Sensational Info About Investment Income In Statement Cash Is On What Financial

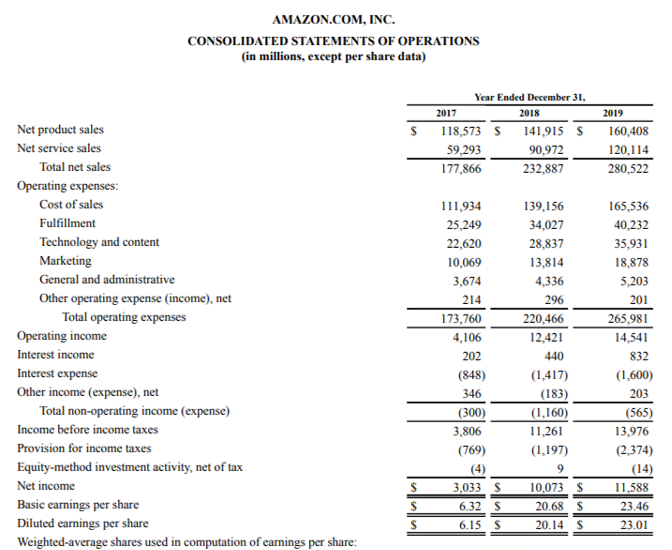

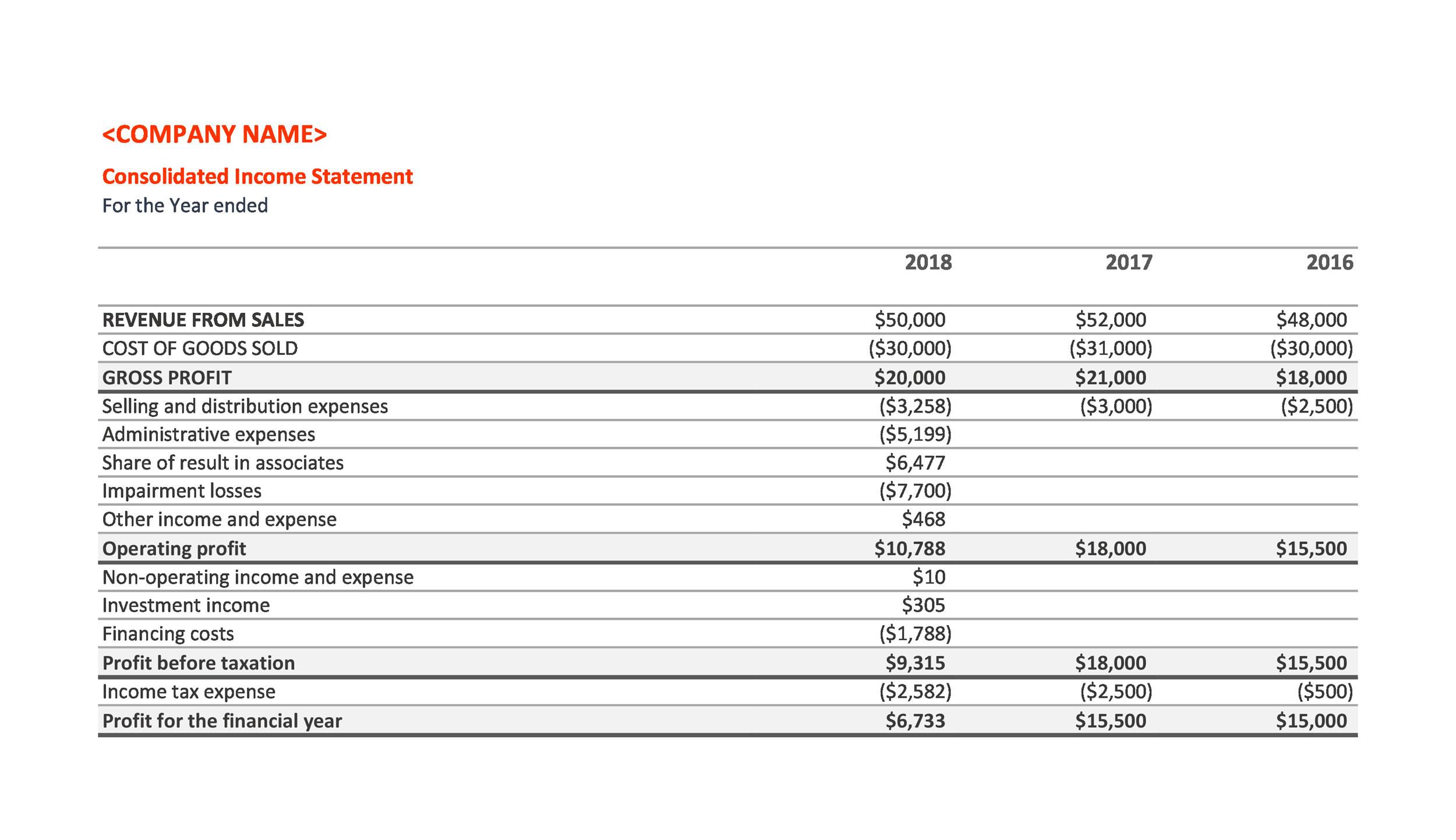

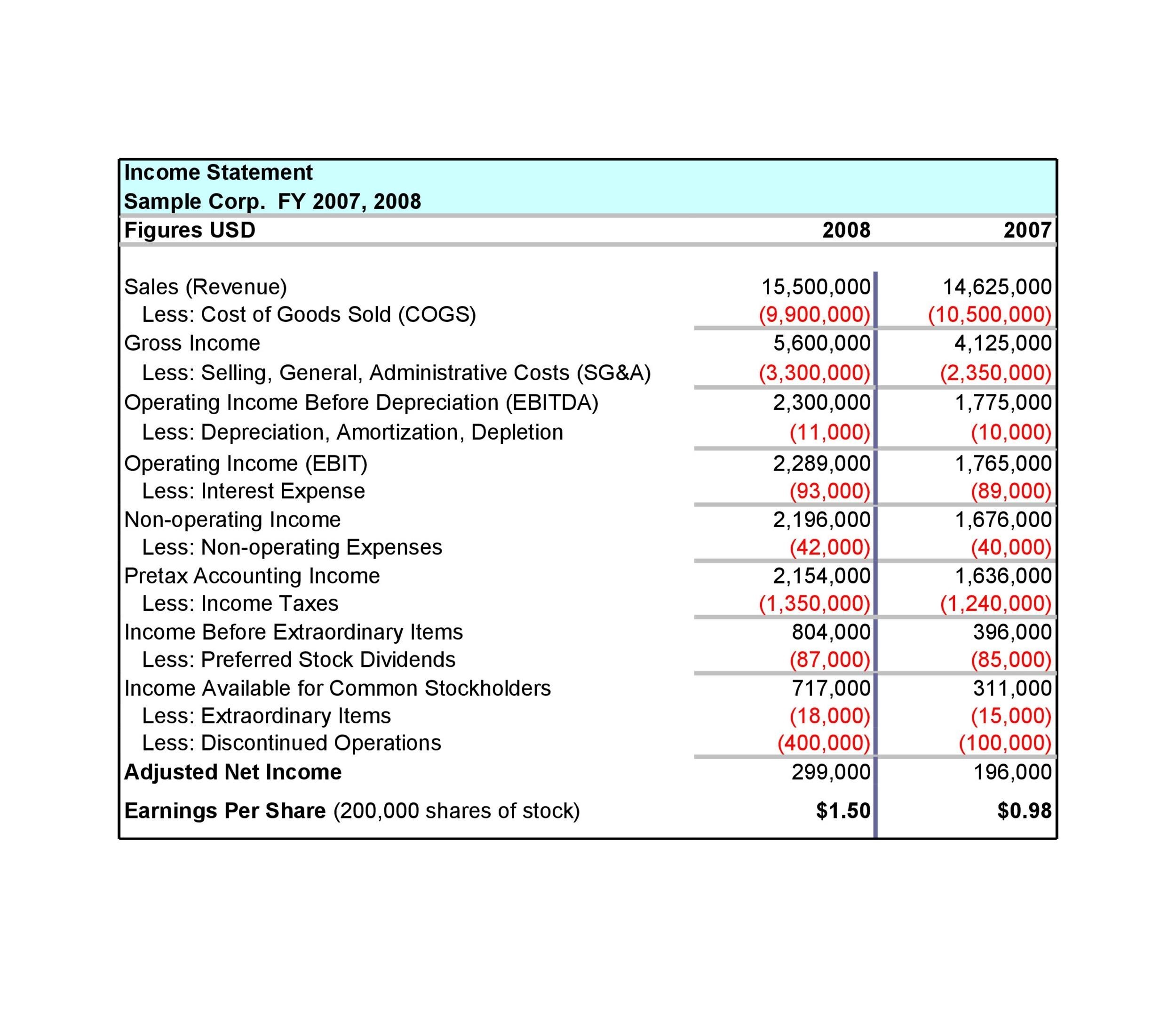

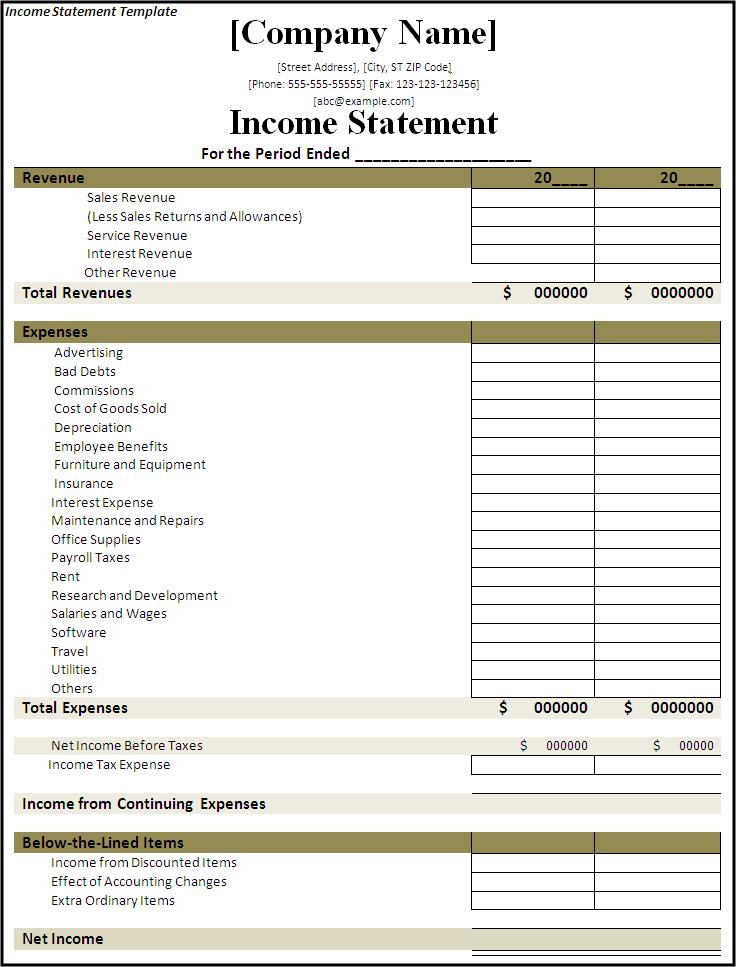

Frequently called the profit and loss statement, an income statement shows how much money a company made (or lost) over a specific time period.

