Painstaking Lessons Of Tips About Depreciation Expense In Profit And Loss Statement Igarashi Motors Balance Sheet

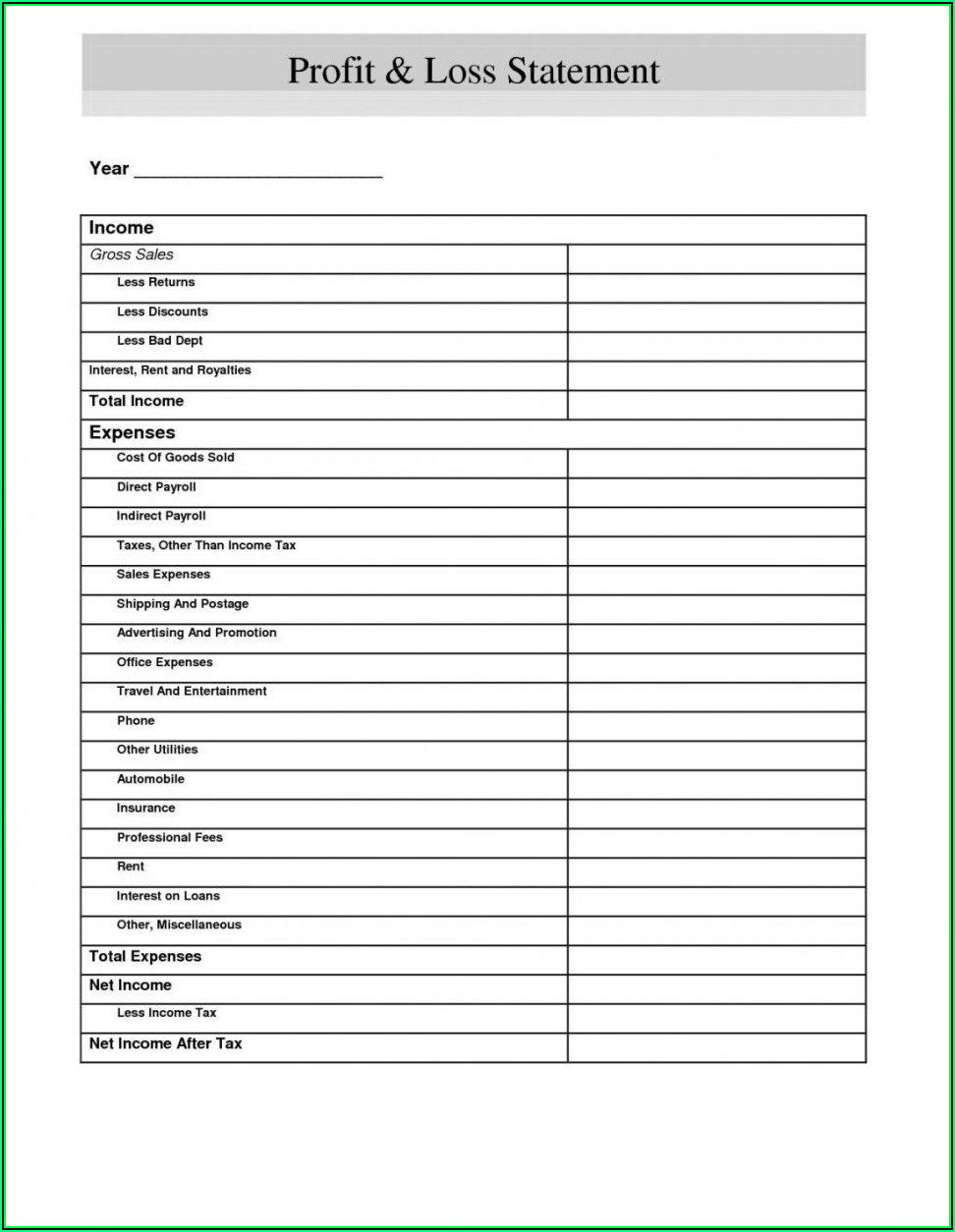

The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss.

