Inspirating Info About Difference Between Direct And Indirect Method Of Cash Flow Limited Company Balance Sheet

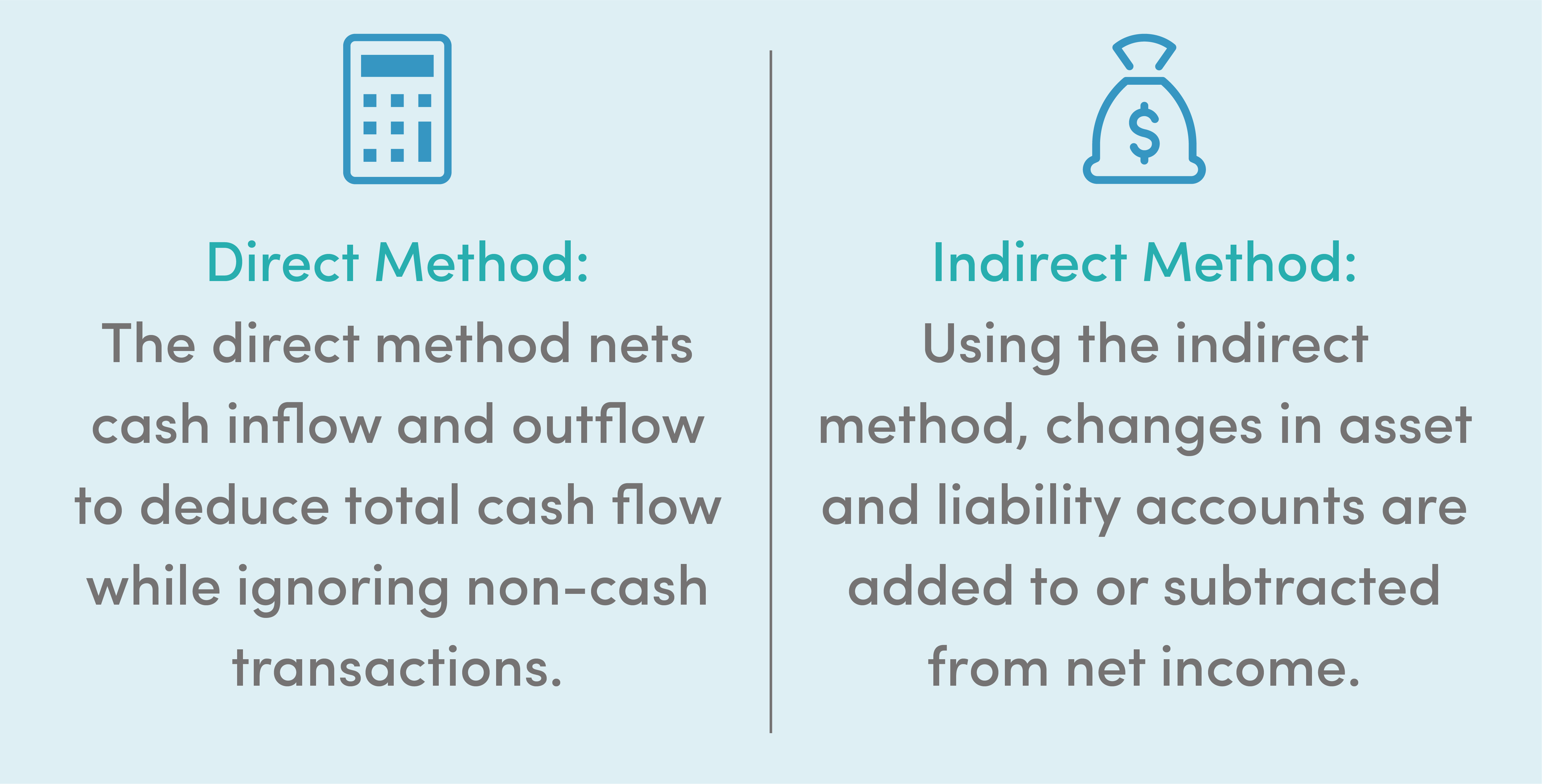

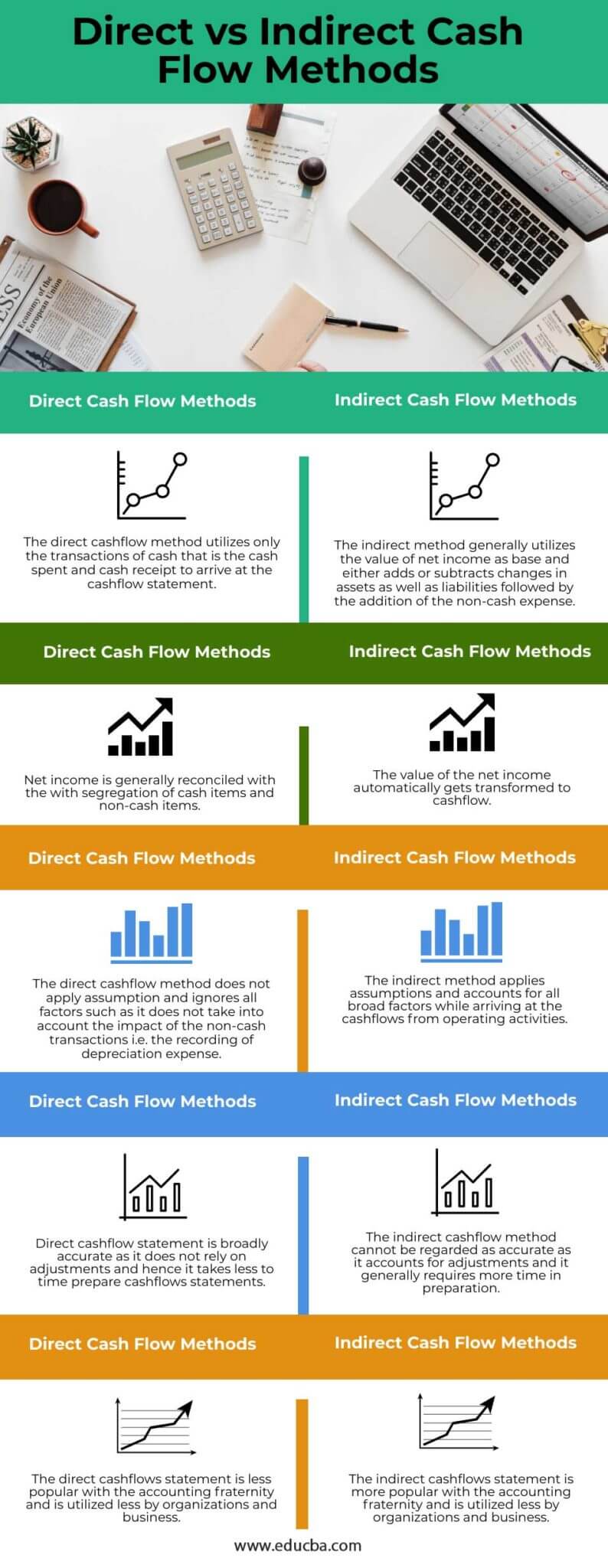

The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later.

Difference between direct and indirect method of cash flow. The indirect method always starts with the net income and makes adjustments. Key takeaways when would i use direct or indirect cash flow methods? If this is your first time broaching the subject of either of these methods then you may want to start with figuring out the “why” instead of the “what”.

