Nice Info About Revenues On Balance Sheet Cash Flow Analysis Format

These statements are the balance sheet,.

Revenues on balance sheet. Cash and cash equivalents were $149 million as of december 31, 2023, down from $192 million as of december 31, 2022. The balance sheet is based on the fundamental equation: If they will be earned within one year, they should be listed as a current liability.

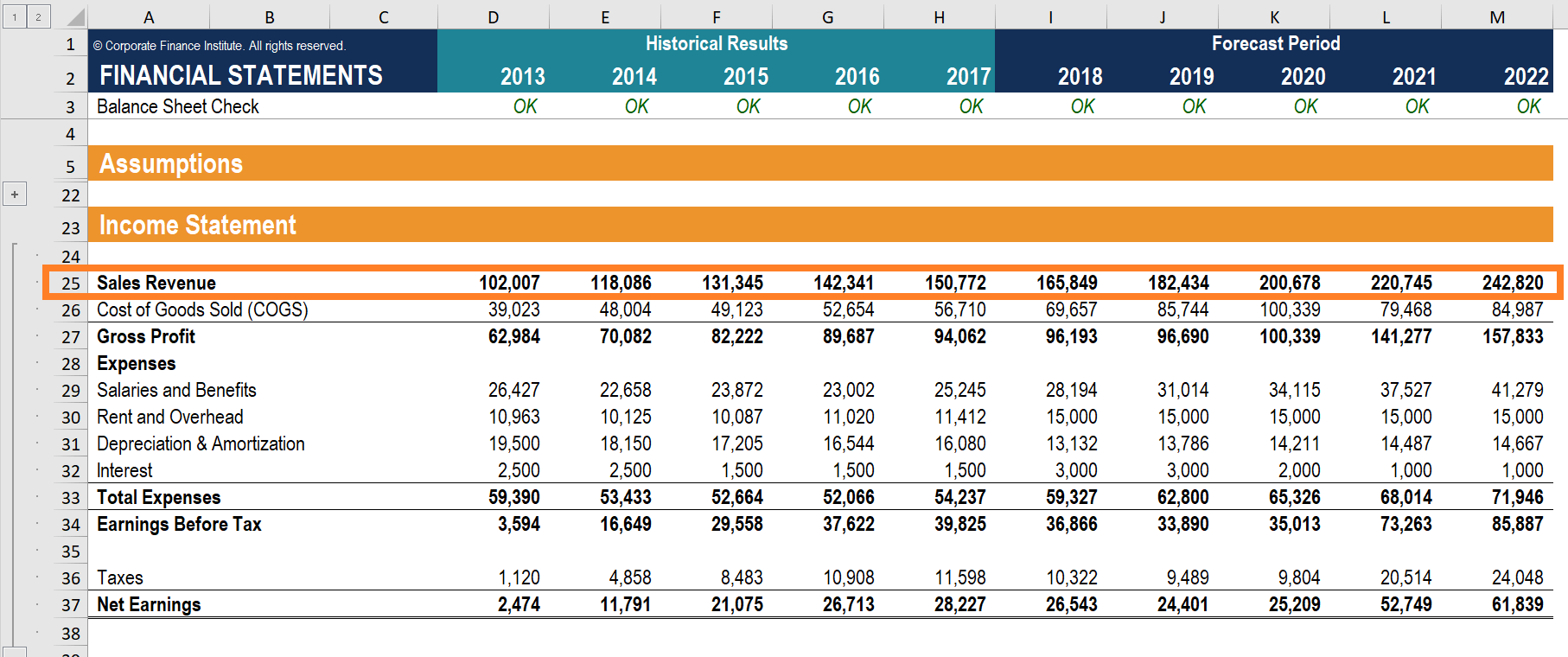

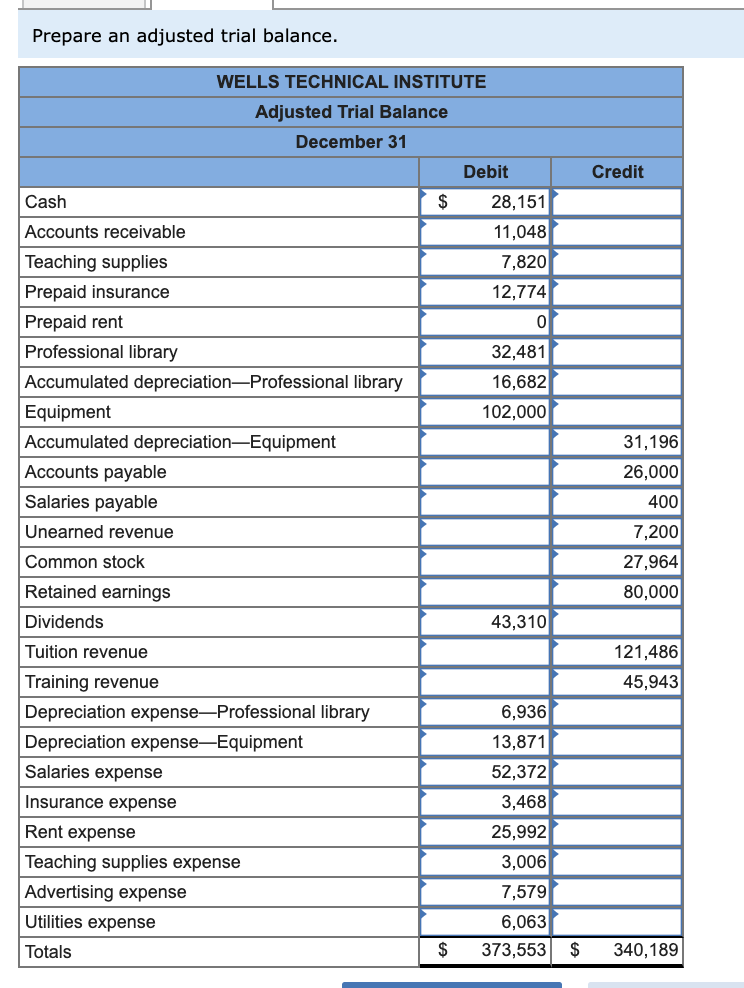

As of dec 31, 2023, cash and cash. There is no direct way to find revenue on a balance sheet because a balance sheet reflects how you have spent and invested your revenue rather than how much you've actually earned. The balance sheet as of december 31, 2018, for delicious desserts, inc., a fictitious bakery, is illustrated in table 14.1.

