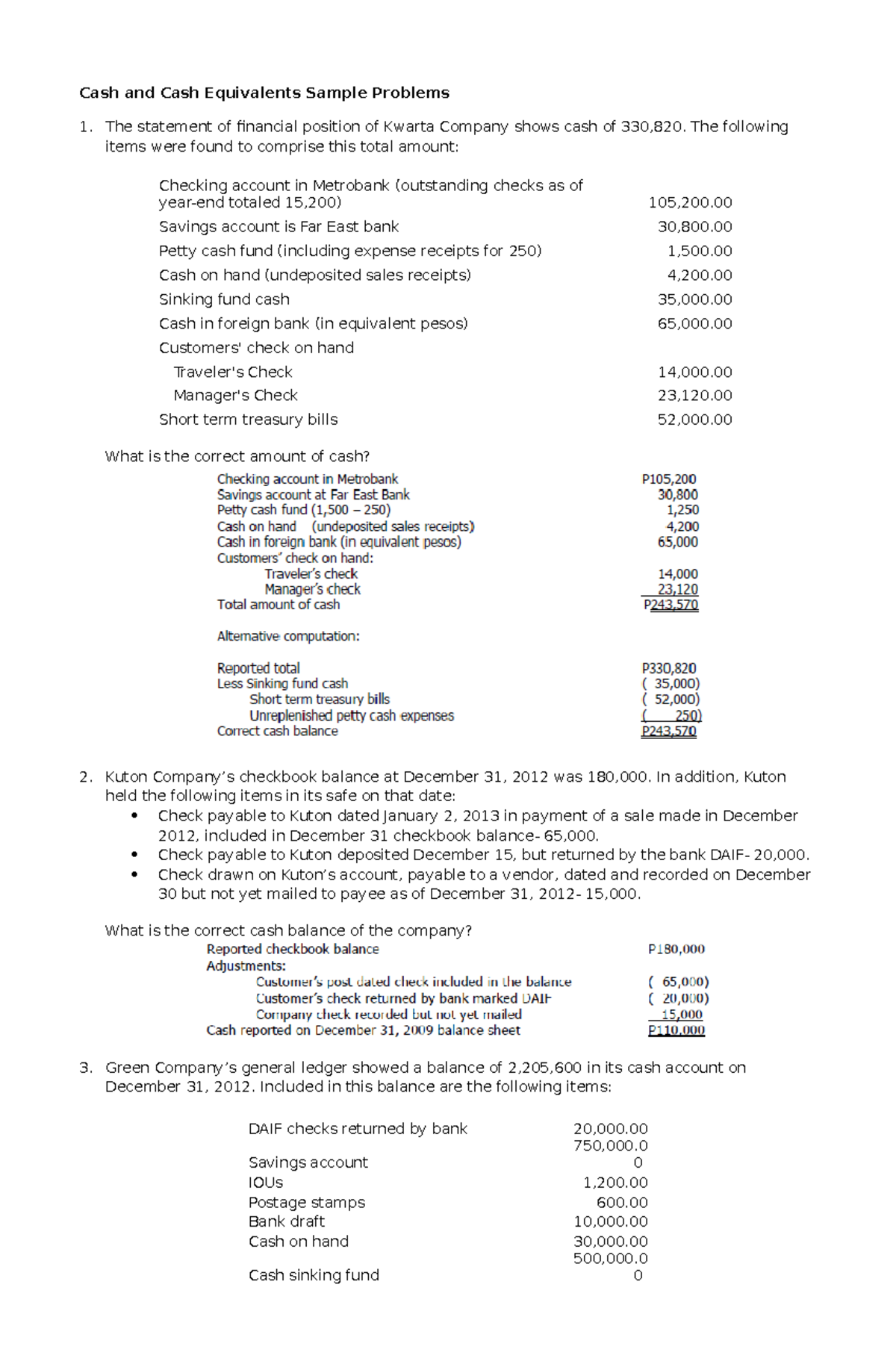

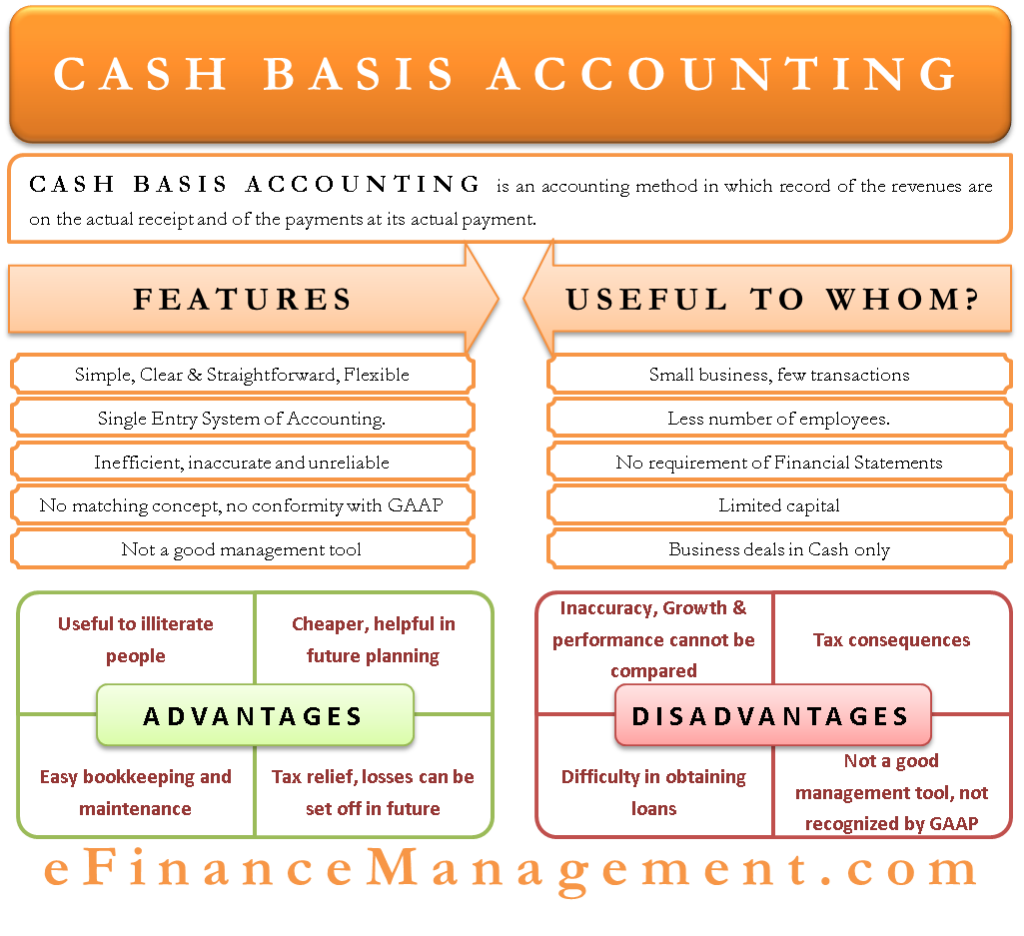

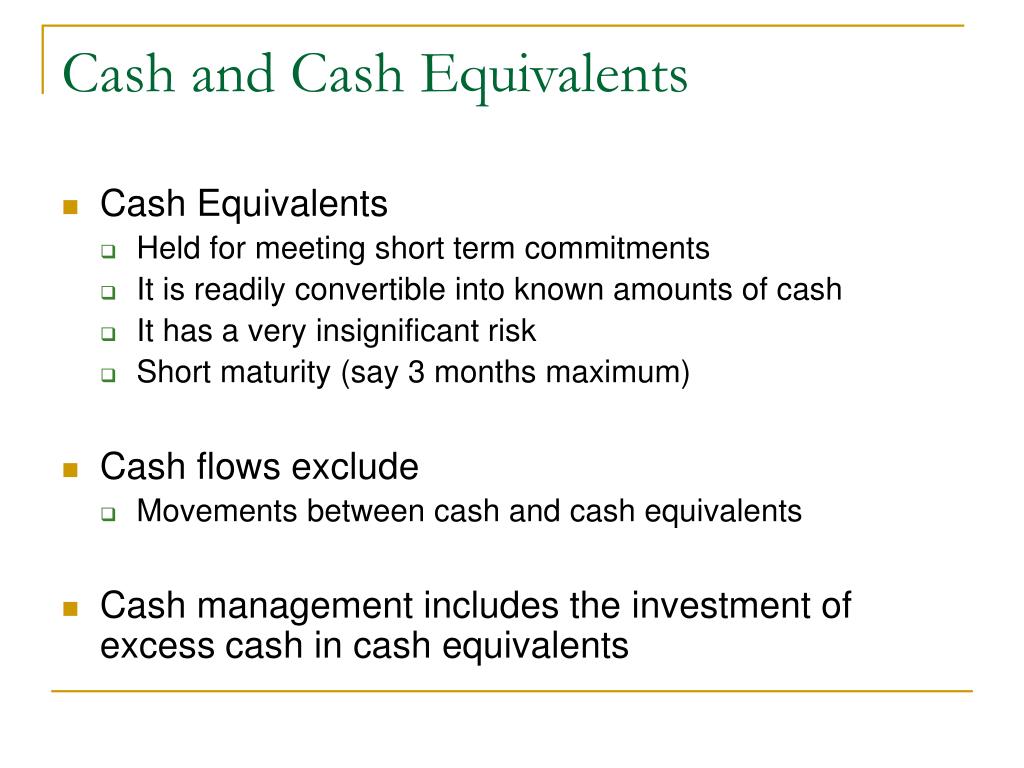

Accounting for cash and cash equivalents. The cash equivalents line item on the balance sheet states the amount of cash on hand plus other highly liquid assets readily convertible into cash. Cash equivalents