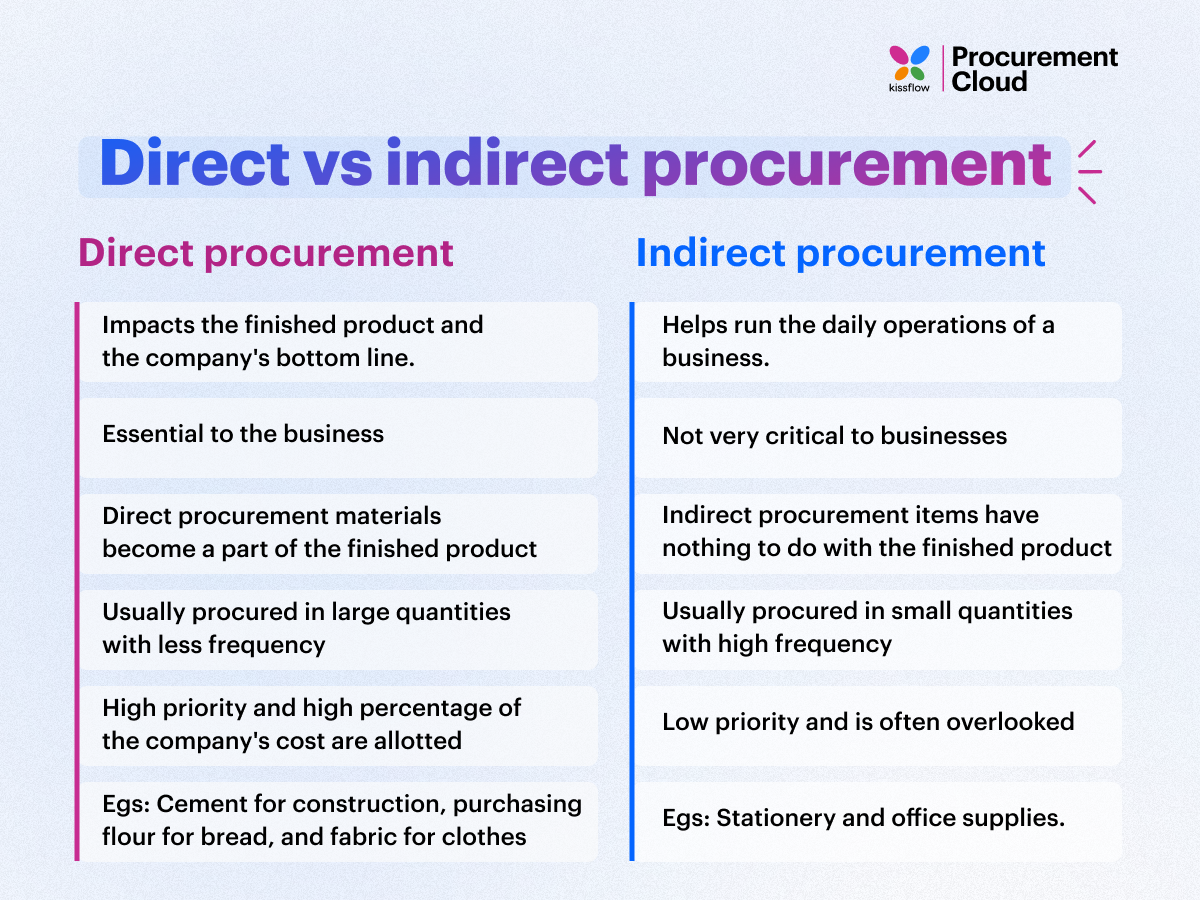

Indirect cash flow forecasting october 5, 2023 7 min cash flow forecasting is a crucial element that can make or break any business, regardless of its size. One of the key differences between direct cash flow vs. When it comes to cash flows from operations, the standards allow us to choose between two distinct approaches.