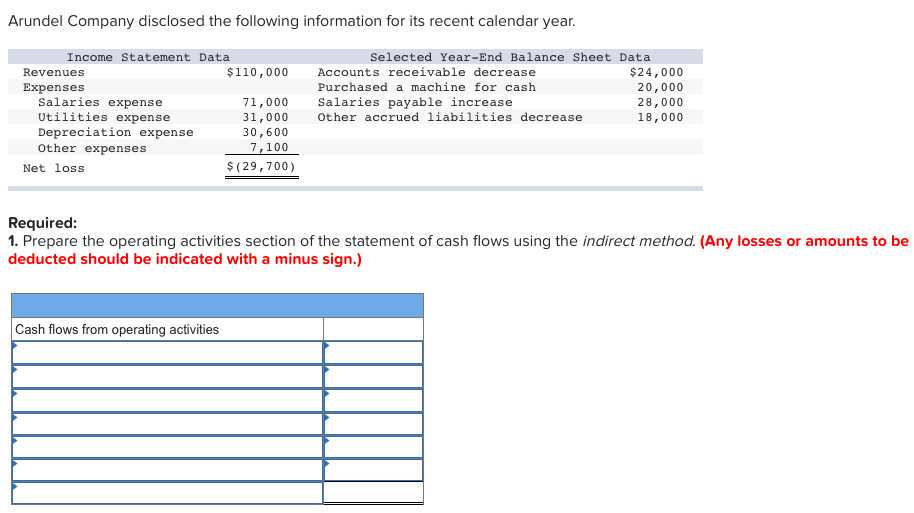

What is a balance sheet? Broadly speaking, working capital items are driven by the company’s revenue and operating forecasts. Total expenses are subtracted from total revenues to get a net income of $4,665.

If total expenses were more than total revenues, printing plus would have a net loss rather than a net income. You can find this information more clearly and easily on an income statement, which tracks revenue and expenditures. Michael logan companies produce three major financial statements that reflect their business activities and profitability for each accounting period.

Definition of revenue received in advance. (for a complete guide to working capital, read our “working capital 101” article.). Written by nancy ashburn nancy ashburn

