Simple Info About Cara Membuat Cash Flow Direct Method Slack Balance Sheet

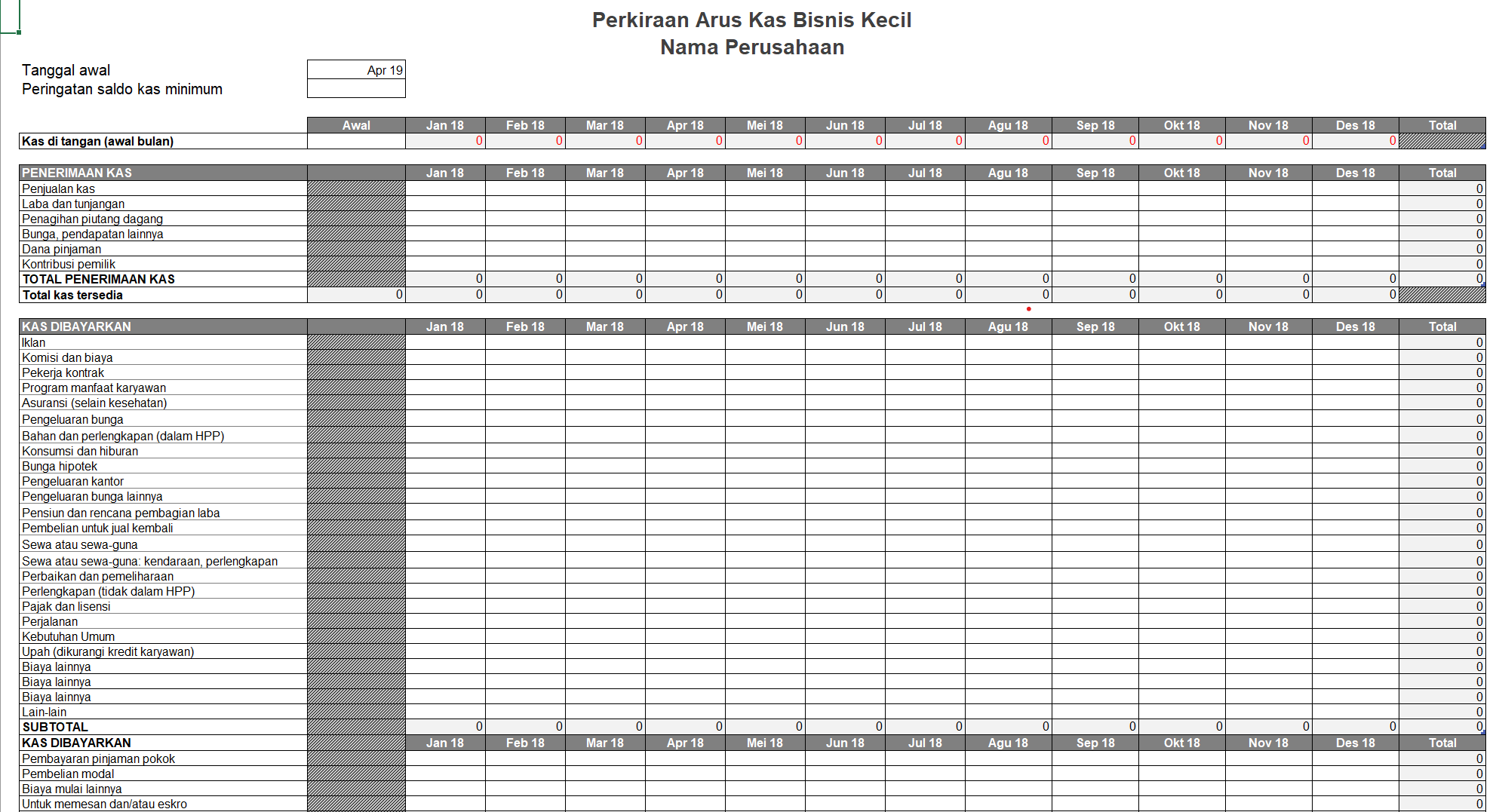

How to build a direct method cash flow statement.

