Stunning Tips About Owners Equity Is Equal To Warranty Expense Income Statement

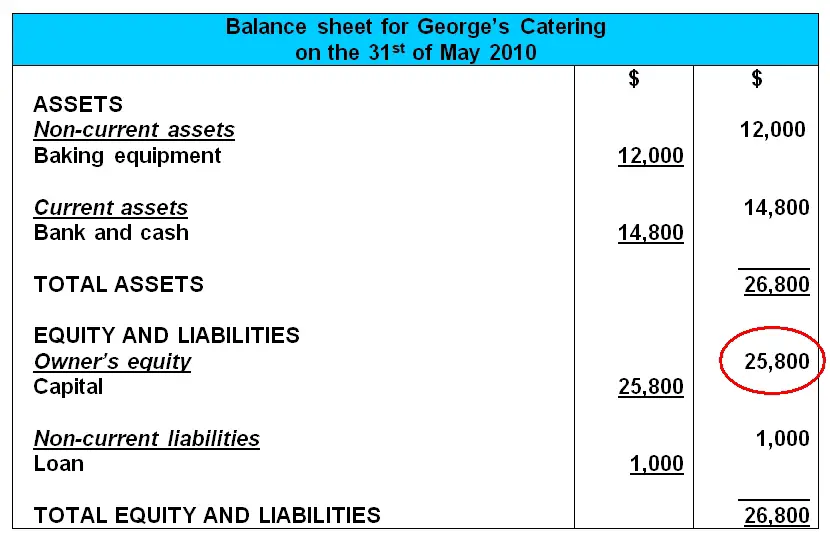

Creating this statement relies on the accurate recording and analysis of your business’s balance sheets.

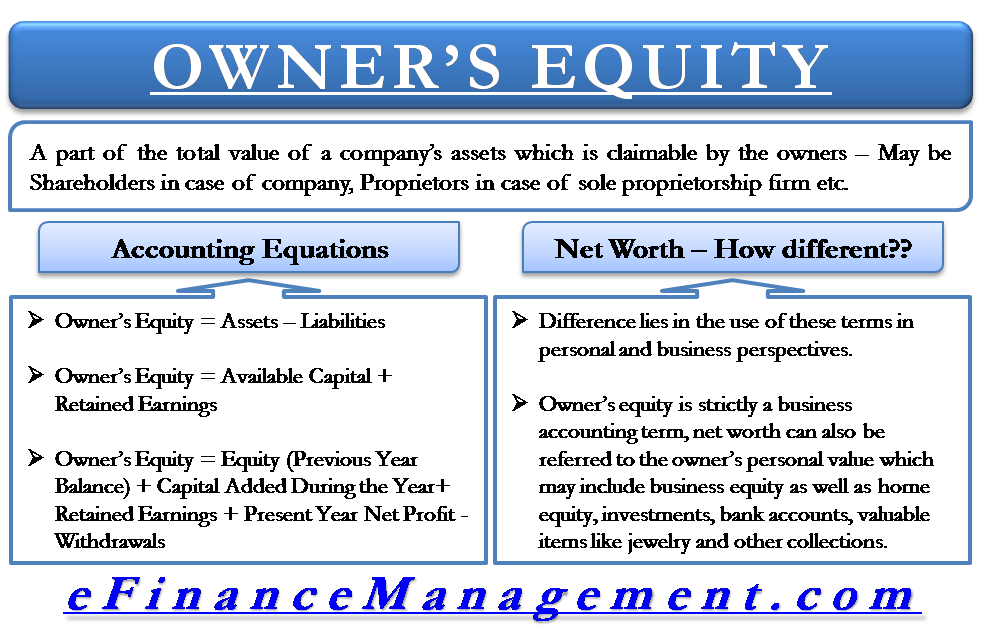

Owners equity is equal to. For llcs or corporations, the term used is shareholder’s or stockholder’s equity. There are different components that make up the owner's equity, including common stock, preferred stock, retained earnings, and treasury stock. By tyler ross.

