Fun Info About Accrued Wages In Balance Sheet Preparation Of Ledger Accounts And Trial

Presentation of accrued wages.

Accrued wages in balance sheet. Accrued income reported on the balance sheet. The accrual of wages expense has a direct impact on the balance sheet, which is a financial statement that provides a snapshot of a company’s financial position. Use a journal entry form to create an accrual in the balance sheet.

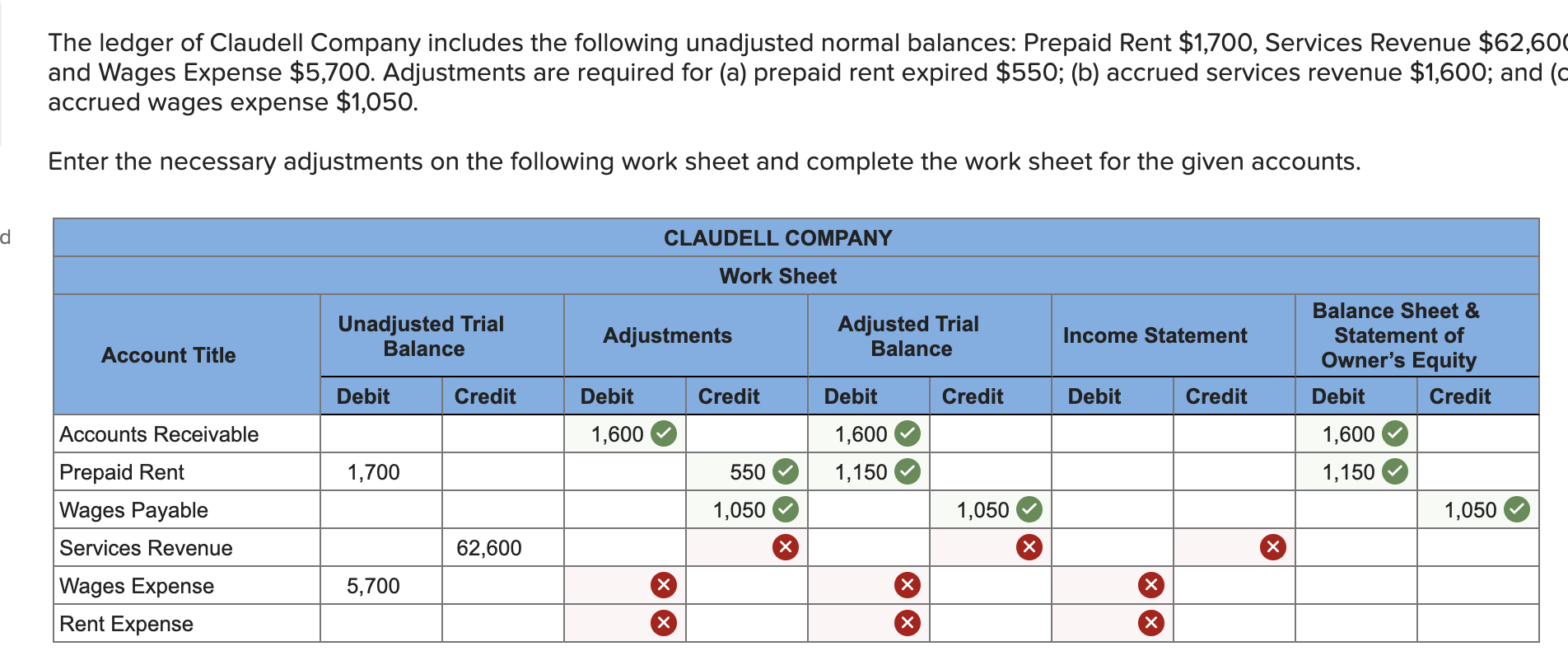

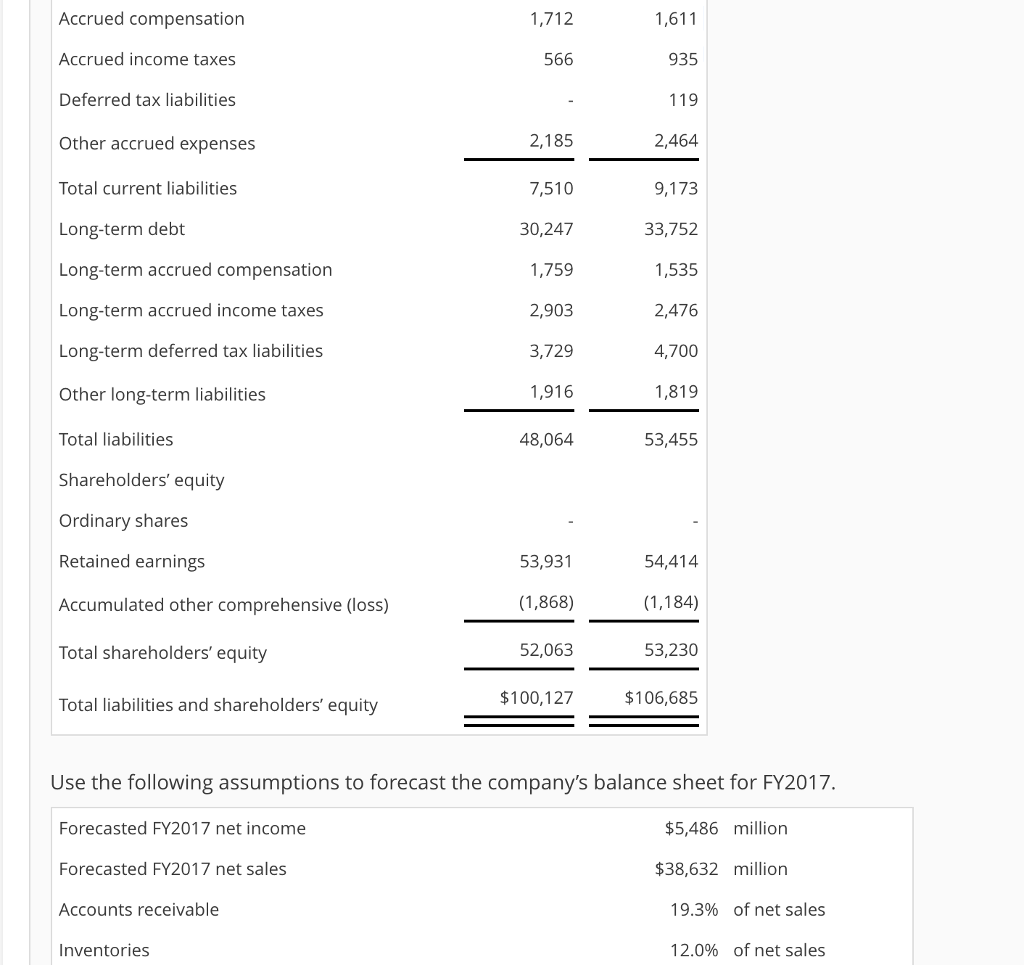

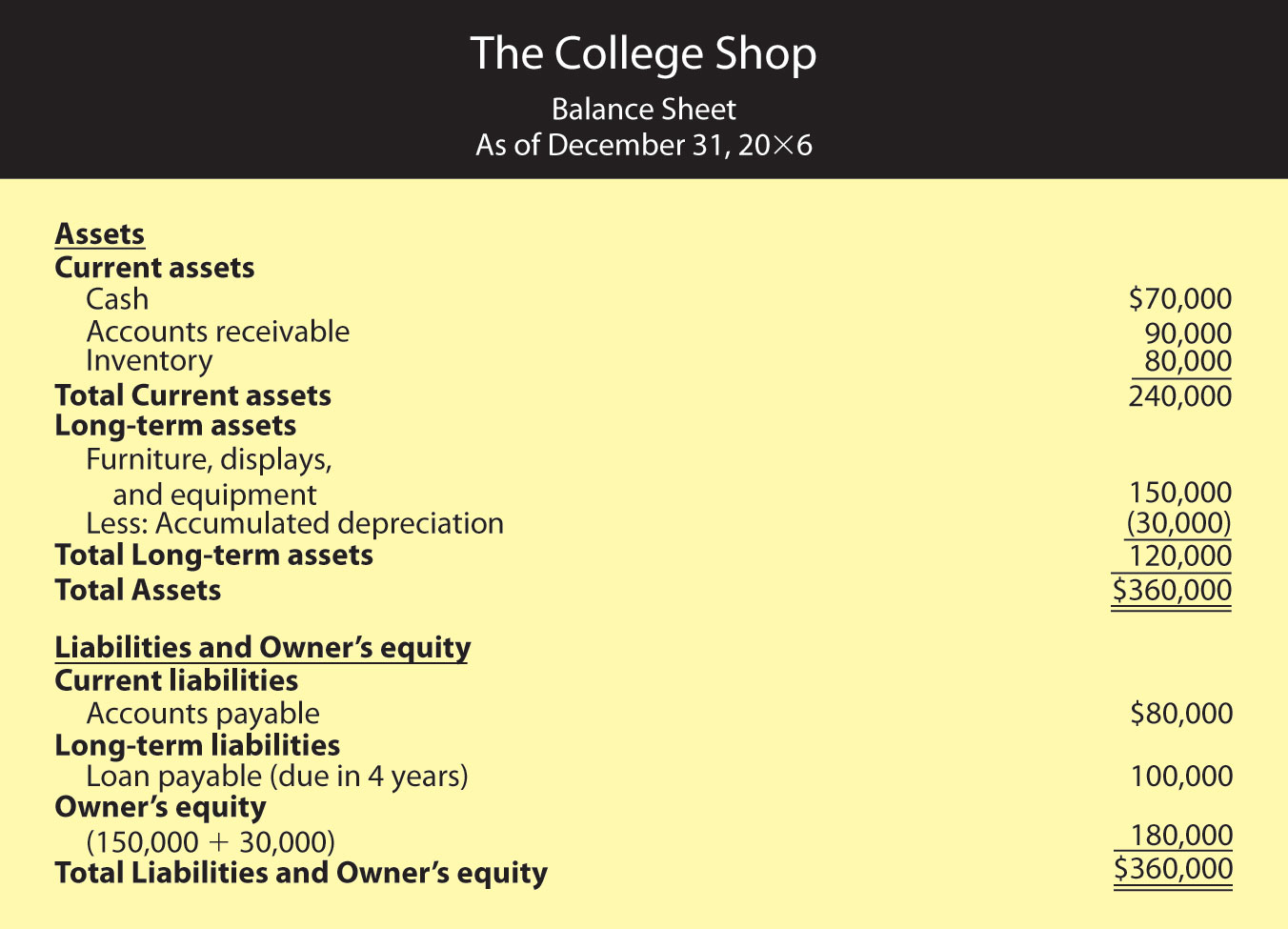

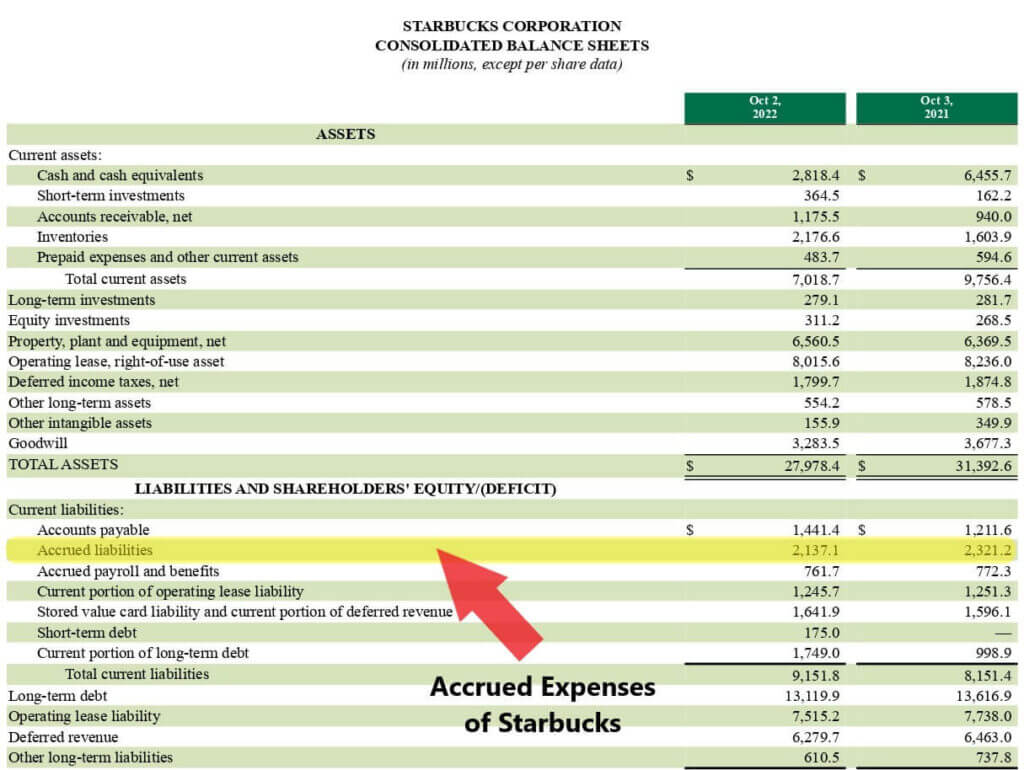

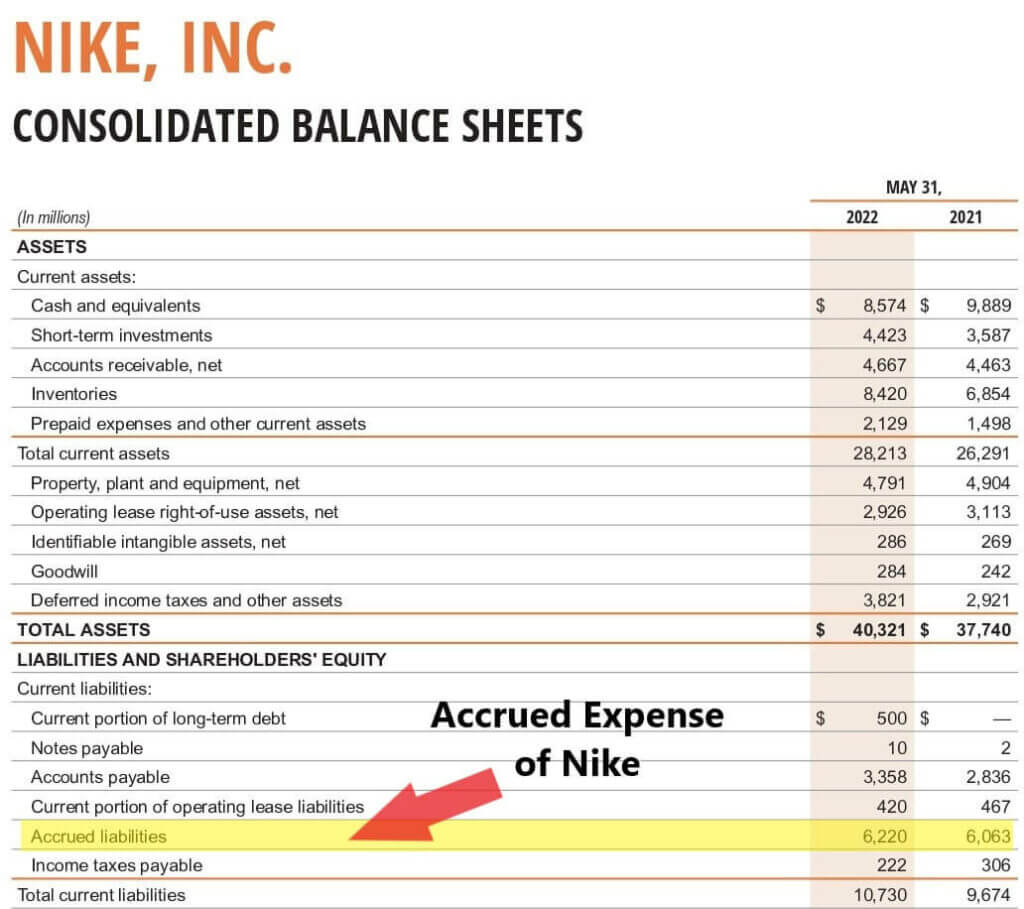

