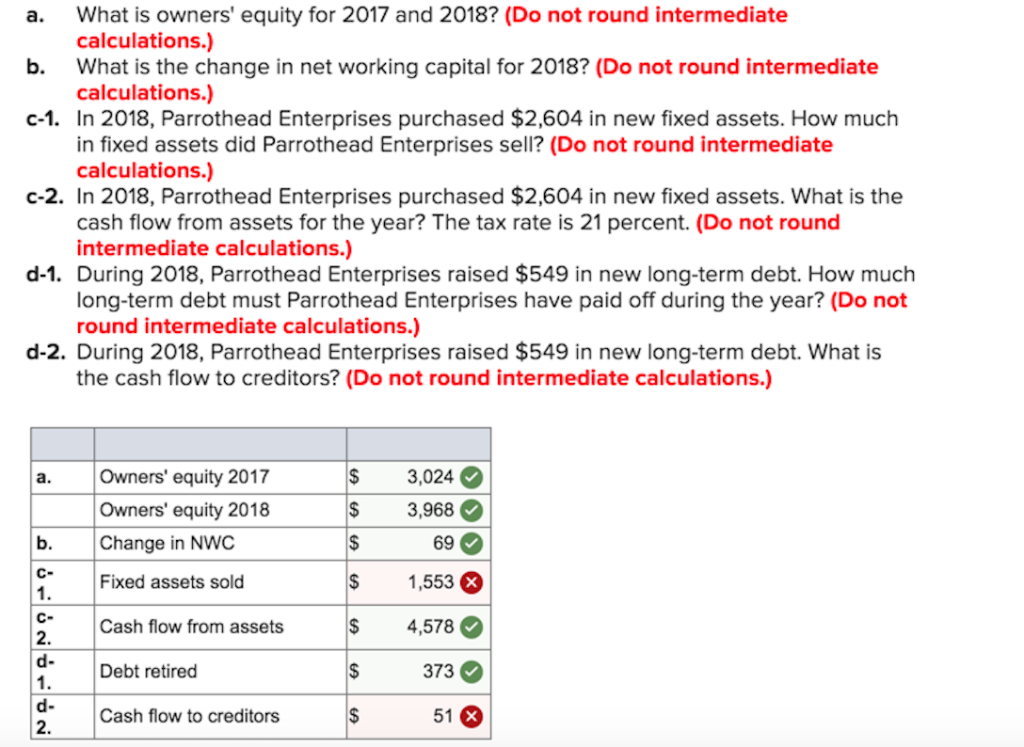

Best Of The Best Info About State Of Owners Equity Understanding Financial Statements