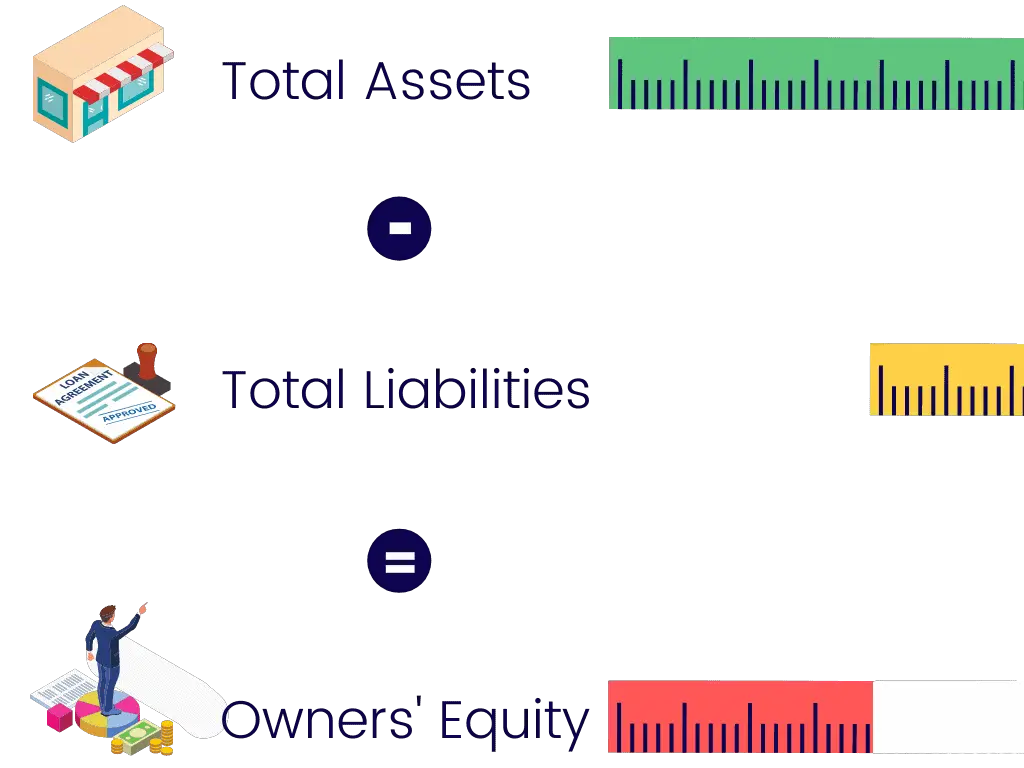

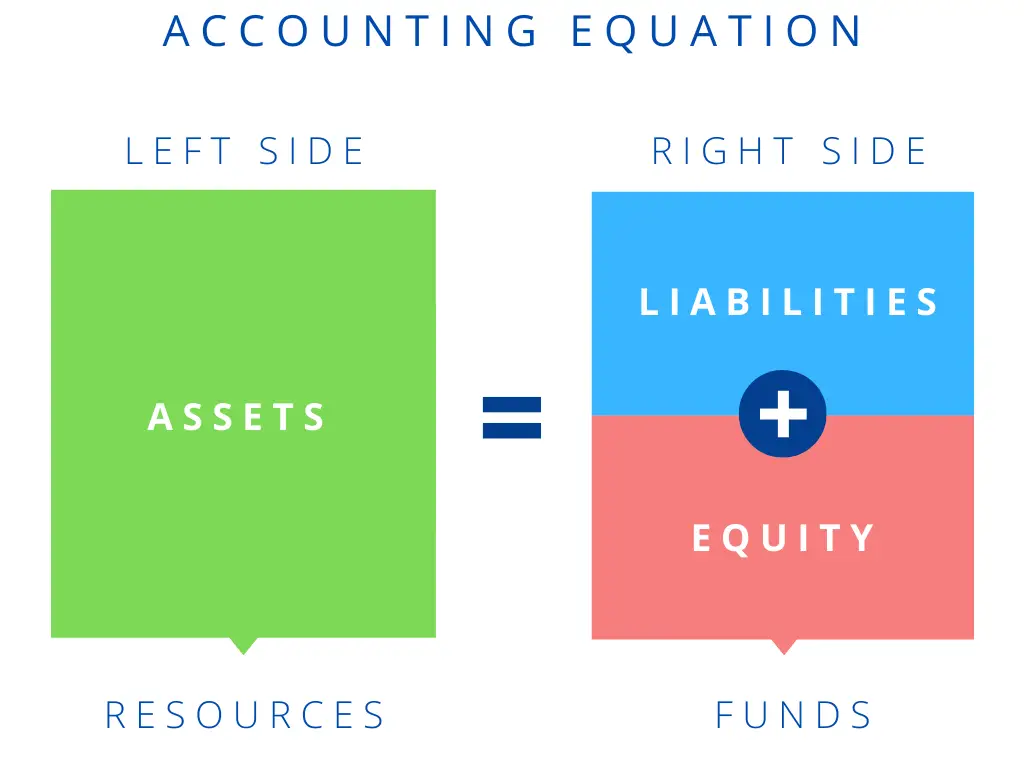

Owner’s equity is a key variable in the classic accounting equation, assets = liabilities + owner’s equity, by which a company’s balance sheet literally “balances.” (if it doesn’t, there may be accounting errors or financial statement fraud.) This calculation provides a snapshot of the financial health of a business at a specific moment in time. Owner’s equity is what is left over when you subtract your business’s liabilities from its assets.

And you want this number to be as healthy as possible. In other words, owner’s equity is the amount of money your business owes you. The term “owner’s equity” is used with sole proprietors and partnerships.