Accrued wages are categorized under the accrued expensesline item, which is a current liability on the balance sheet. However, labor expenses appear on the balance sheet as well, and in three notable ways: Where are accruals reflected on the balance sheet?

If the amount is payable within one year, then this line item is classified. Accrued wages are the balance sheet account and are usually payable within the next 12 months. The amount of accrued salaries are mentioned as current liabilities in the balance sheet.

This is because had these salaries. Accrued wages are money a company owes to employees for work done but not yet paid. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

Accrued wages journal entry overview. You may pay salaries to the 26 th of the month and post the additional days of the month using an. This is because an accrued salary expense affects both the expense.

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services. And are considered a current liability.

Definition of accruals the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred,. The accounting term “accrued wages” describes the unpaid compensation not yet paid by a company to employees for the services they have already provided. In case of any agreement, the payment.

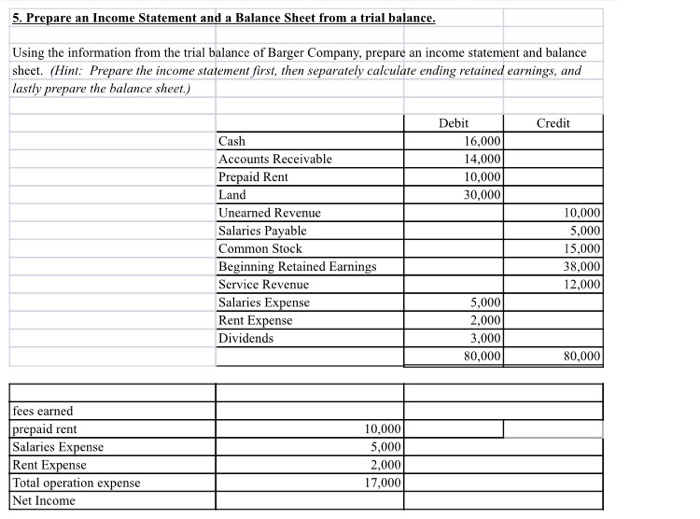

An accrued salary expense is likely to affect both the income statement and the company’s balance sheet. For example, if a company has performed a service for a customer but has not. Salaries, wages and expenses are vital components of your income statement, which lists everything you earned and.

They appear as a liability on the balance sheet. The net effect, however, of accrued salaries is null. Income statement vs.

The accrued wages are due at the end of a financial period and recorded in the liabilities section of a balance sheet as a current liability for the business entity. In accounting, accrued wages are the wages that the employees have earned but have not received the payment yet. Wages payable, works in progress, and capitalized expenses.