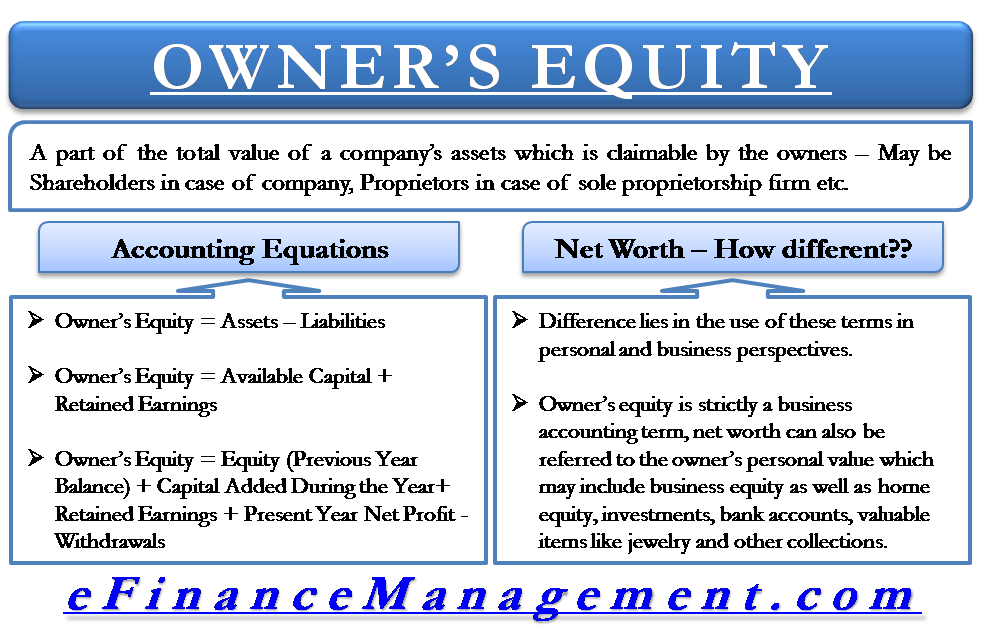

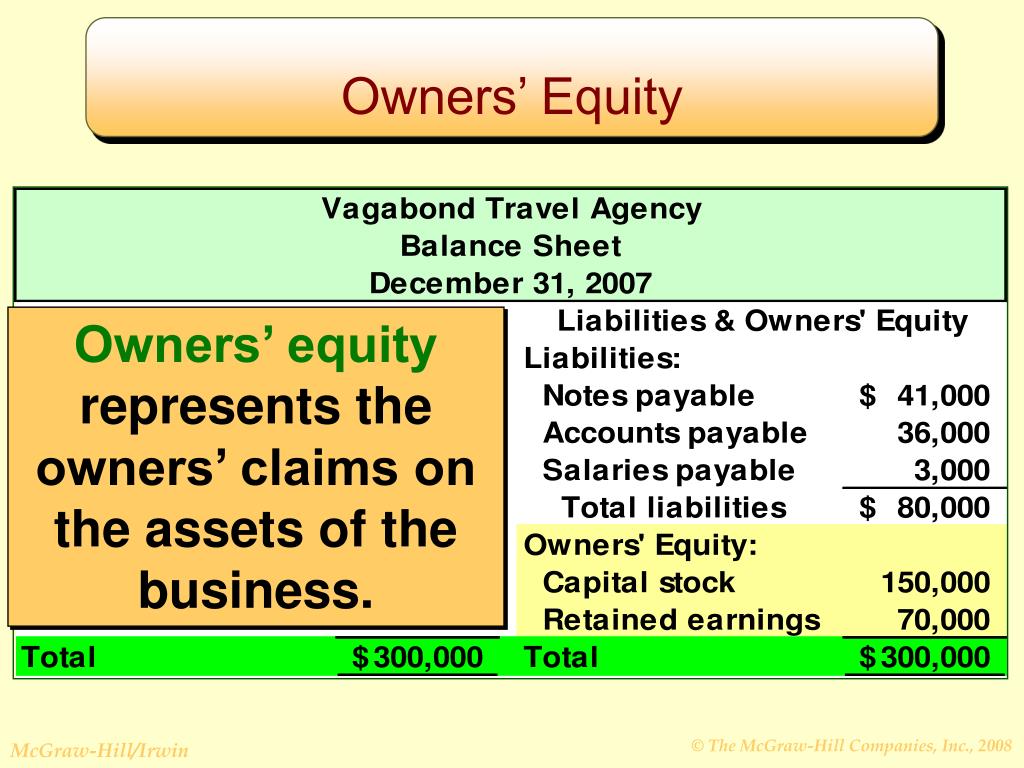

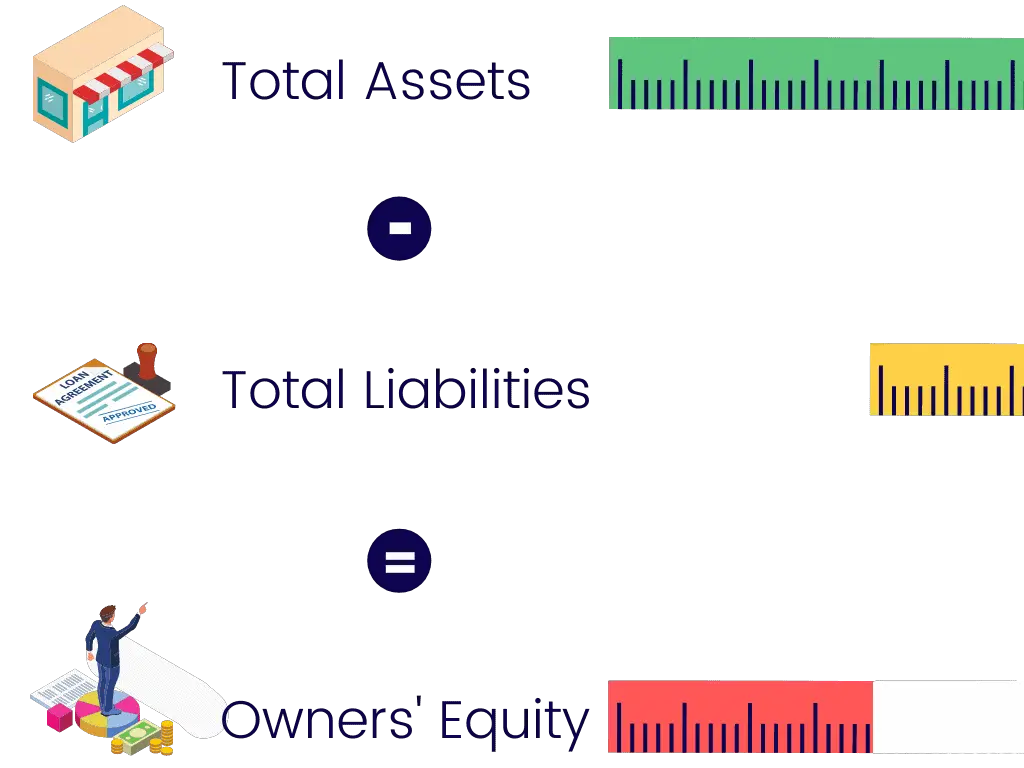

Owner’s equity is tracked on the balance sheet and is a product of your assets minus your liabilities.

State of owners equity. However, nowadays, corporates also utilize this