Unbelievable Tips About Cash Flow Statement Layout Is Insurance An Expense On The Income

What is cash flow statement?

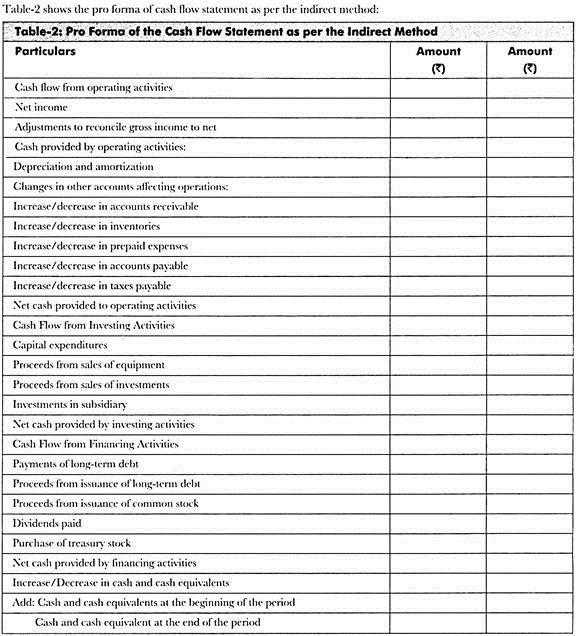

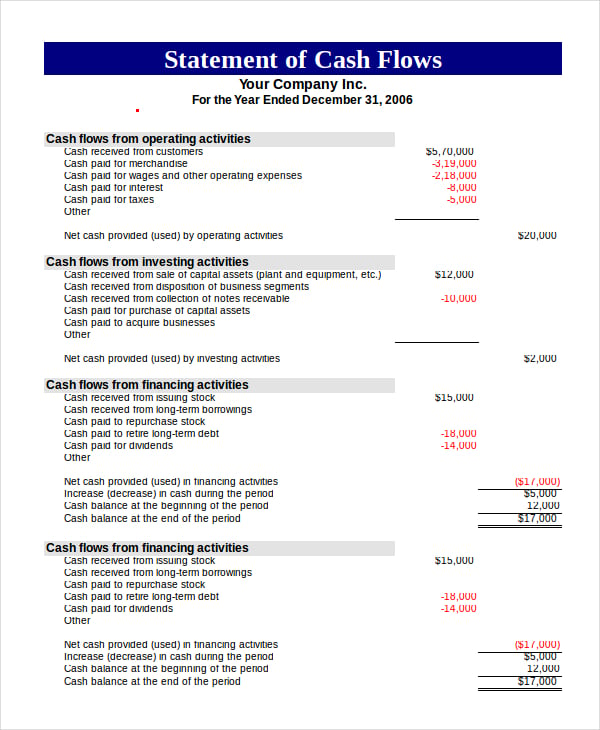

Cash flow statement layout. The cash flow statement format is divided into three main sections: Presentation of a statement of cash flows. The cash flow statement is split into three sections, operating activities, investing activities, and financing activities.

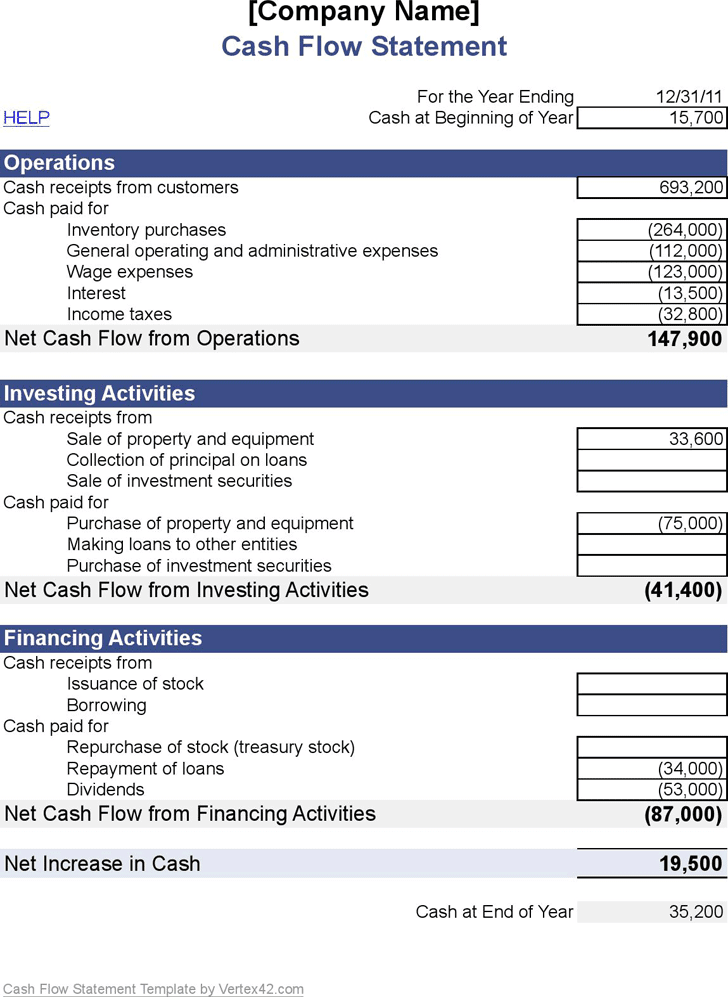

Check out this example of a cash flow statement to learn how they work. Let’s see what happened to that cash over the course of the year. It’s the same number that we saw on the balance sheet on dec 31, 2012.

A cash flow statement is a financial statement that summarizes the inflows and outflows of cash transactions during a given period of business operations. 2 manage the cash flow accounts; This information can be used to prepare a cash flow statement.

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. An entity presents its cash flows from operating, investing and financing activities in a manner which is most appropriate to its business. Analysis and income statement presentation 5m.

The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities. Cash flow from operating activities. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

Cash flow statement example. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. A statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The statement of cash flows this article sets out the requirements under the new standard and the differences between frs 102 and the previous standard, frs 1 cash flow statements (frs 1). Operating, investing and financing activities the basic cash statement sets out to show cash movements during the accounting period.

Coolgadget started the year with $50,000 in cash. A statement of cash flows is a financial statement which summarizes cash transactions of a business during a given accounting period and classifies them under three heads, namely, cash flows from operating, investing and financing activities. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally.

The cash flow statement, combined with financial analysis of ratios and metrics, helps a company assess its liquidity, which is the ability to pay obligations when due. Statement of cash flows. In financial statements, the cash flow statement is derived from the profit and loss statement amounts and movements in the balance sheet for the selected period.

Here’s the first section of the cash flow statement, with all the details showing: It helps identify the availability of liquid funds with the organization in a particular accounting period. Choose from 15 free excel templates for cash flow management, including monthly and daily cash flow statements, cash projection templates, and more.