Inspirating Tips About Investment Securities On Balance Sheet Financial Statement Preparation Services

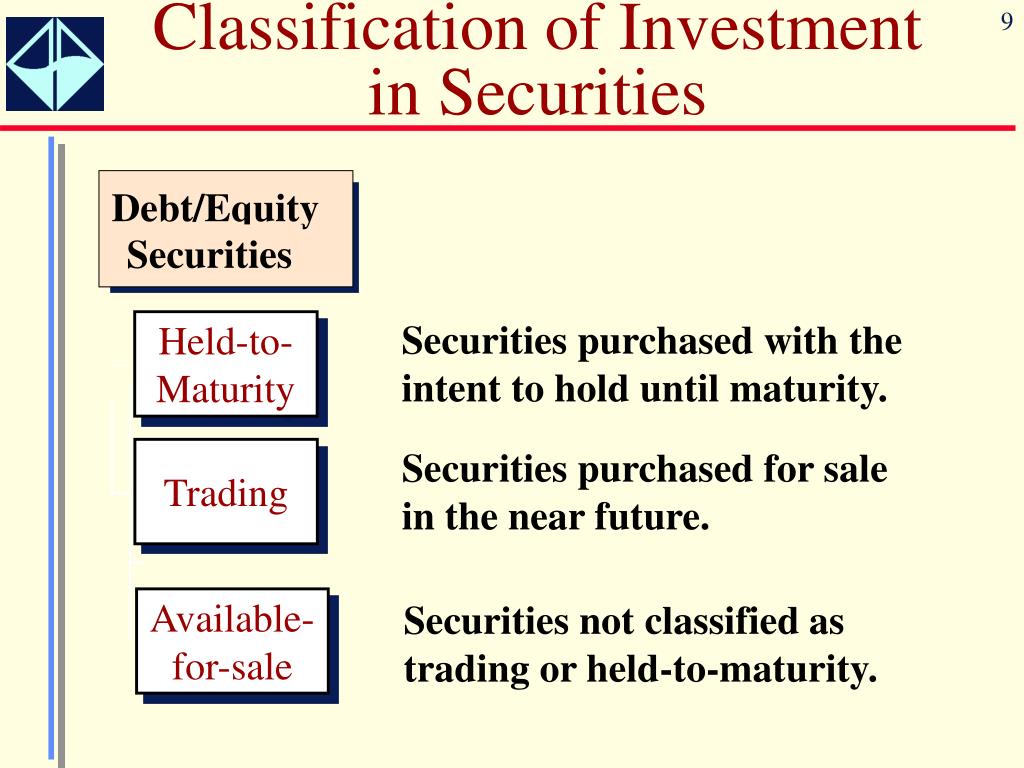

12.1 accounting for investments in trading securities learning objectives at the end of this section, students should be able to meet the following objectives:

