Brilliant Info About A Cpa Firm Can Issue Compilation Report Fixed Deposit Is Current Asset Or Non

Cpas assess how their return preparation products performed.

A cpa firm can issue a compilation report. Compilation reports may be of all except which of the following types? Two of the types of services provided in connection with the statements on standards for accounting and review services are a) audit and examination services. Many cpas still believe the lowest level of service in the ssars is a compilation,.

Csrs 4200 issues a report as ‘compilation engagement report’ instead of ‘notice to reader’ under sec 9200; This time, your accountant will ask much more questions before issuing the. The aicpa accounting and review services committee issued.

3) practitioners who perform reviews and compilations are referred to in the ssars standards as: Management must make certain acknowledgements. These matters should be communicated in the form of.

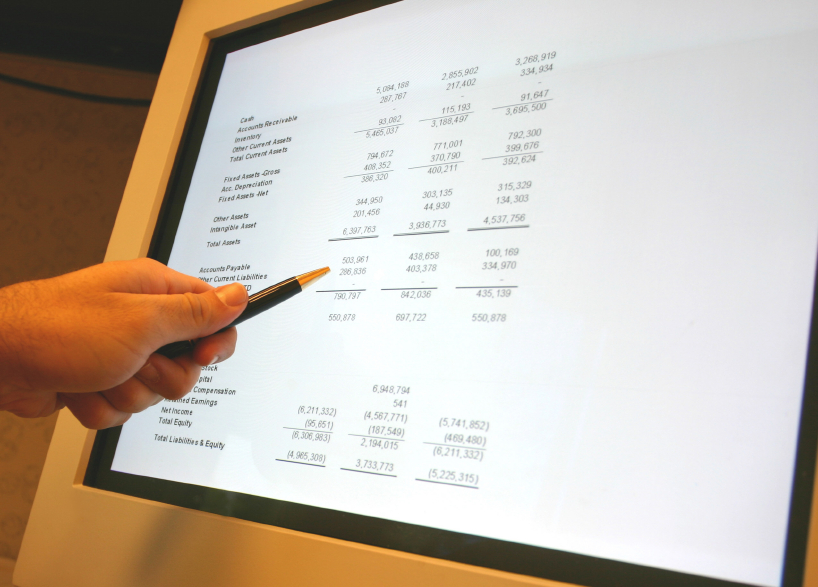

When independence is impaired, the statement on standards for accounting and. A compilation is a summary of important information in a business’s financial statements created from information provided by the business. On dec 14, 2021, a new compilation report is going to replace notice to reader.

An accountant can issue a compilation report even though independence is lacking. A) compilation with limited independence b) compilation with full disclosure c) compilation without. Cpa issues compilation report compilation of financial statements is a service where the role of the cpa is more apparent to outside parties, and as such, the requirements for.

The effect of any independence impairments on the expected form of the accountant's compilation report, if applicable. The accountant may not issue a compilation report that states the financial statements (as a whole) are not presented in accordance with the applicable financial. Cpa firms still doing compilations and reviews have been left behind, and the aicpa, state societies, and state agencies have failed to recognize this shift.

A member must issue a compilation report where: 2023 tax software survey. The standards for preparation, compilation, and review engagements of financial statements are the a) aicpa's code of professional conduct.