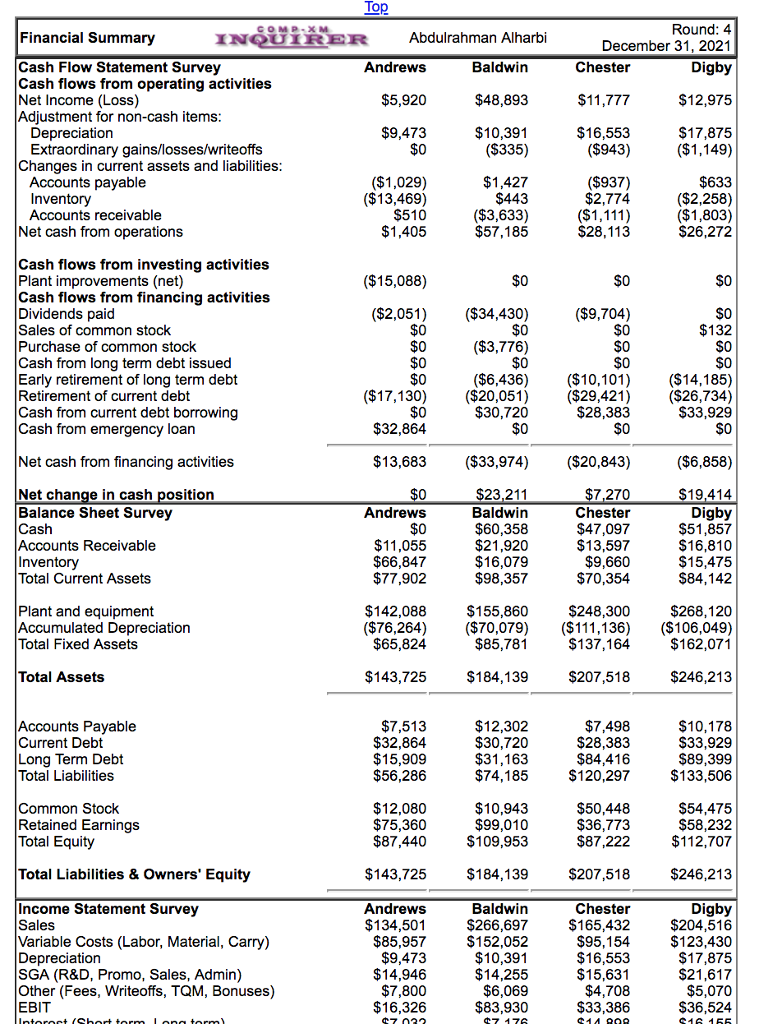

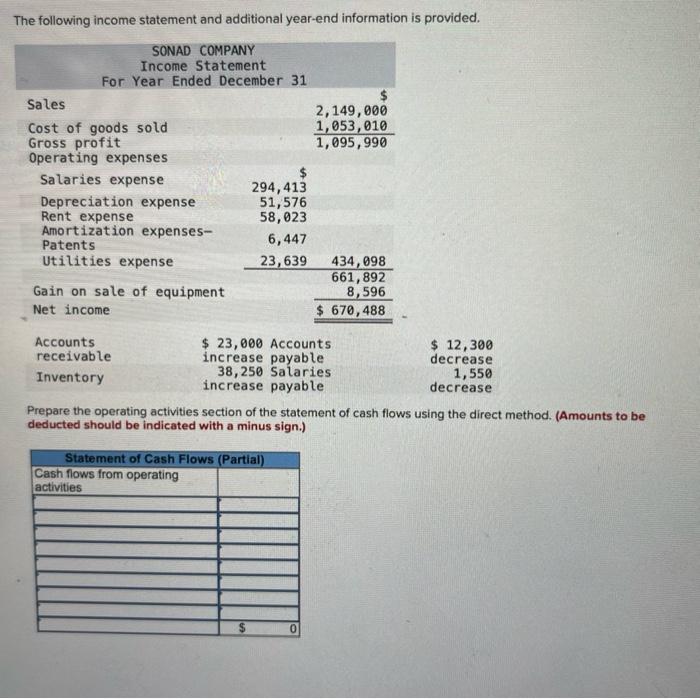

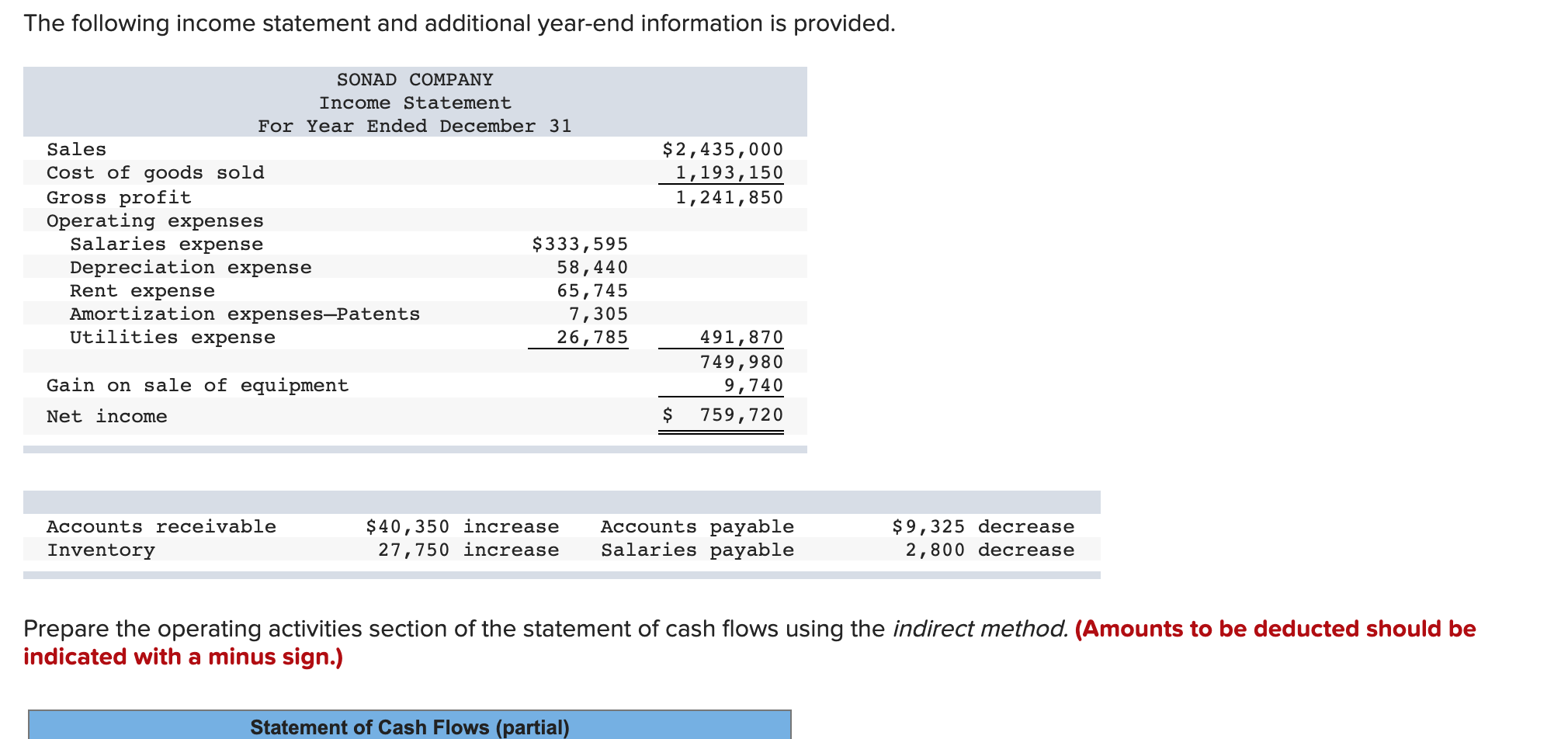

Depreciation expense in profit and loss statement. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. It is accounted for when companies record the loss in value of their fixed assets through depreciation. Small business | finances & taxes | profit by cam merritt updated january 11, 2019 a depreciation expense has a direct effect on the profit that appears on a.

How to classify expenses in profit or loss statement under ifrs? It spreads the cost of the fixed asset. Revenue, expenses, and net income.

Your p&l statement shows your. Essentially, it is an accounting technique used by companies to allocate the cost of a. By silvia financial statements 23 how to classify expenses in profit or loss?