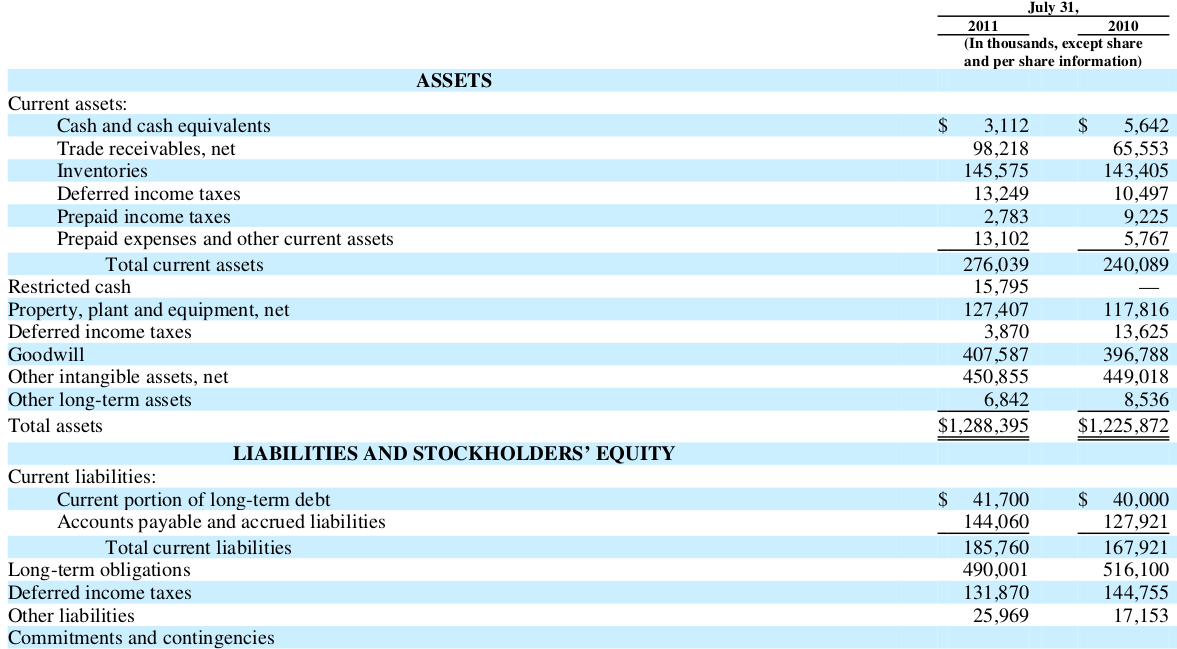

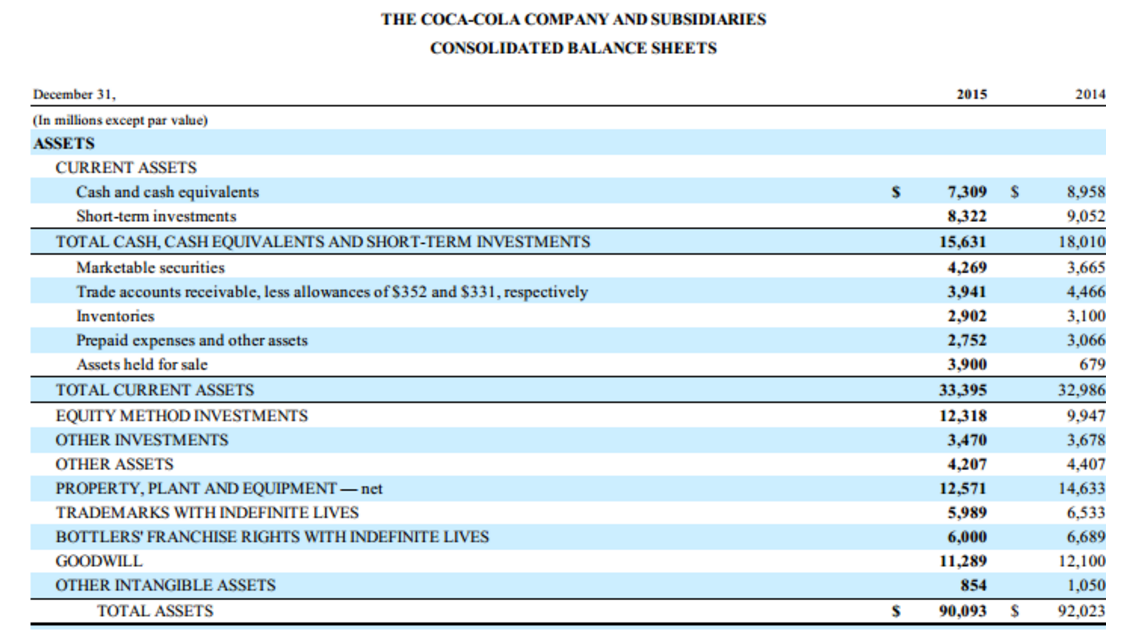

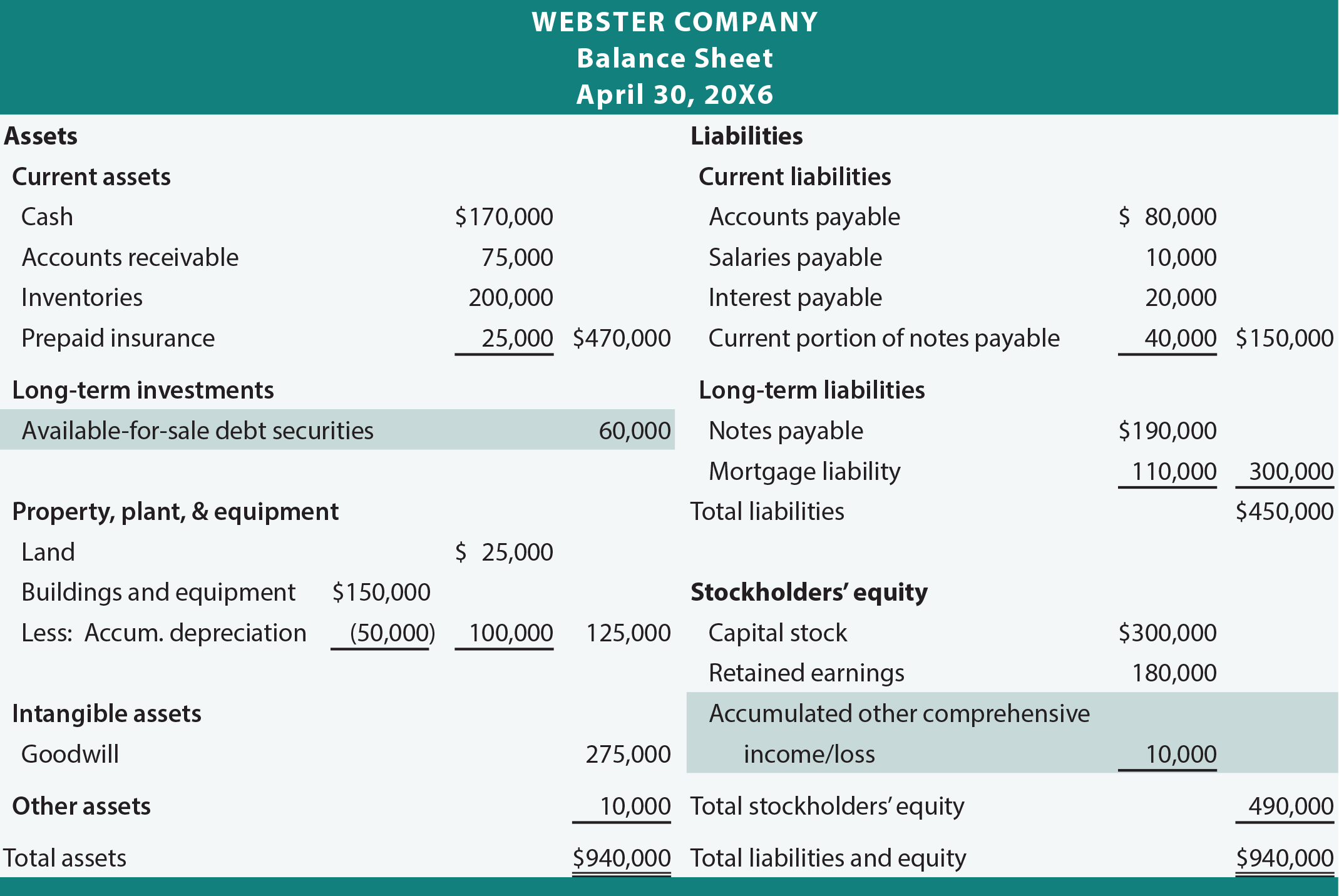

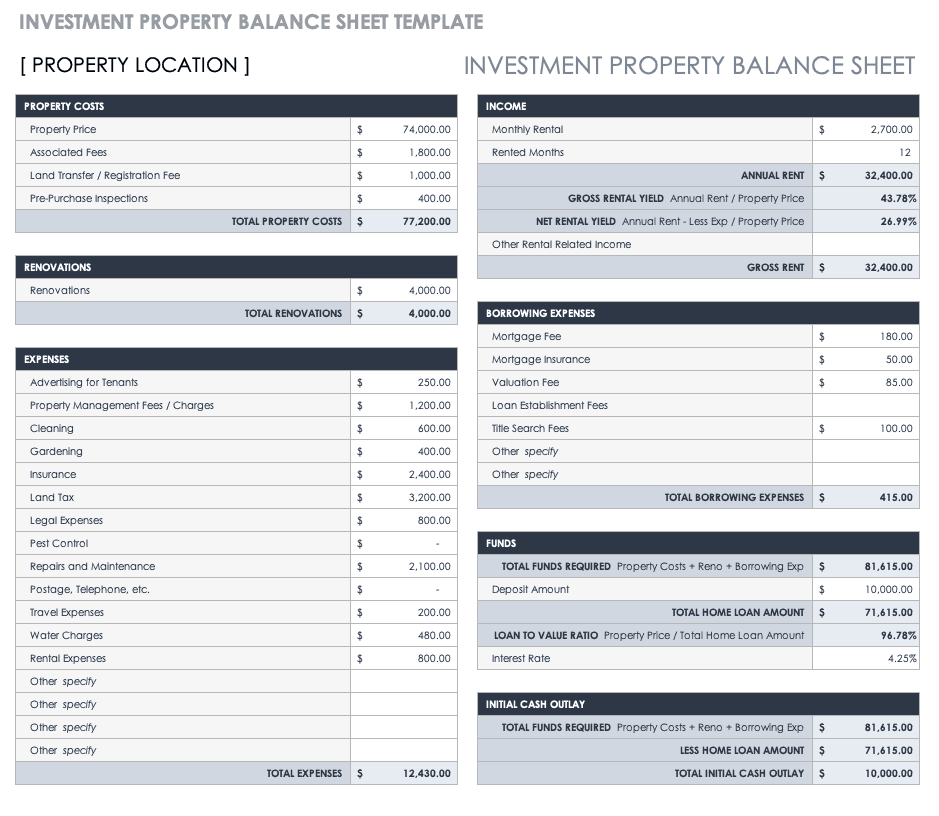

Investment securities on balance sheet. Typically, investments are securities held for more