Spectacular Info About View Form 26as With Pan Number Wall Street Mojo Ratio Analysis

If you are not registered with traces, please refer to our e.

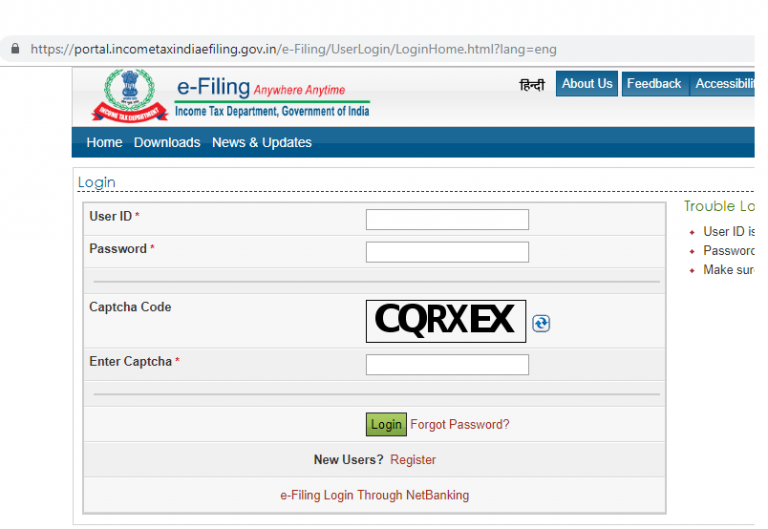

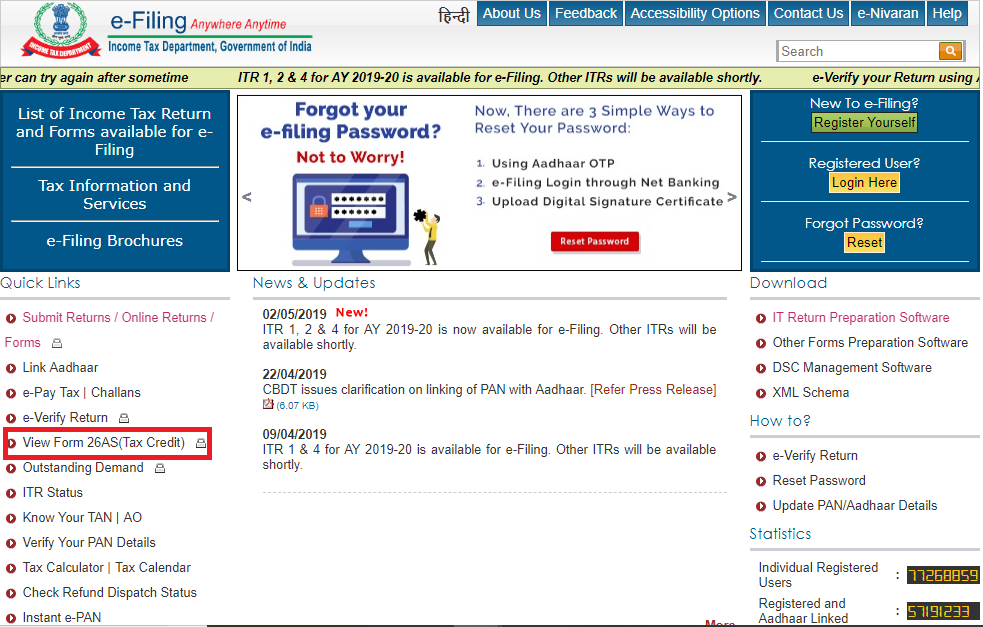

View form 26as with pan number. Enter your pan number, password and date of birth / date of incorporation in dd/mm/yyyy format. Look for an option related to income tax or form. Look for the option tax credit or view form 26as confirm your pan details when prompted.