are one of three main asset classes in. Cash and cash equivalents are the liquid assets in any business.

Cash and cash equivalents is a line item on the balance sheet, stating the amount of all cash or other assets that are readily convertible into cash. However, cash is currency on hand or in banks, including notes and coins,. Cce is actually two different.

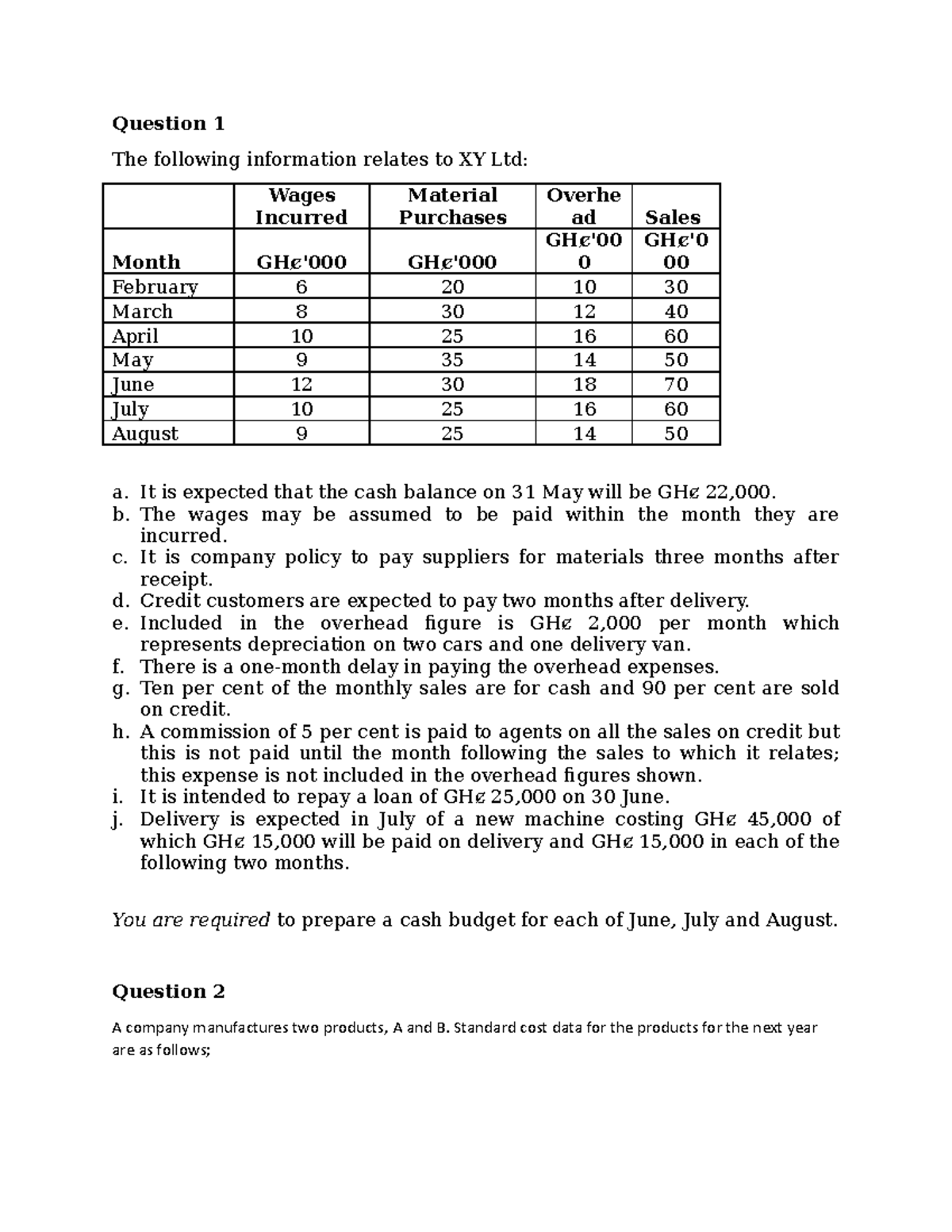

The phrase cash and cash equivalents is found on balance sheets in the current assets section. The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents. They have a maturity of three months or less with high credit quality, and are unrestricted.