than a year. Marketable securities are a component of current assets on a firm's balance sheet. We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said.

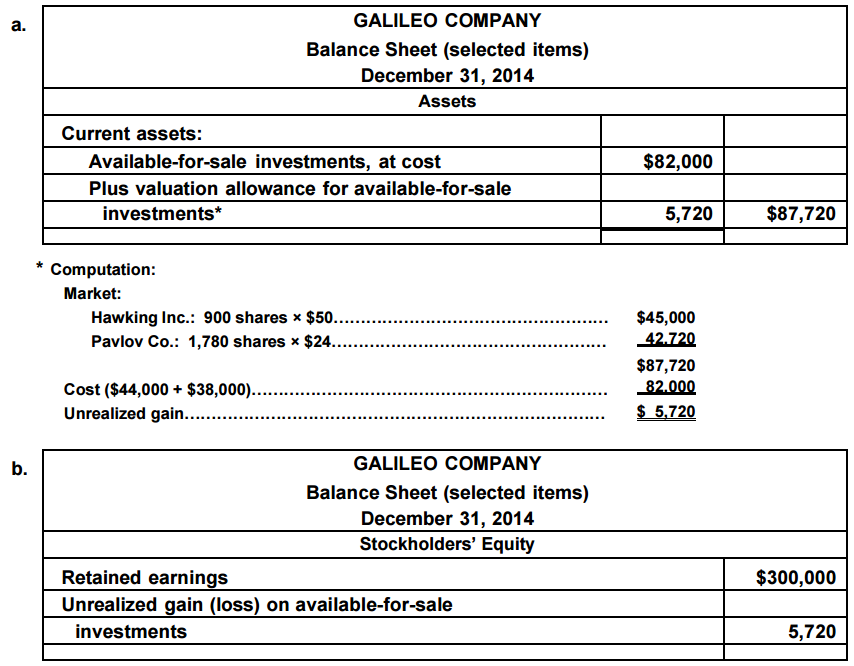

Fsp corp may present these marketable securities on the balance sheet as follows: Certificate deposits, u.s government securities, and commercial. These investments will be listed under current assets on the balance sheet because they are due within a year, but will not be considered as part of cash and equivalents.