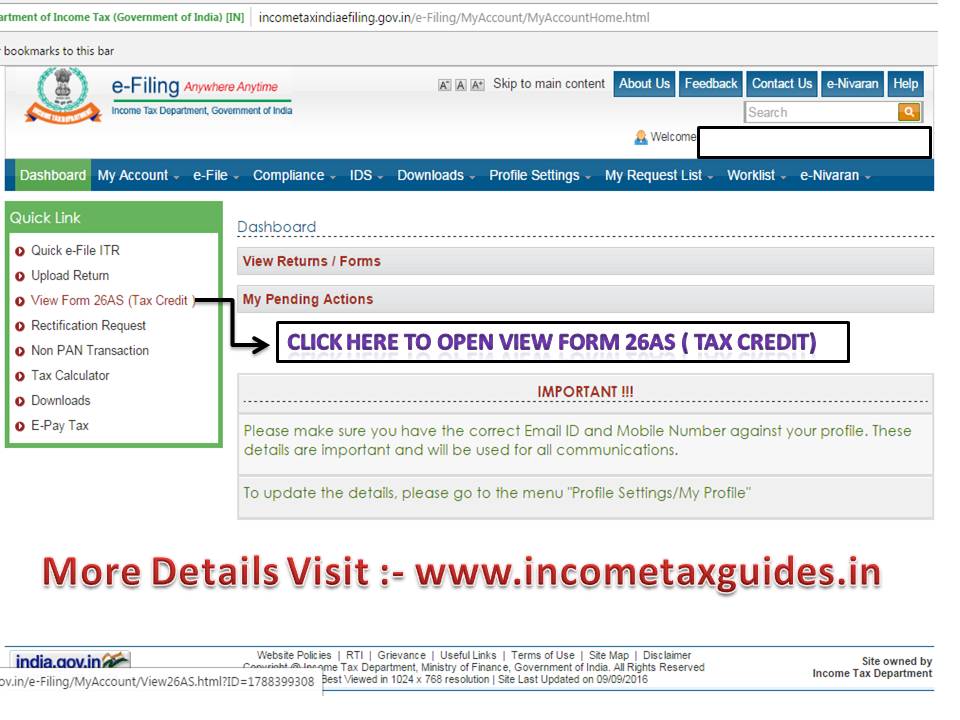

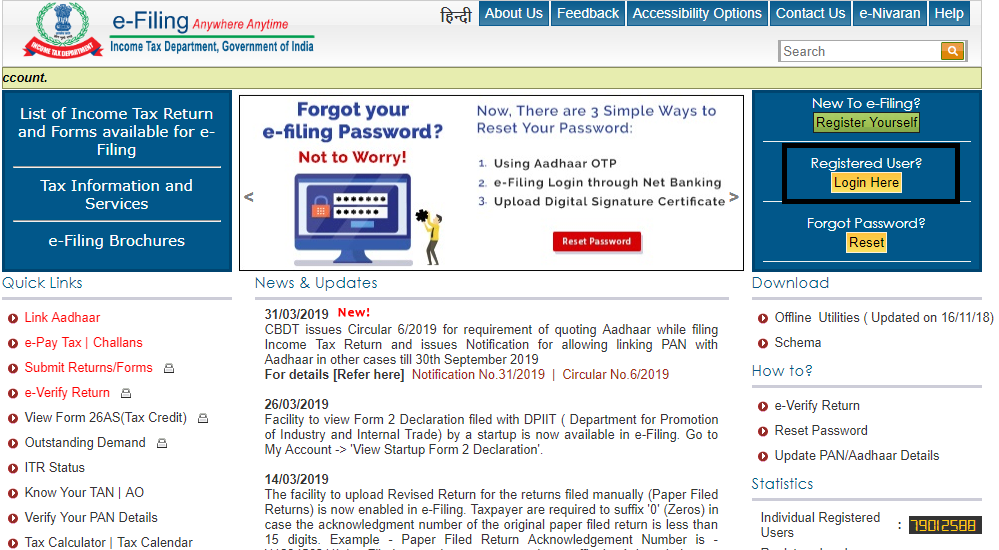

It is readily available for viewing. What is form 26as ? Some banks provide the facility to view form 26as through net banking.