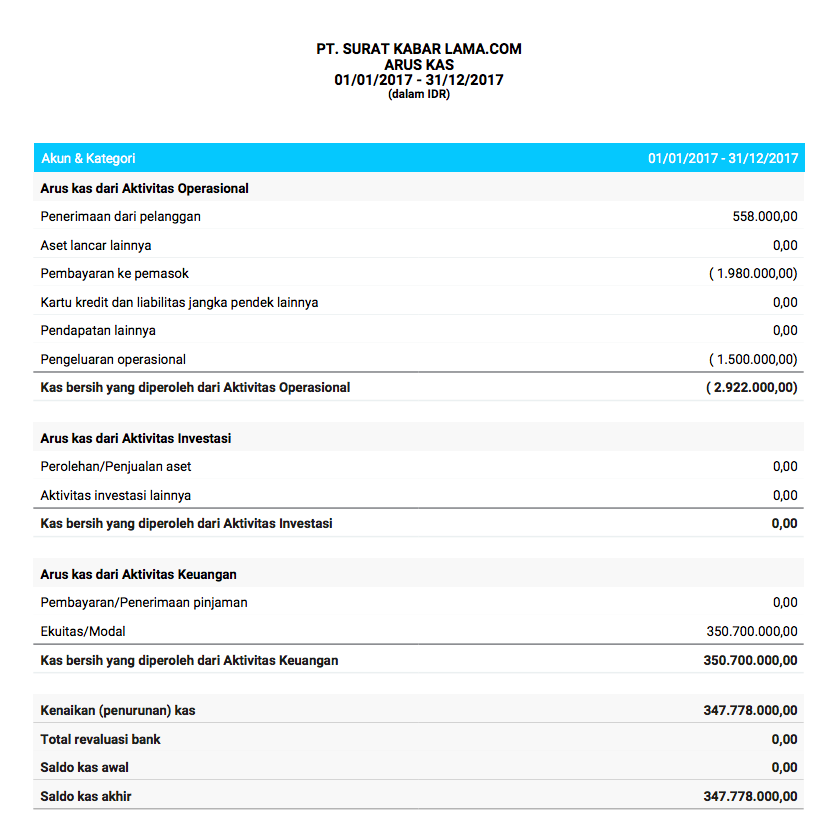

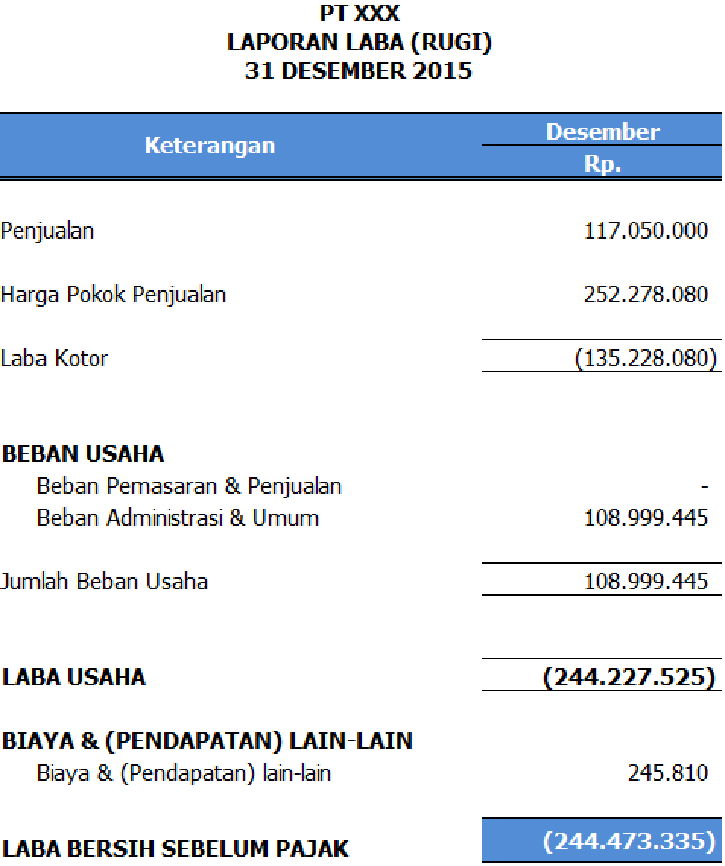

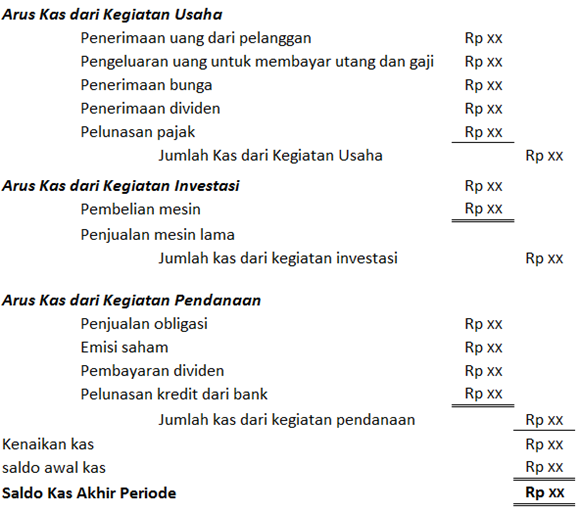

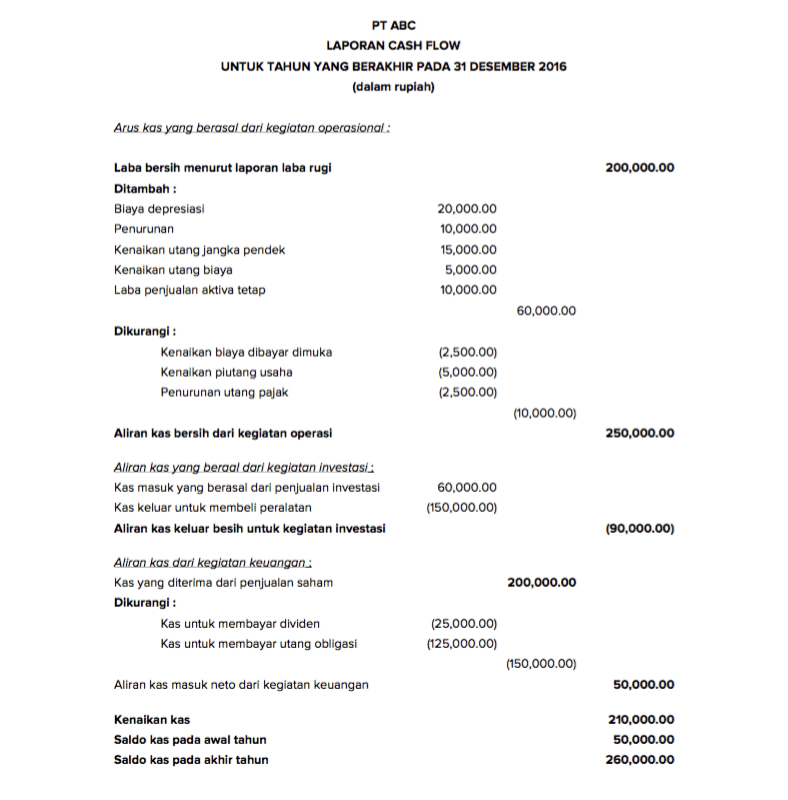

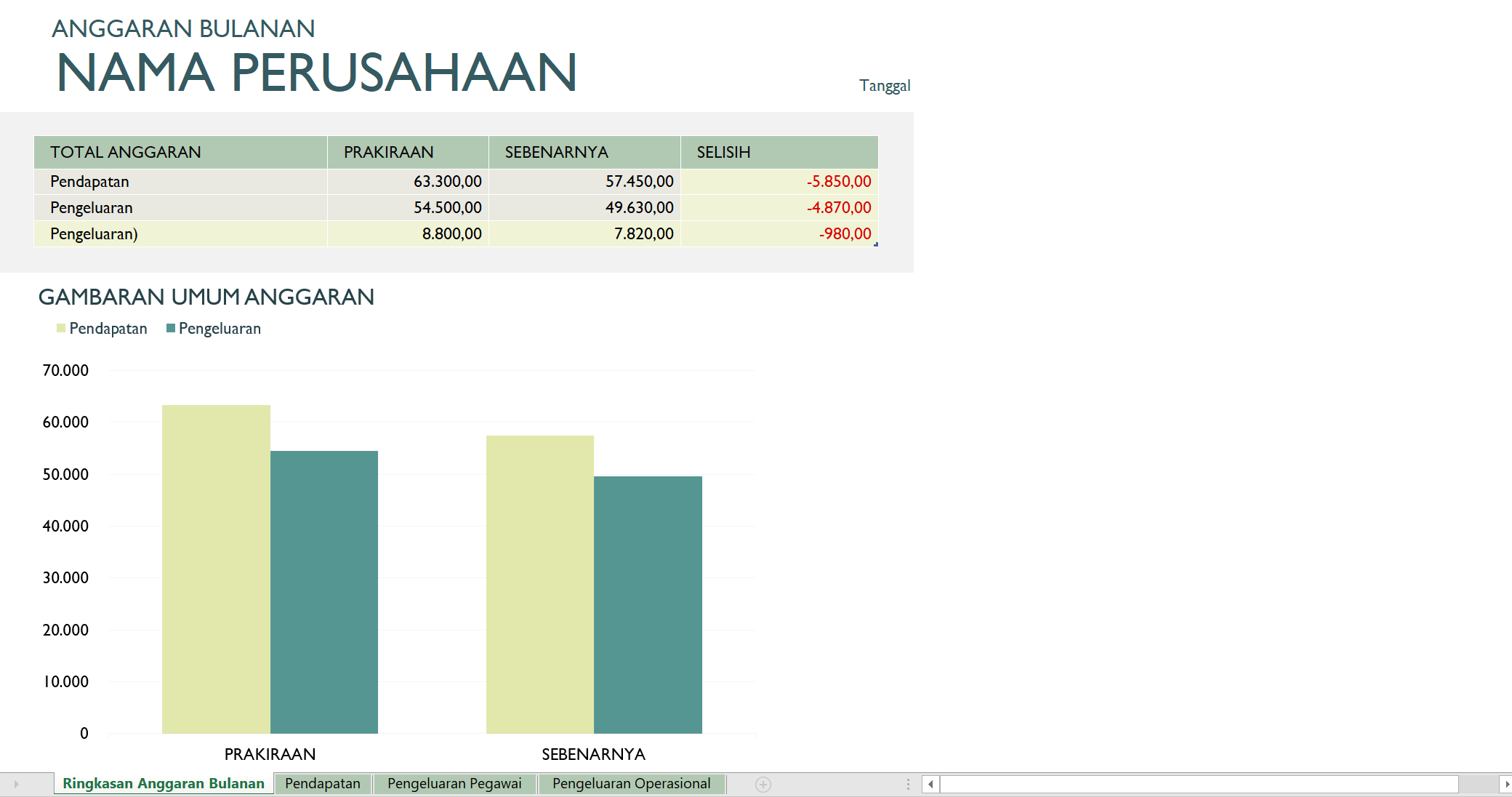

Cara membuat cash flow direct method. Items that typically do so include: The direct method of cash flow statement format presents a clear picture of a company’s cash flow. Laporan arus kas atau cash flow merupakan laporan yang memperlihatkan secara rinci arus kas yang masuk (penerimaan) dan kas yang keluar (pengeluaran) dari.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Nah, jika anda ingin menghitung cash flow operasional perusahaan, anda bisa menggunakan rumus berikut: Preparing a cash flow statement using the direct method can be as easy as using the indirect method, if the lines that will be displayed are given some forethought.

The direct method (cash flow) is an accounting approach used in the preparation of a cash flow statement, which portrays the exact payments and receipts of. The cash flow statement direct method involves a detailed breakdown of operating expenses and income. Cash flow operasional = laba bersih +.

This method provides clarity about a company’s performance. Sum up all cash outflows from. The formula for calculating operating cash flow is:

Sum up all cash inflows from operating activities; Ada dua metode untuk membuat laporan cash flow yaitu metode langsung (direct method) dan metode tidak langsung (indirect method): There are two approaches to creating a cash flow statement.

Operating cash flow = total cash received for sales − cash paid for operating expenses. It is one of two methods a company can apply when. They are cash flow statement indirect method and direct method.

Items that usually do this include: The direct method of presenting the statement of cash flows presents the specific cash flows related to things that affect cash flow. The direct method or the indirect method only apply.

:max_bytes(150000):strip_icc()/Direct_method_final-819489c8494e43f498e8b084e922bee0.png)