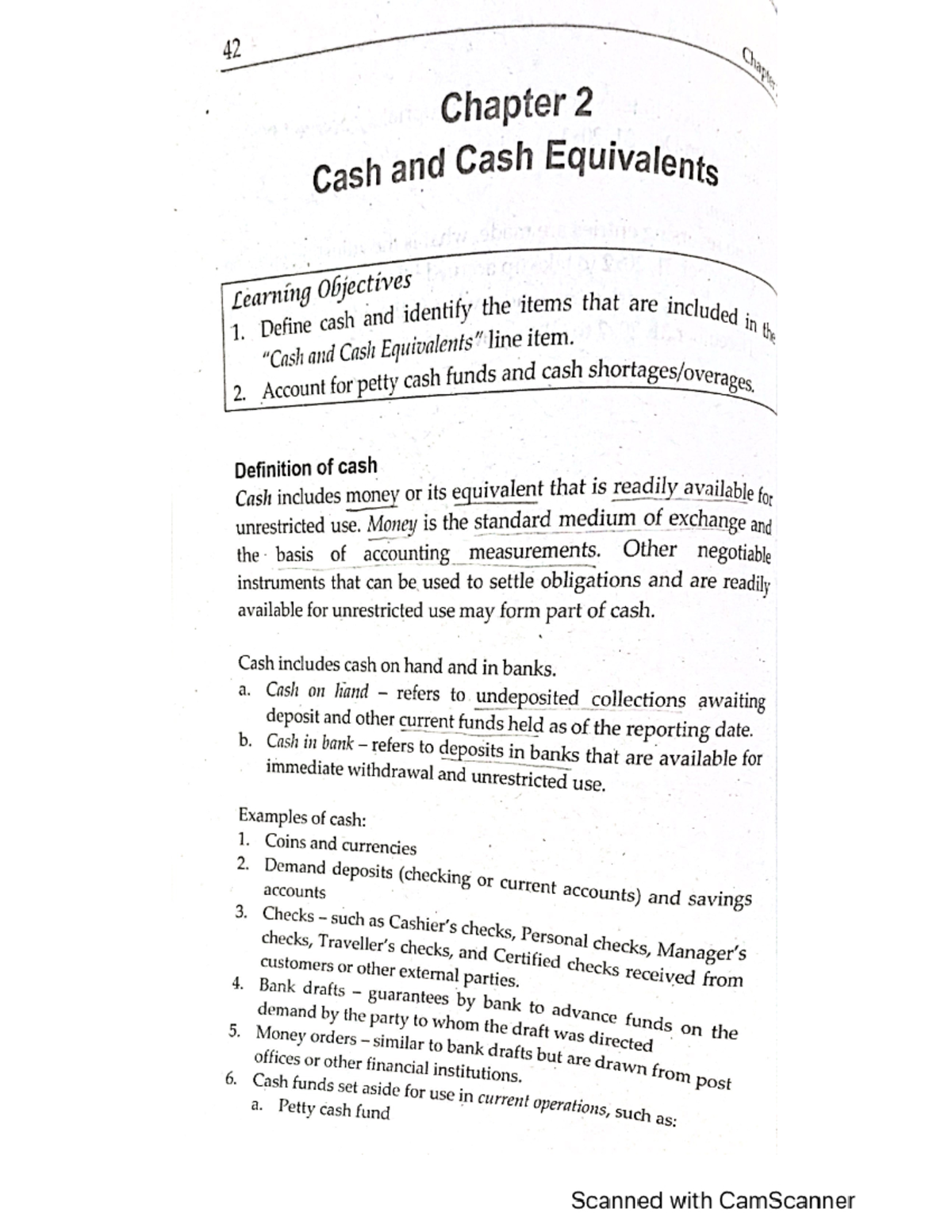

Describe cash and cash equivalents, and explain how they are measured and reported. Items acceptable for deposit in these accounts. The most liquid asset on the balance sheet.