term. Explanation “owner’s equity” is a commonly used terminology for sole proprietors. Identify the structure and key elements of the.

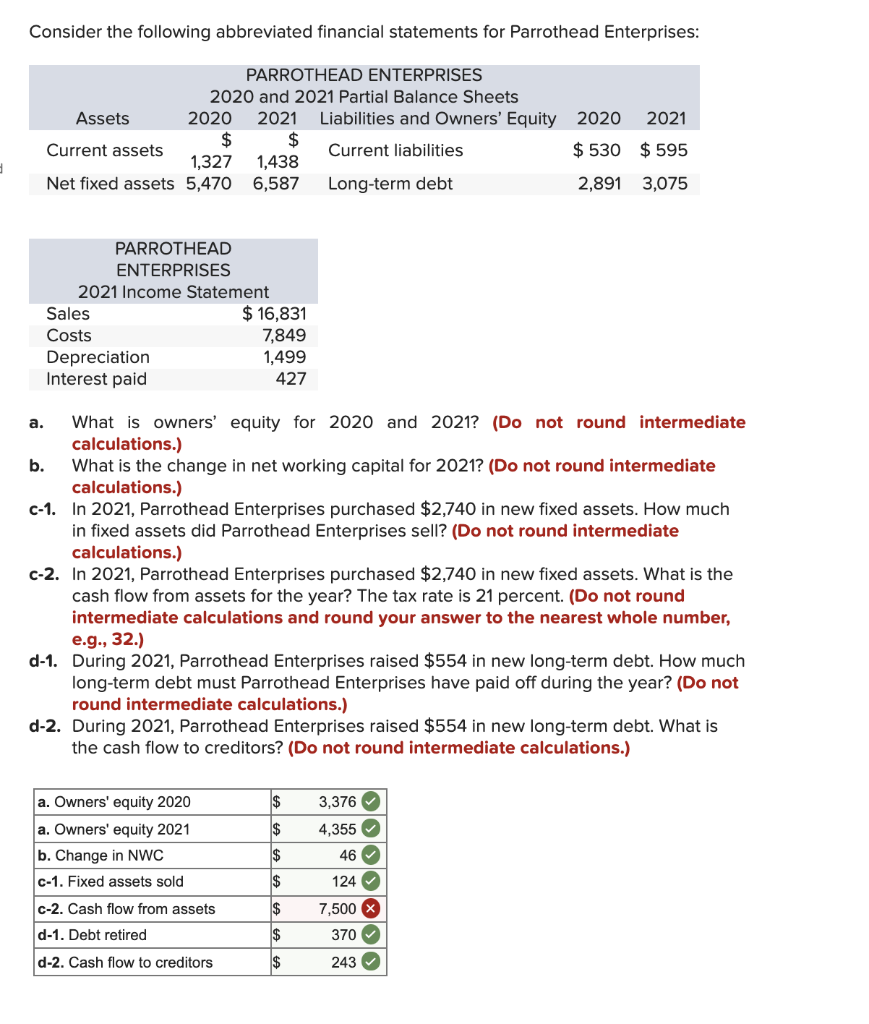

Common shares(#) = 100 million 2. Can you think of another way to confirm the amount of owner’s. It may seem significant, but it is less.