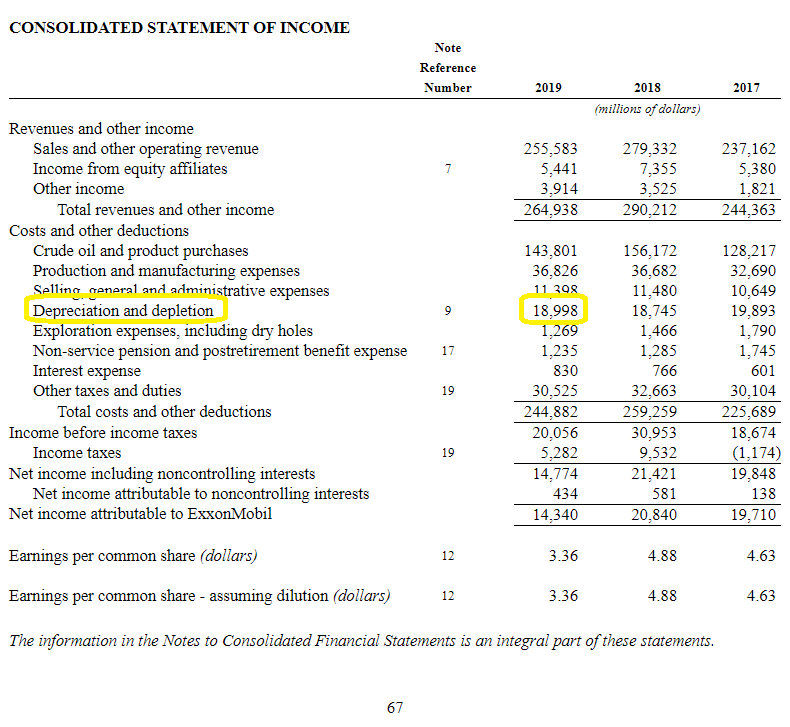

Definition of depreciation depreciation is the systematic allocation of an asset's cost to expense over the useful life of the asset. Physical assets, such as machines, equipment, or vehicles, degrade over time and reduce in value incrementally. You can list depreciation in the operating expenses of the income statement if the asset serves the production.

More advanced profit and loss statements also include. Depreciation expenseis an income statement item. In the realm of finance, depreciation expense plays a seminal role.

The carrying amount of the plant and. Murphy updated july 23, 2021 reviewed by margaret james. A profit and loss statement contains three basic elements:

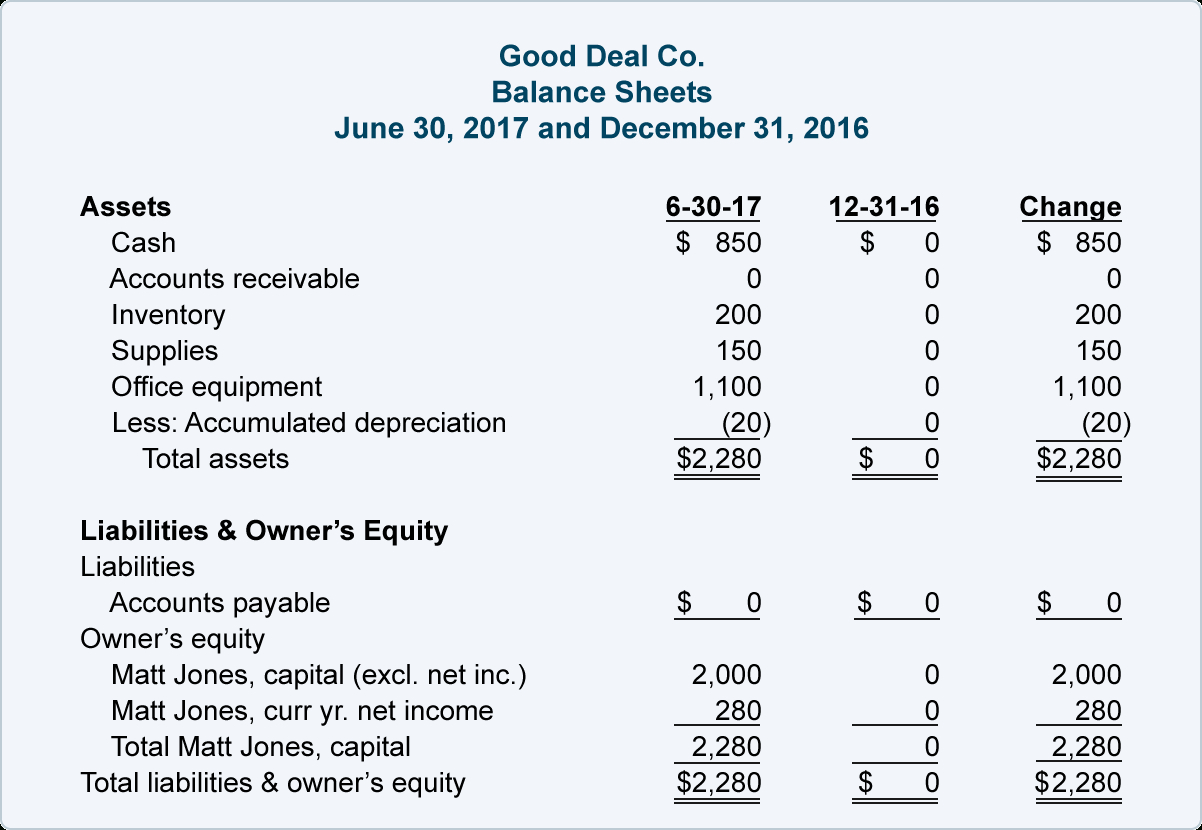

Corporate finance accounting are depreciation and amortization included in gross profit? Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. In the world of taxes for trades, professions, or vocations, not al. The depreciation expense amount changes every year because the factor is multiplied with the previous period’s net book value of the asset, decreasing over time due to.

The $39,000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. It’s one of the core financial statements that all nonprofits need. Example of depreciation let's assume that a.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)