Assets = $1,000,000 + $1,000,000 + $800,000 + $400,000 = $3.2 million. If you buy a house for $500,000 and pay $100,000 toward the loan, and have belongings worth $65,000, your liabilities are around $400,000. The resulting figures will reflect each of the owner’s equity in the business.

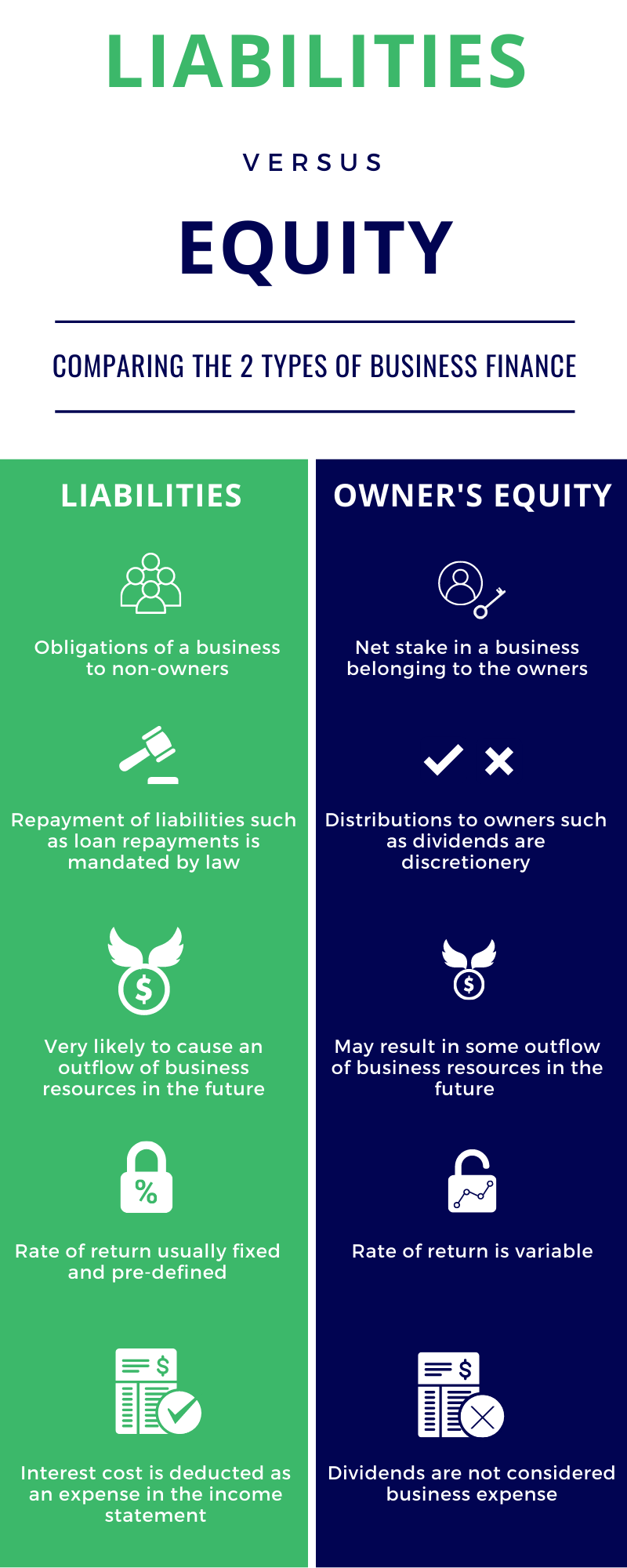

This is attributable to one, or multiple owners, depending on how the company is owned. Owner’s equity is typically seen with sole proprietorship s, but can also be known as stockholder’s equity or shareholder’s equity if your business structure is a corporation. A statement of owner’s equity covers the increases and decreases within the company’s worth.

It moves up and down over time as the business invoices customers, banks profits, buys assets, takes loans, runs up bills, and so on. It is equal to the total value of a company's assets minus the liabilities. Owner’s equity is tracked on the balance sheet and is a product of your assets minus your liabilities.

Assets = $ 15,000 + $ 17,000 + $ 12,000 + $ 17,000 + $ 20,000+ $ 5,000+ $ 19,000 = $ 105,000; Calculate the equity of individual owners. Breaking down barriers to achieve gender equality \n\nevent description:

It reports any changes to the company’s equity, including earned profits, dividends, inflow of equity, withdrawal of equity, and net loss. The other three are , balance sheet and statement of cash flows. [7] if there are two equal owners in the business, each one’s owner’s equity would be half the total business equity.

Join us on march 5th for the launch of the women, business and the law 2024 report and data!. Owner’s equity in a balance sheet Divide the total business equity by the percentage each owner owns.

Liabilities = $500,000 + $800,000 + $800,000 = $2.1 million. The term is typically used for sole proprietorships. These changes are reported in your statement of owner’s equity.

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)