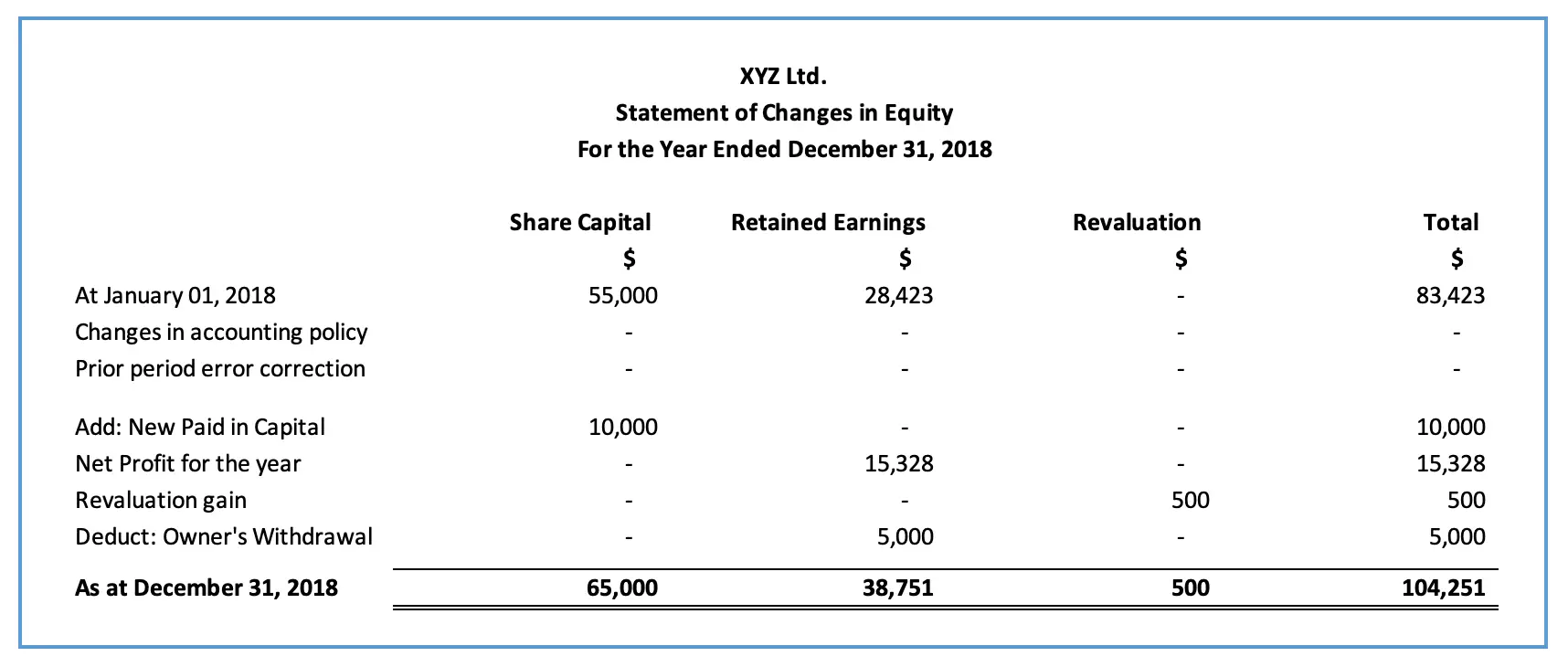

Retained earnings = $10 million by. Suppose a company’s equity accounts on january 1, 2020, the start of its fiscal year 2020, consists of the following. Owner's equity refers to the percentage of the company's value allocated to the owner or owners of the business.