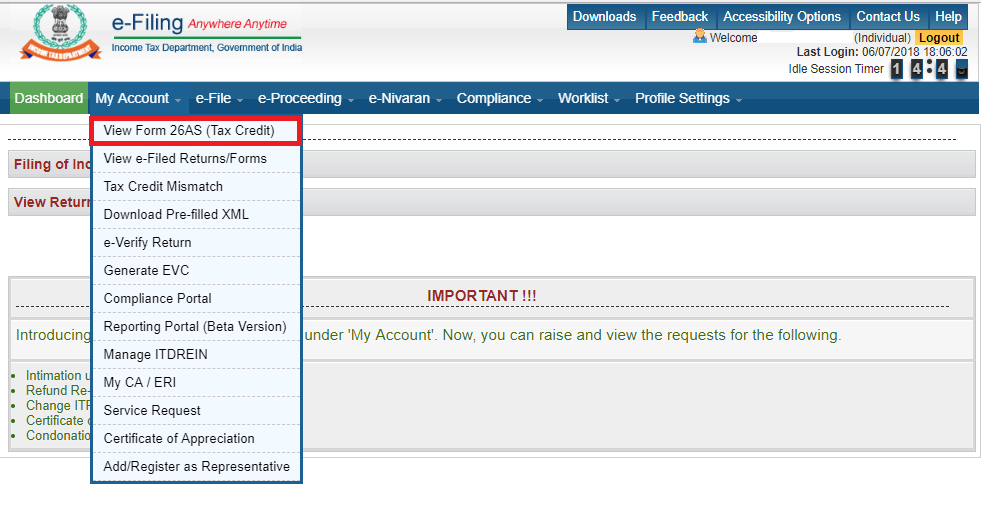

How to view form 26as? Choose the assessment year and the format in which you want to view form 26as. Users having pan number registered with their home branch can avail the facility of.

Enter the password step 4: Users of retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : Continue to the next step.

On the tds reconciliation analysis and correction enabling system (traces) portal. Click on ‘ login ‘ and enter your user id (pan or aadhar number). Options include online viewing (html format) or downloading as a.

Alternatively, the form can be viewed. And enter the captcha code. The website provides access to the pan holders to view the details of tax credits in form 26as.

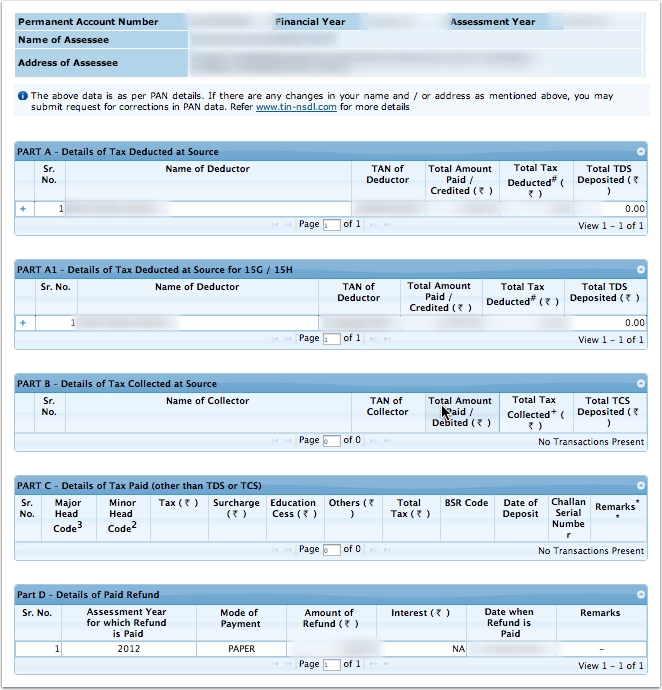

To be able to do this, you must have your. Individuals have the option to view form 26as from the traces portal and can also download it as shown in the previous section. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes.

Log in to your net banking account. How do i view form 26as using the net banking feature? Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit statement as pdf, view it as html > click on 'export as pdf'.

It is a crucial document for taxpayers as it helps them in filing their income tax returns correctly and ensures that they receive credit for the taxes paid. Pan holders with net banking accounts at any authorized bank have the option to view form 26as. You may view form 26as by pan no.