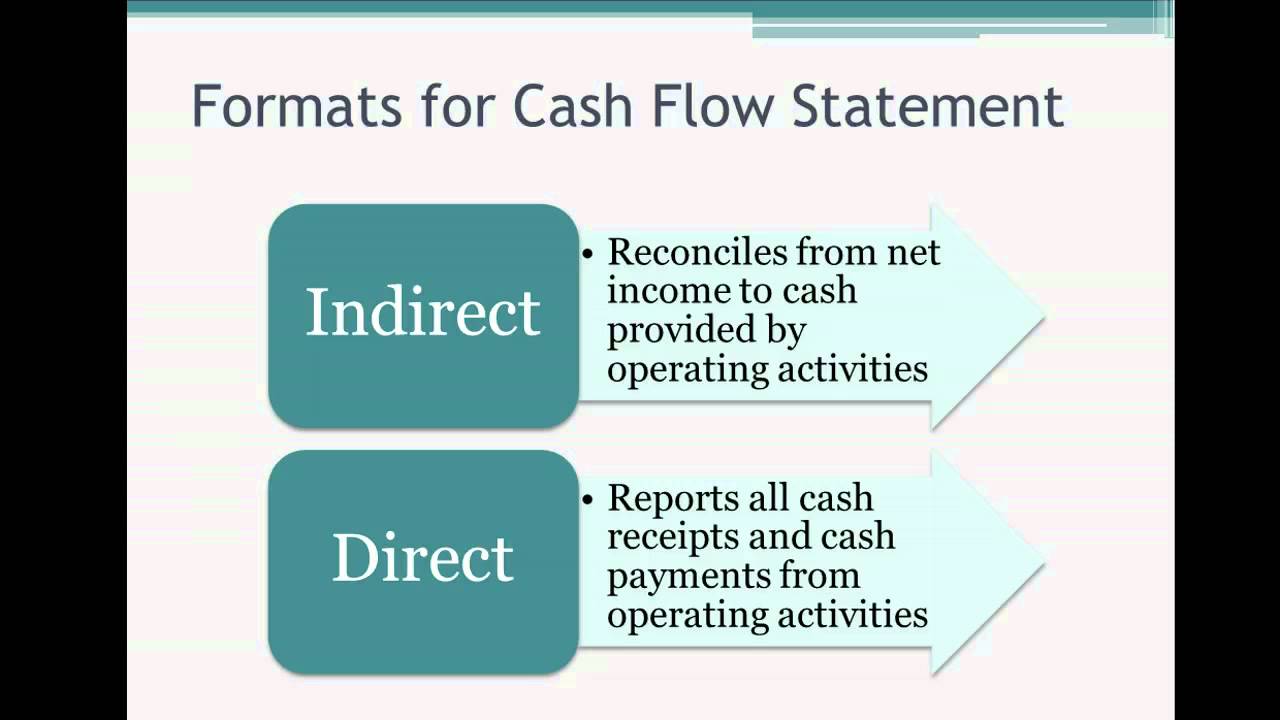

Key difference between cash flow methods and their impact on analyzing cash flows accounting business how to do your accounting november 1, 2023 There are two different ways of starting the cash flow statement, as ias 7, statement of cash flows permits using either the 'direct' or 'indirect' method for operating activities. Indirect cash flow method is the type of transactions used to produce a cash flow statement.

The direct method is intuitive as it means the statement of cash flow starts with the source of. When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: Key takeaways a cash flow statement is one of the three financial statements.

But under the surface, it’s much more complex than that. The indirect method begins with your net income. In the direct method of cash flow statement preparation, actual receipts from customers and actual payments to suppliers, service providers, employees, taxes, etc.

However, the indirect method is much easier for a finance team to assemble since it uses information obtained directly from the balance sheet and income statement. Direct technique presents operating cash flows as a list of incoming and departing cash flows. The indirect cash flow method uses the same general classifications as the direct cash flow method.

Alternatively, the direct method begins. Indirect cash flow the indirect method focuses on net income and may include cash that is. So what's the difference between direct and indirect?