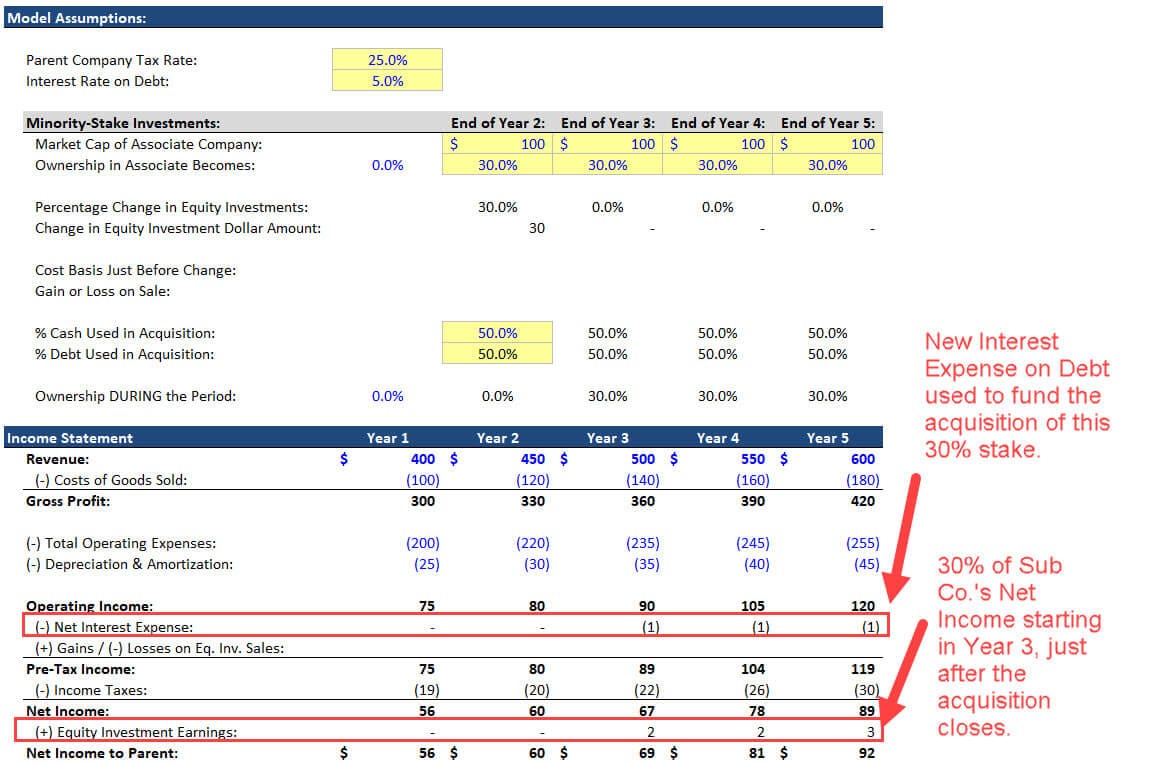

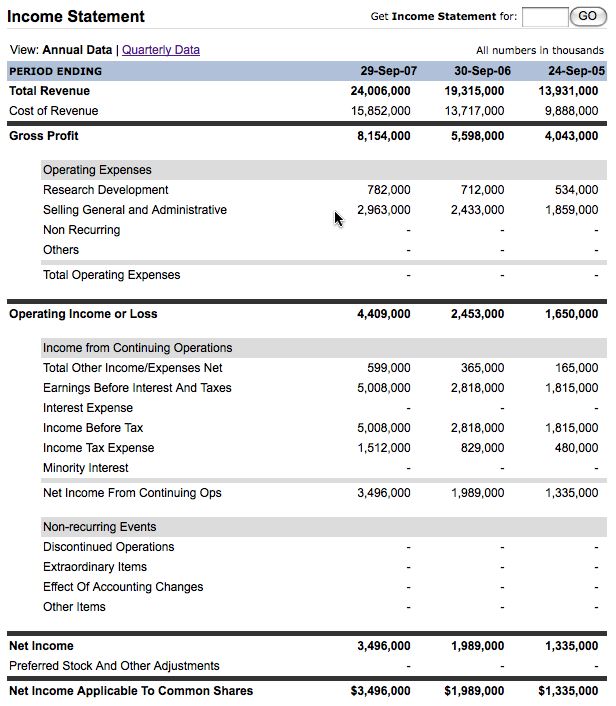

Investment income in income statement. Investment income refers to the amount earned on investments in common stock, bonds or other financial instruments of outside companies in the forms of dividends, interest and capital gain. On the income statements of publicly traded companies, an item called investment income or losses is commonly listed. Using the previous example, $525 per week over 52 weeks would result in a gross annual income of $27,300 ($525 x 52).

Accounting for investment income. To find your annual gross income, multiply your average weekly income by the number of weeks you work in a year. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded partnership (ptp) income.

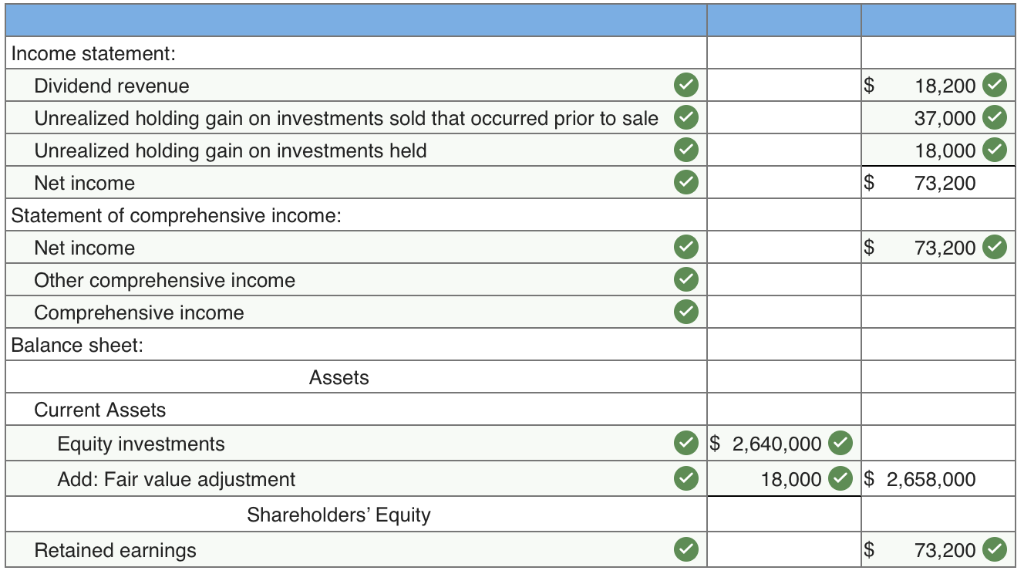

Companies have multiple reasons for. For example, say you buy a stock and then sell it later for $100 more than you originally paid. The income statement:

Add up the income tax for the reporting period and the interest incurred for debt during that time. By analyzing the different income statement components, investors can gain insights into the company’s profitability, cost efficiency, and operational effectiveness. It is a vital component of overall investment returns.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. Investment income refers to the profits from investments, including interest, dividends, capital gains, and rental income. An income statement is a financial document that details the revenue and expenses of a company.

This is where the company reports the portion of its net income. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. The income statement shows a company or individual’s money.

It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. Essentially, an income statement provides a snapshot of a company's revenue and costs that investors use to assess the health and profitability of a company. What is an income statement?

What is an income statement? Sales on credit) or cash vs. How should fsp corp present the equity in net earnings of company a as a single amount in the financial statements?

The income statement is an invaluable tool for investors in understanding a company’s financial performance and making informed investment decisions. There are several reasons why investors should pay close attention to income statements. Why is it important to know what an income statement is?

An income statement compares revenue to expenses to determine profit or loss. Updated 4/21/2023 continuing our discussion on investment portfolios for companies like amazon, microsoft, prudential, and apple. Different investment types yield different forms of income.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)