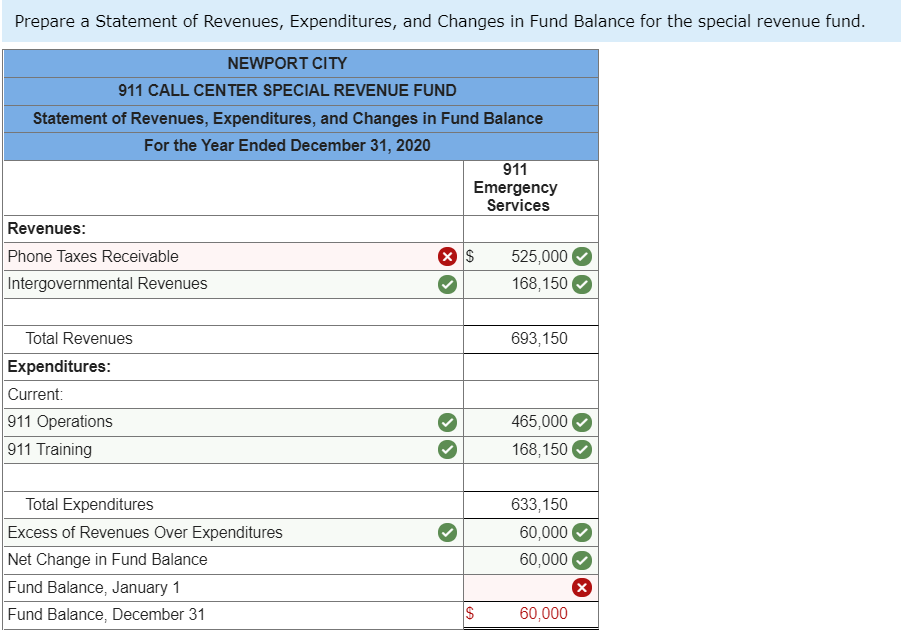

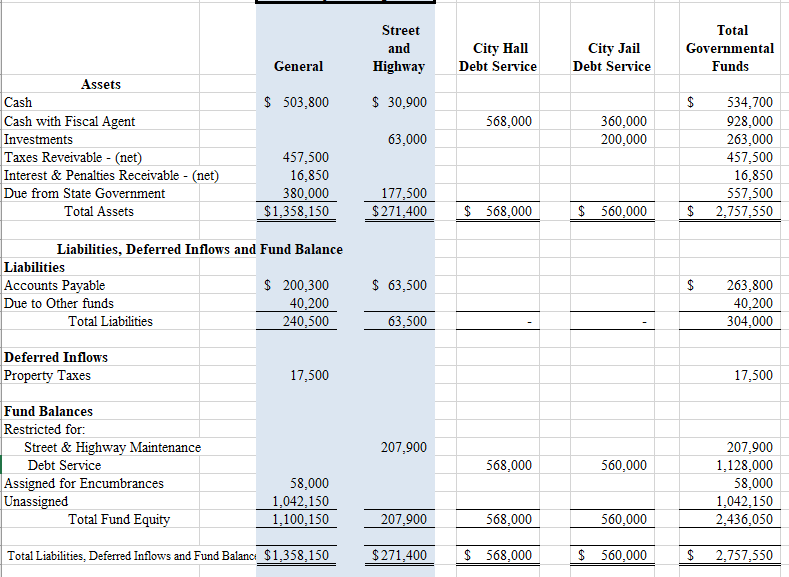

Assets, liabilities, and owners’ equity taking stock of your investments. Revenues and gains should be recorded only when they are reasonably certain, and expenses and losses should be recorded as soon as they are probable. Including the period prior to the acquisition in february 2022, revenues contracted 3.7%.

Balance sheet and cash flow. The three main categories of. Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold.

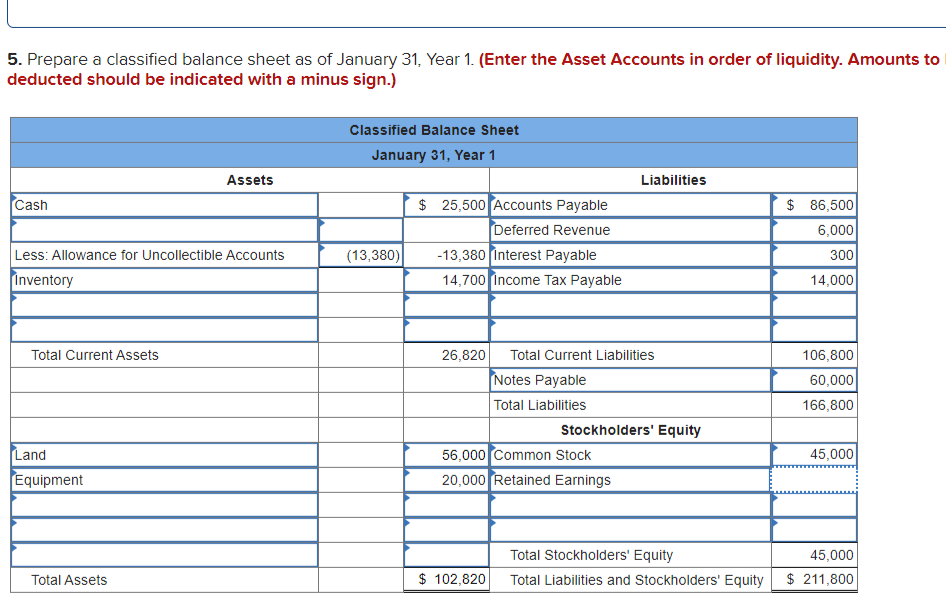

However, it also has an impact on the balance sheet. Examples, formula, & how to read | britannica money investing the corporate balance sheet: Assets = liabilities + equity.

A balance sheet offers a snapshot of a company’s financial health at a specific point in time. It is the top line (or gross income) figure from which costs. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

First and foremost, it’s essential to know what a balance sheet is and how it works. These revenues will be balanced on the assets side, appearing as cash, investments,. Under the accrual basis of accounting, revenues received in advance of being earned are reported as a liability.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)