Brilliant Strategies Of Info About Cash Flow Statement And Fund Deferred Tax Calculation Example Excel Paytm Financial Statements

Get free advanced excel exercises with solutions!

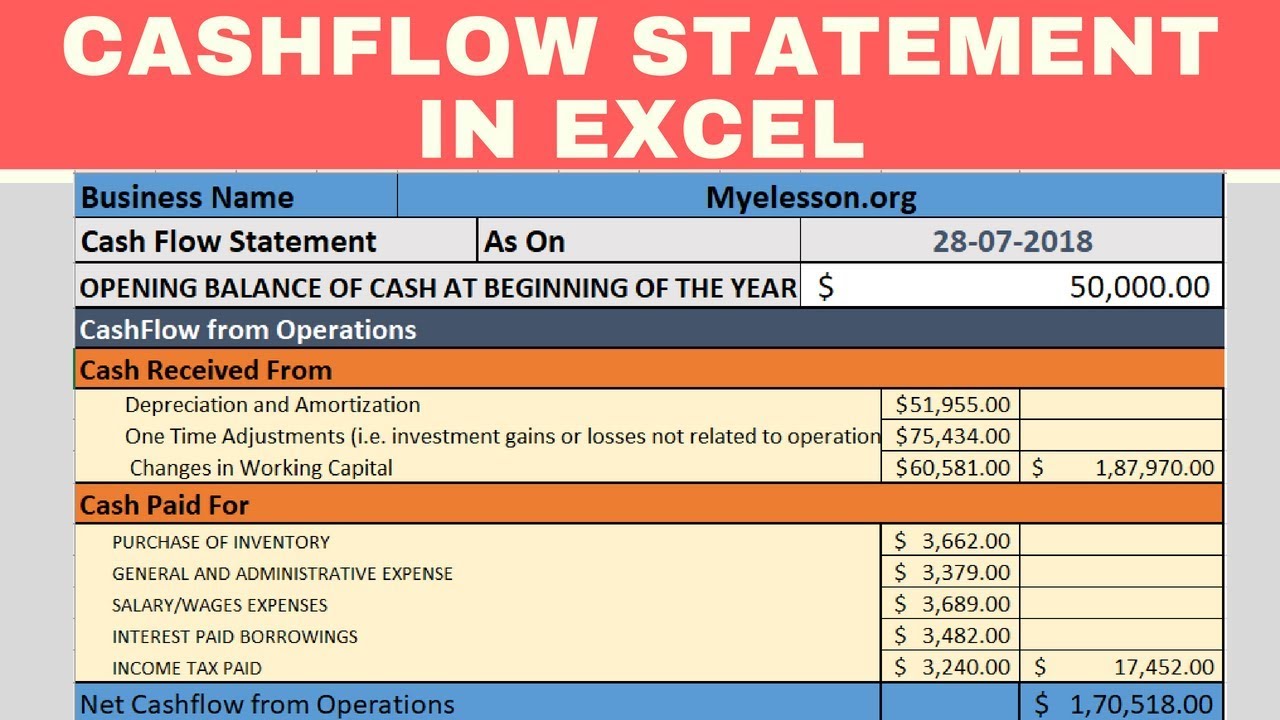

Cash flow statement and fund flow statement deferred tax calculation example excel. Download a statement of cash flows template for microsoft excel® | updated 9/30/2021. To start, you will need the. That way, you can see how much you gained and spent.

This template accounts receivable template lists customers, invoice tracking. A fund flow statement is a statement that shows the movement of funds and reports an enterprise's financial operations. In this section, we will discuss the difference between cash flow statement and fund statement, using their format and examples.

Tools required for calculating deferred taxes in excel. Ifrs calculation examples with an illustrative excel file below you will find the list of all ifrs calculation examples available on ifrscommunity.com, each accompanied by a. The cash flow statement, or statement of cash flows,.

It is relevant to the fa (financial. Deferred tax on statement of cash flow. In this article, we are going to focus on how to calculate cash flow in excel.

Net change in cash = cash from operations + cash from investing + cash from financing subsequently, the net change in cash amount will then be added to the. Cash flow vs fund flow. Operating cash flow, represented on the cash flow statement, refers to the income that flows in and out of a business due to its operational income and expenses.

The cash flow will record a company's inflow. This article considers the statement of cash flows of which it assumes no prior knowledge. Cash flow statement and fund flow statement deferred tax calculation example excel.

A company's cash flow and fund flow statements reflect two different variables during a specific period of time. It shows the various means by which. Excel | smartsheet don’t let balances owed to your business slip through the cracks.

Excel is a powerful tool that can be used for calculating deferred taxes. Red dollar amounts decrease cash. If we prepare a statement of cash flow using the direct method, the deferred tax will not show in operating activities as it is not a cash transaction.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. A detailed calculation of this amount is included below the cash flow statement on the direct sheet and at the top of the cash flow statement on the indirect sheet. Offsetting cash inflows and outflows in the.

There exist different types of. Choose a period to cover cash flow statements are usually broken down into monthly periods.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)