Best Of The Best Info About Financial Ratios For Government Agencies Managers Use Statement Analysis To

In addition, financial indicators have been widely applied with local governments, as evidenced by the 42 financial ratios proposed by the international city/county.

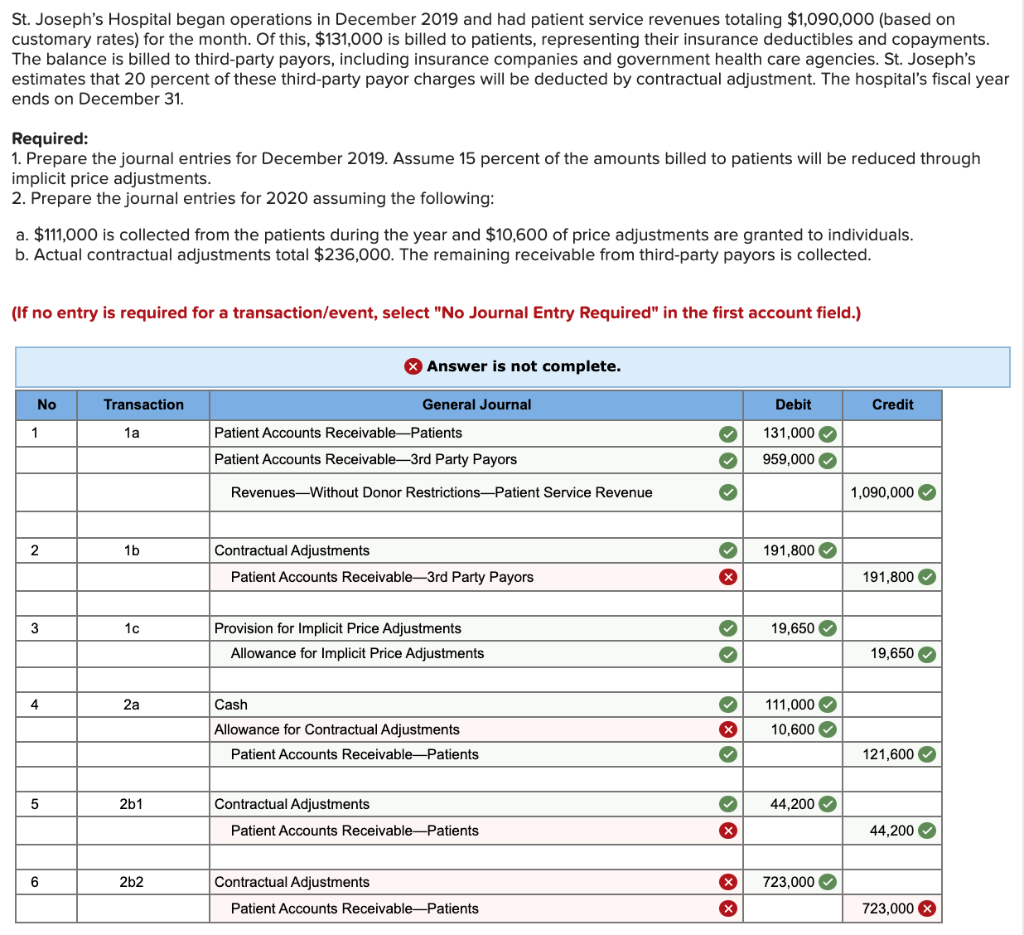

Financial ratios for government agencies. The securities and exchange commission (sec), the federal government agency that regulates public companies, designates the fasb as the official source of gaap for. The framework adapts and extends an earlier methodology and. However, rather than focusing on a set of common indicators, the literature reports a plethora of different ones used for four main purposes:

