Recommendation Tips About Tax Ready Income Statement Change In Stockholders Equity Formula

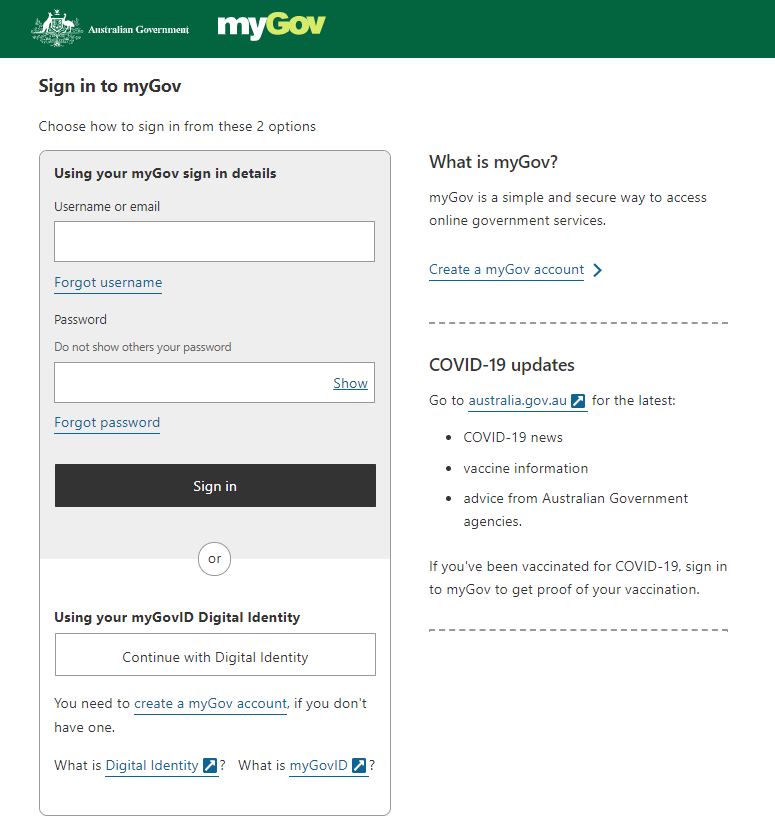

Jayt101 (i'm new) 21 july 2021 hi there, i have received a message from the ato on mygov claiming that my income statements have been finalised and i am able to.

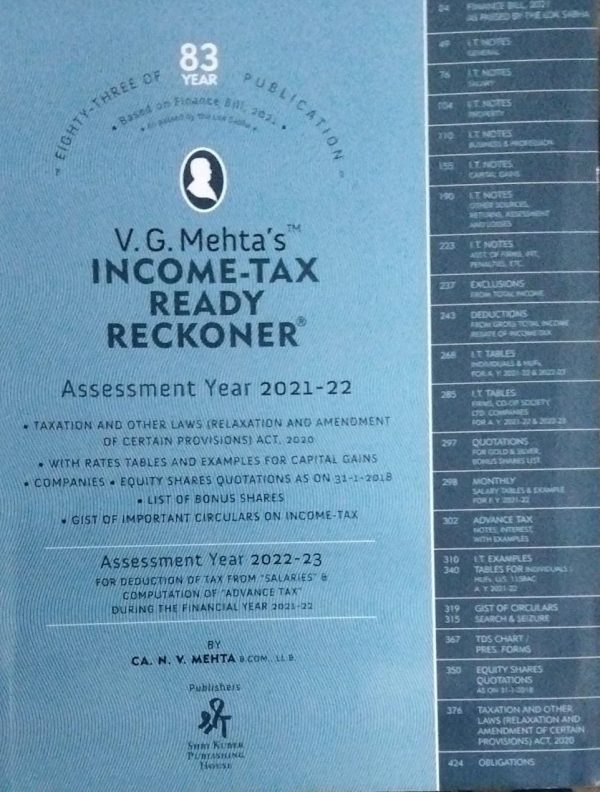

Tax ready income statement. You are unable to change this status yourself. This information is called an income statement. If you lodge before the statement is 'tax ready', you may have to amend your tax return.

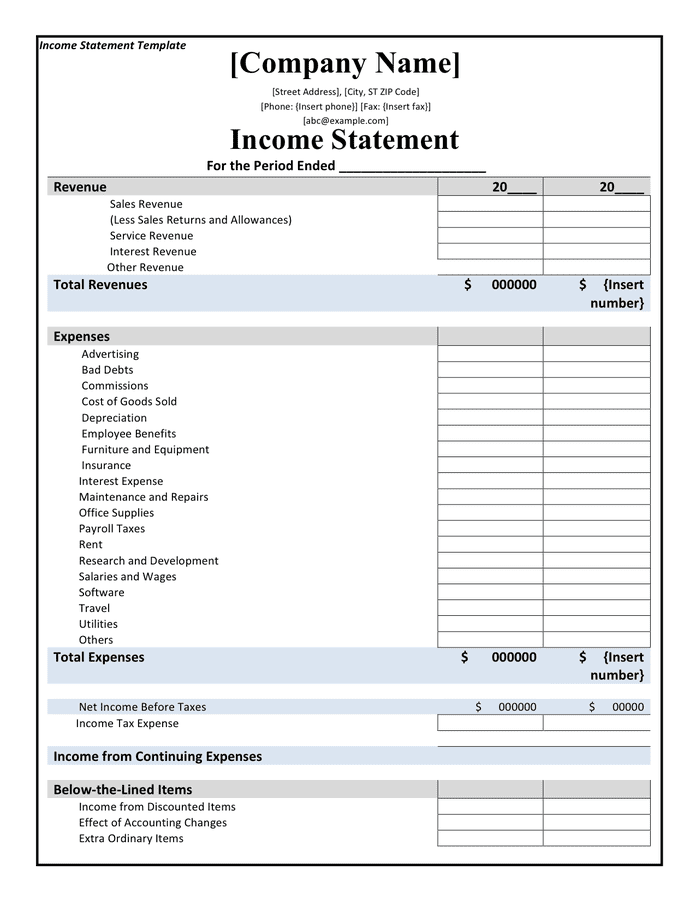

The “tax ready” status means it is ready to use for tax purposes. What is an income statement? Income before taxes:

This message was taken from mytax whilst trying to complete my tax return we'll notify you when your employer finalises your income statement to make it 'tax ready'. i'm the. Net income divided by the. It is the income statement that is listed as not tax ready, not the tax return, so missing.

You will need to speak to your employer if after 31 july your. I finalised my income statements for employees before 30 june and they are still not tax readyin mygov. If your income statement information isn't marked as 'tax ready' by your employer, you will see a red box in ato online services that says 'not tax ready'.

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. When it comes your income statement not showing as tax ready.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. You may need several different documents depending on your sources of income, but here are a few common ones: An income statement is the document prepared by your employers where you can see your income for the financial year.

I am speaking with the tax office but they don't know much either? If you do not have a mygov account, you can easily create an account. You pay tax on most income you earn.

Your guide to filing accurate returns by admin_tushar | oct 17, 2023 | tax | 0 comments what should you do if your employer. We will send a notification to your mygov inbox when all of your income statements are 'tax ready'. Now that group certificate/payment summaries/income statements are not printed, the employees who don't look at mygov regularly wouldn't know that they are ready.

If your income statement shows as 'not tax ready', you will see a red box with 'required' next to your employer’s name. Most people have tax withheld by their payers throughout the year, which usually covers the amount of tax they need to. To complete your tax return, you should.

You are unable to change this status yourself. Once you make a finalisation declaration, after the end of the. With only a few days left to go.