The purpose of keeping cash and cash equivalents is to meet daily expenses, pay off. In financial accounting, cash is defined as the sum of: Examples of cash in accounting, a company's cash includes the following:

Cash and cash equivalents cash and cash equivalents are recorded as current assets cash and cash equivalents ( cce) are the most liquid current assets found on a. Chapter 4 — cash and cash equivalents 4.1 definition of cash and cash equivalents 4.2 book and bank overdrafts 4.3 centralized cash. Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

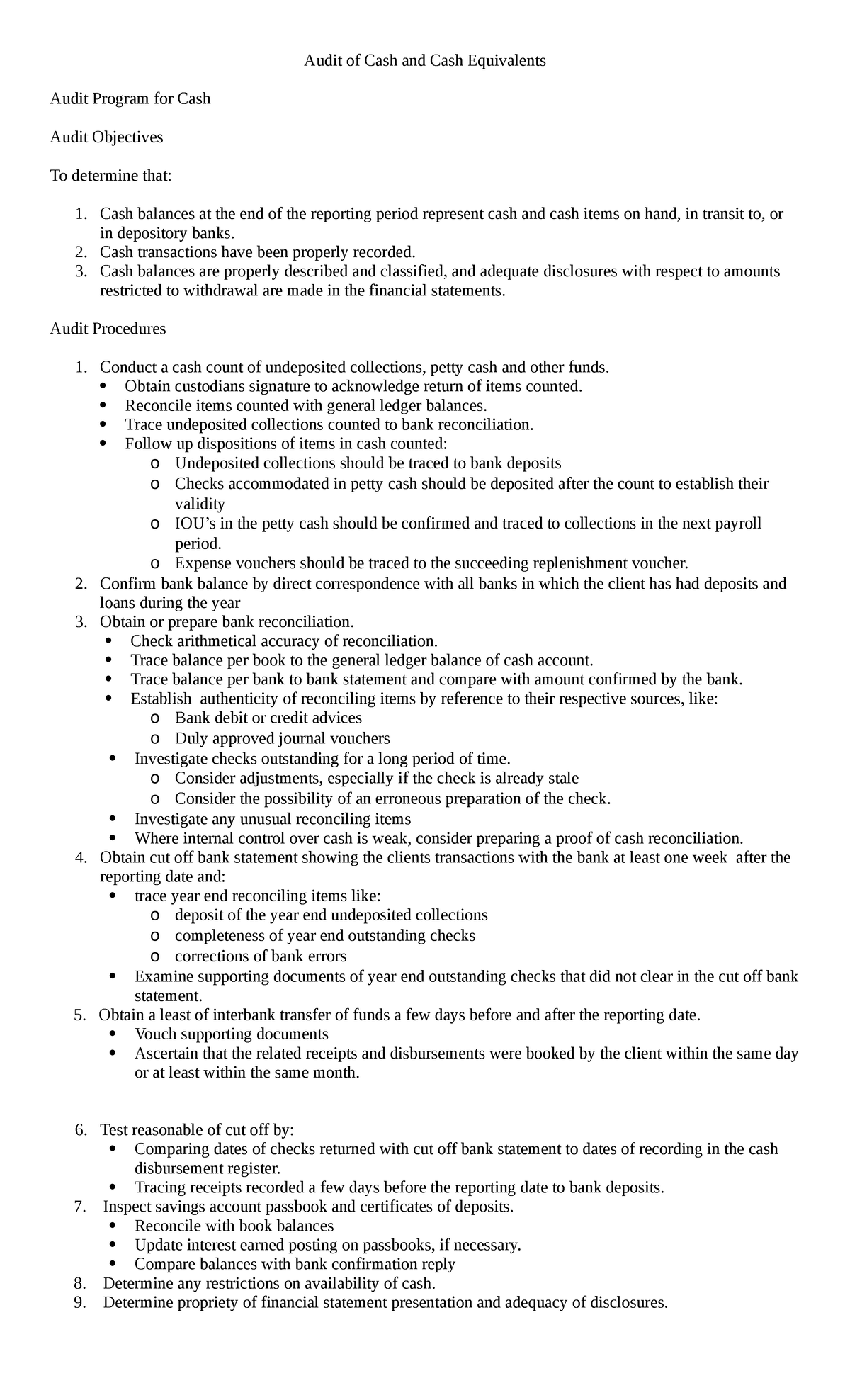

Explain the purpose and key activities of internal control for cash. View all / combine content. Cash equivalents, in general, are highly liquid investments in an entity’s balance sheet.

Easily converted to cash, original maturity 90 days or less. What is the definition of cash & cash equivalents in accounting? Cash and cash equivalents consist of cash on deposit with banks and highly liquid investments with maturities of 90 days or less from the date of purchase.

They include bank certificates of deposit, banker’s acceptances, treasury bills,.

:max_bytes(150000):strip_icc()/CCE-009ecb73dfd94702821efed1264573af.jpg)