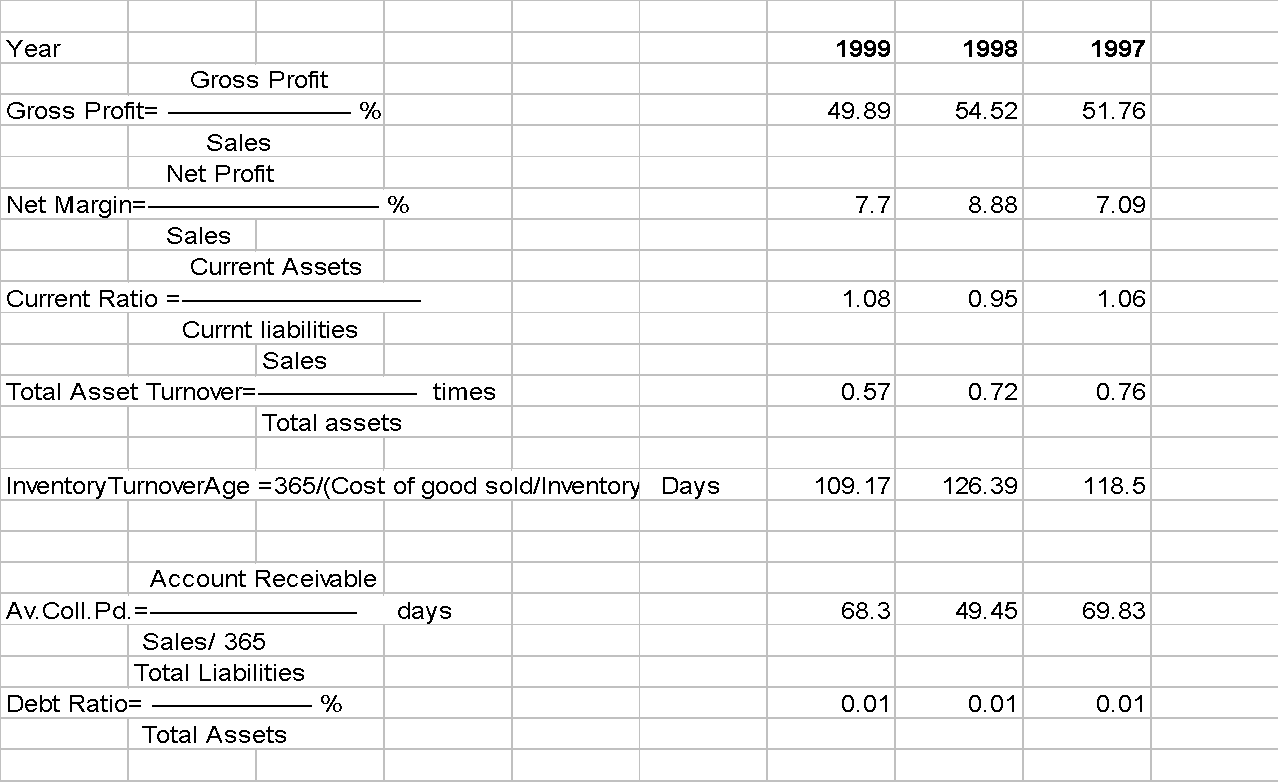

Government revenue ratio (government revenue/total revenue) ($1,261,618)/($10,625,911) = 0.12: Top five financial kpis for government entities the ratio of operating costs to budget. Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a.

It is calculated by dividing current assets by current liabilities. How does this organization’s financial position compare to its peer organizations? Financial ratios can be categorized as measures of financial position, liquidity, solvency, and fiscal capacity.

The financial statements provide gsa's financial results, including the balance sheets, the statements of net cost, the statements of changes in net. A framework to assess the financial performance of local governments is presented in this paper. The government finance officers association (gfoa) also has recognized value in the use of comparative data from other governments as evidenced by its.

Content copyrighted by financial accounting foundation, or any third. These ratios provide users with key indicators of the financial performance of a local. A ratio of more than 1 is generally accepted to show a low risk.

The liquidity or current ratio is a traditional method of assessing an entity’s ability to meet its debts as and when they fall due. A financial condition analysis is particularly appropriate for state and local governments. Since our public sector finances, uk:

It can also be useful for nonprofit organizations, though the data sources. Like all organizations, government entities need to know how their. Legislation financial ratios are included in the notes to the annual financial report.

From table 1: Financial position ratios financial position ratios are used to. Payable by agencies that administer the government’s pension and other benefit plans for its military and civilian employees.

Updated july 27, 2021 reviewed by andy smith while many investors have at least some understanding of typical financial statements like the balance sheet, income statement. The financial report of the u.s.