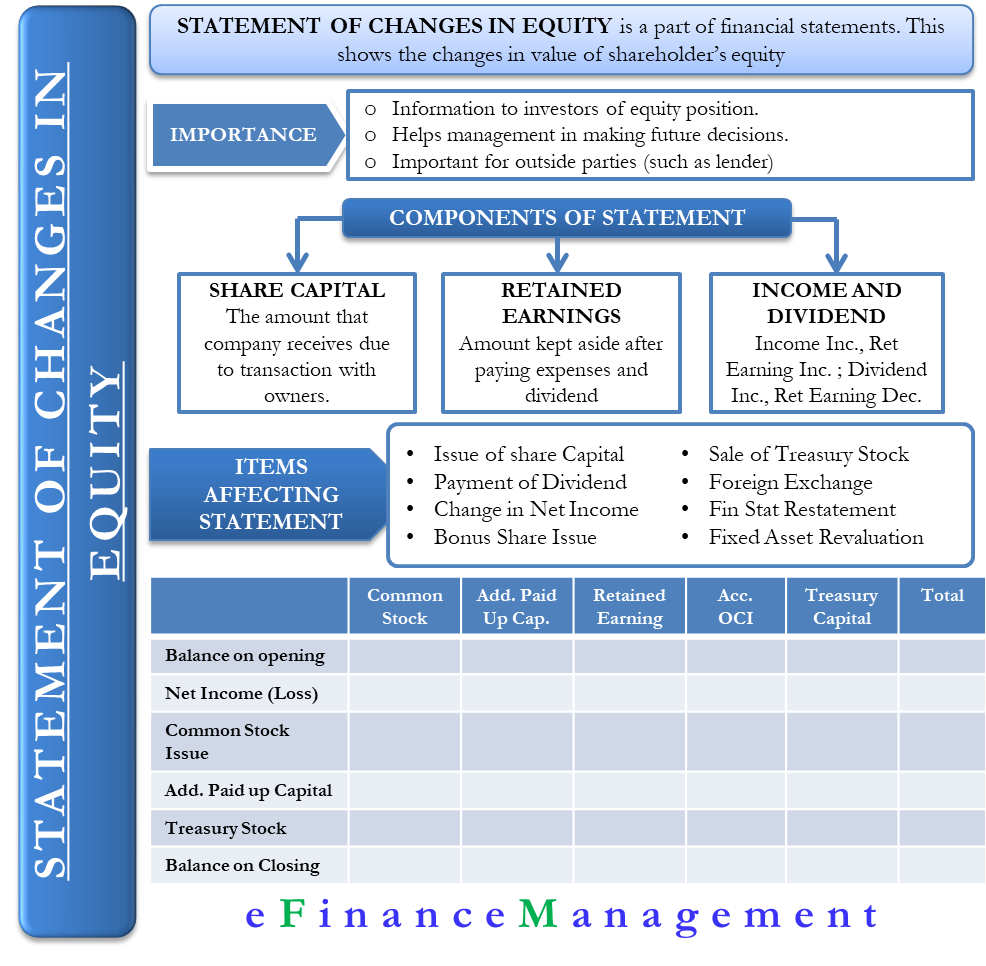

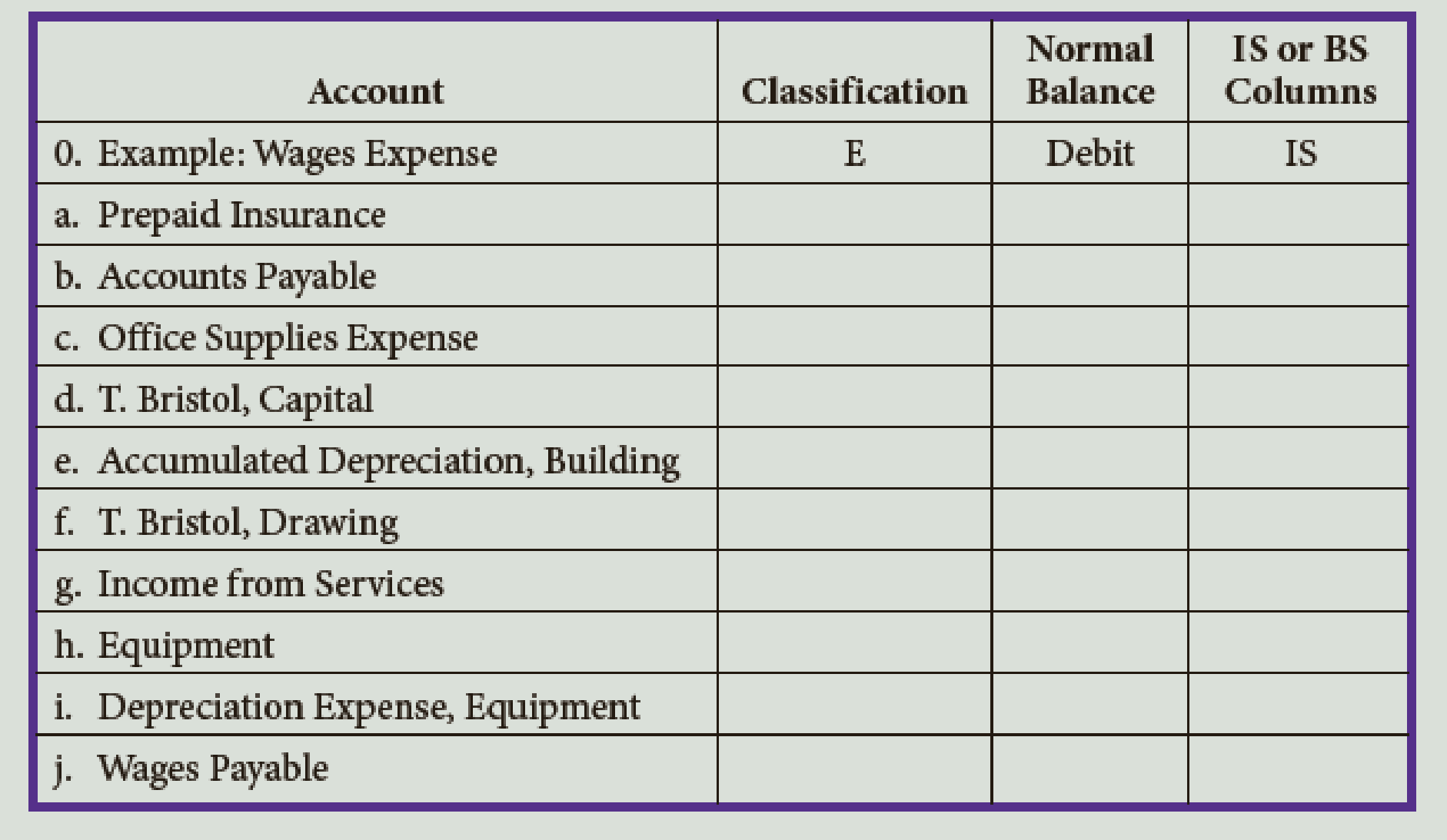

Gather the needed information the statement of changes in owner's equity is prepared second to the income statement. Definition of owner's equity owner's equity refers to the residual claim on assets that remain after all liabilities have been settled. The statement of owner’s equity, also known as the statement of shareholder’s equity, details this equity section of the balance sheet.

We will still be using the same source of. The stockholders’ equity section of the balance sheet for corporations contains two primary categories of accounts. Outline the purpose and importance of the statement of owner’s equity.

Common stock($) = $12 million 3. A statement of owner's equity (or statement of changes in owner's equity) shows the movements in the capital account of a sole proprietorship. Owner’s equity is typically seen with sole proprietorship s, but can also be known as stockholder’s equity or shareholder’s equity if your business structure is a.

And, so long as the growth rate of capital exceeds the growth rate of wages, wealth inequality in the united states and elsewhere will continue to grow. Business owners, lenders, investors, and potential buyers use the statement of owner’s equity to determine a company’s value, measure business health and. Assets, liabilities and subsequently the owner’s equity can be derived from a balance sheet.

According to the farlex financial dictionary, “owner’s equity can be used to determine a person’s or a company’s creditworthiness, as well as to evaluate the. Owner’s equity is defined as the proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders. It moves up and down over time as the business invoices customers, banks.

It represents how much of the company the owner retains after. Additional paid in capital(apic) = $6 million 5. A statement of owner’s equity reflects these increases and decreases in owner’s equity over a specific period.

What is a statement of owner’s equity? The formula for owner’s equity is: Owner's equity is the asset that remains after a business has paid off all of its debts and liabilities.

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)