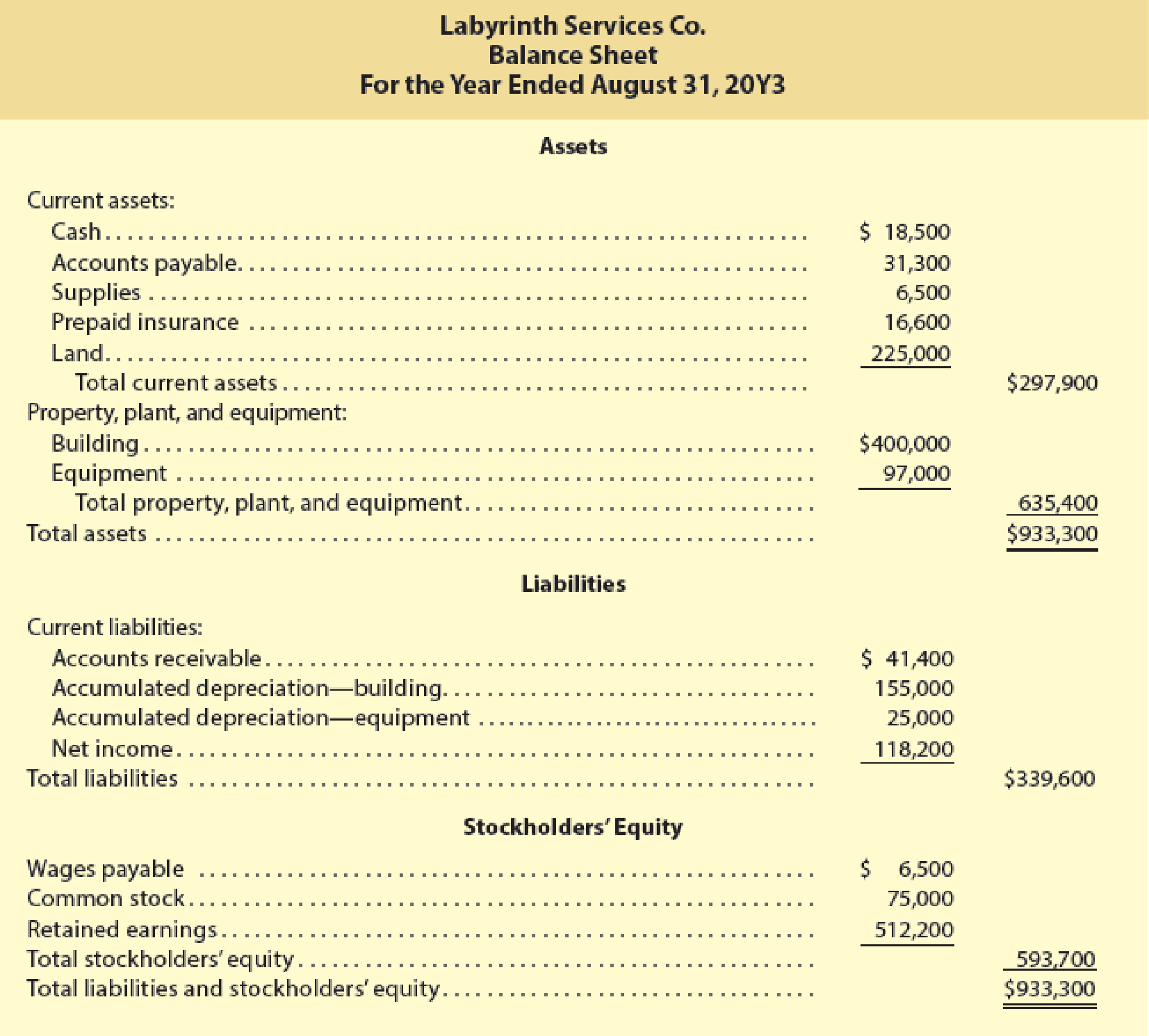

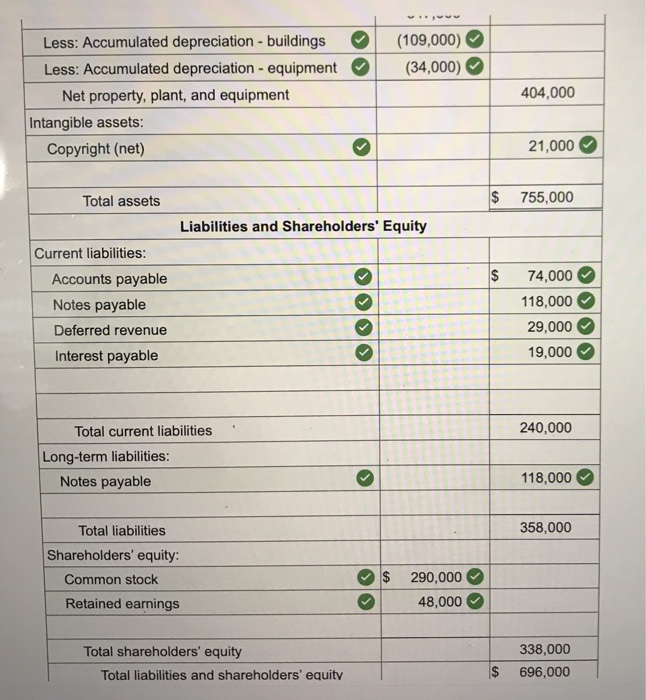

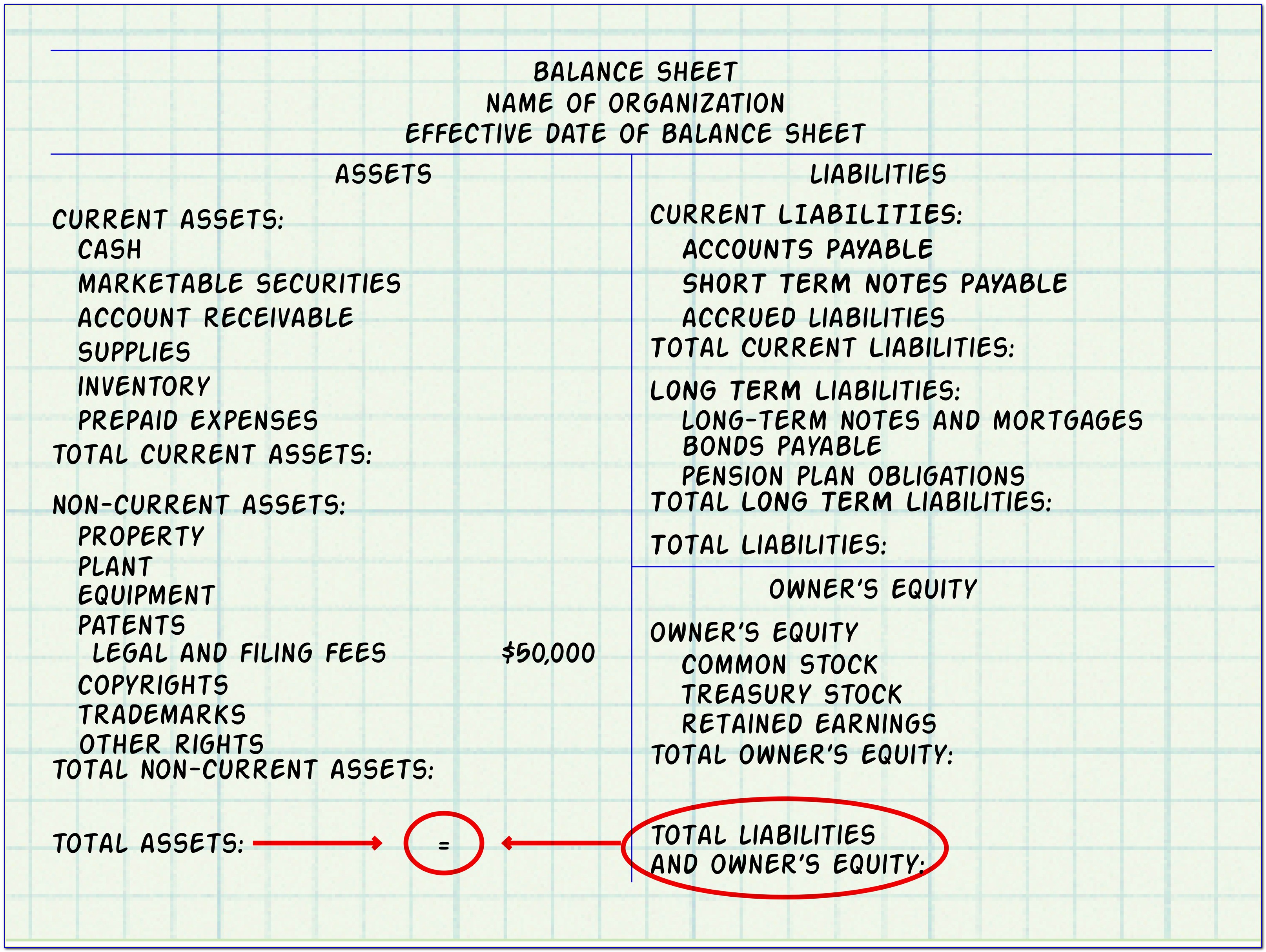

The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a. A company may list its tangible assets on its balance sheet in a few categories, such as: Investment securities are a category of securities—tradable financial assets such as equities or fixed income instruments—that are purchased with the intention of.

This chapter does not address all of the. It is part of a figure that helps determine how liquid a company is, its. As the fair value of trading securities recorded in the balance.

If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is. The business can decide to invest in a range of financial assets, including equity securities, debt securities, or. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period.

These assets are short term, as the company. Trading securities are considered current assets and are found on the asset side of a company's balance sheet. What are the 3 components of the balance sheet?

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)