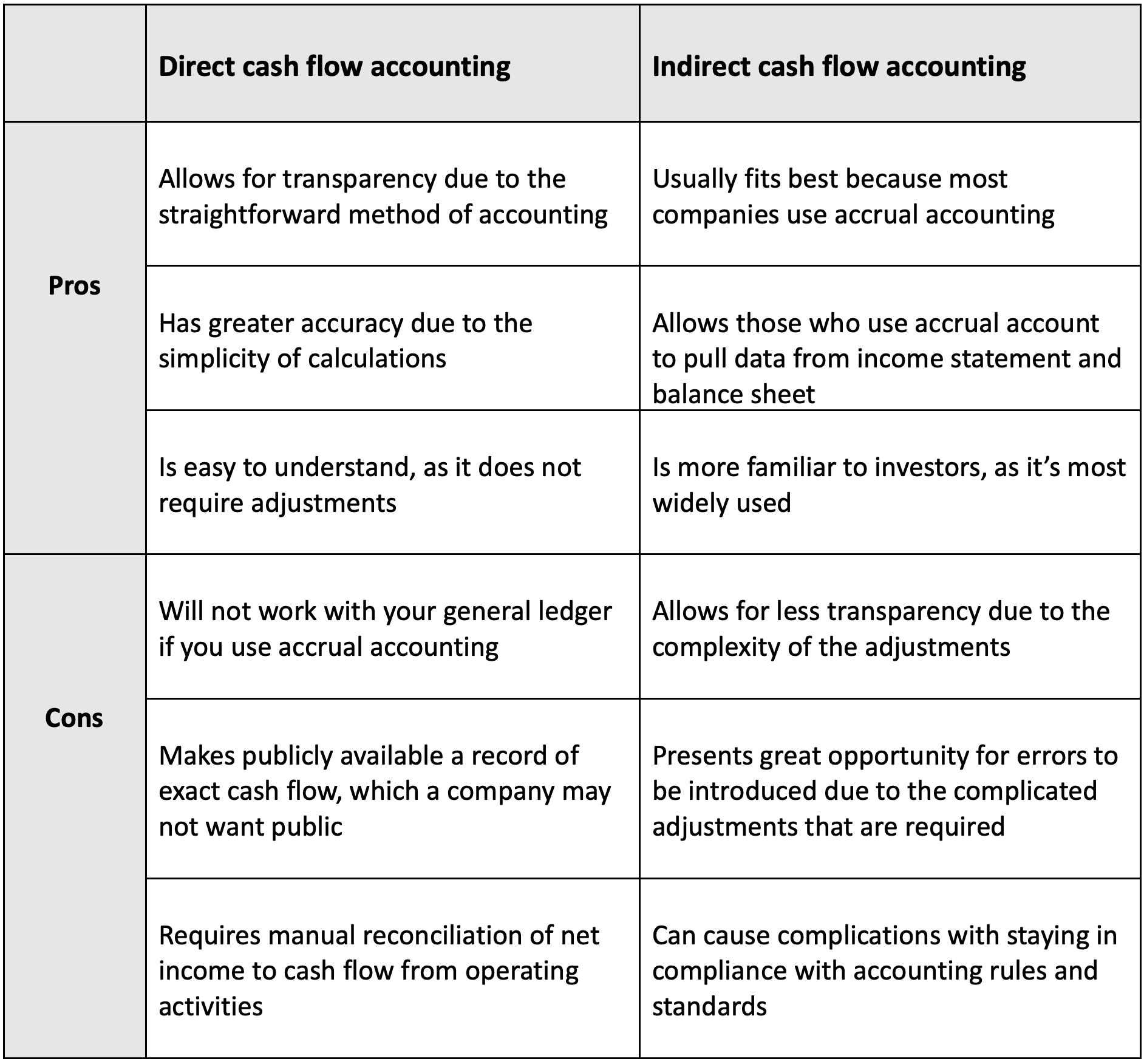

Comparing the direct and indirect cash flow methods. Direct cash flow indirect cash flow; (there are no differences in the cash flows from investing activities and/or the cash flows from financing activities.)

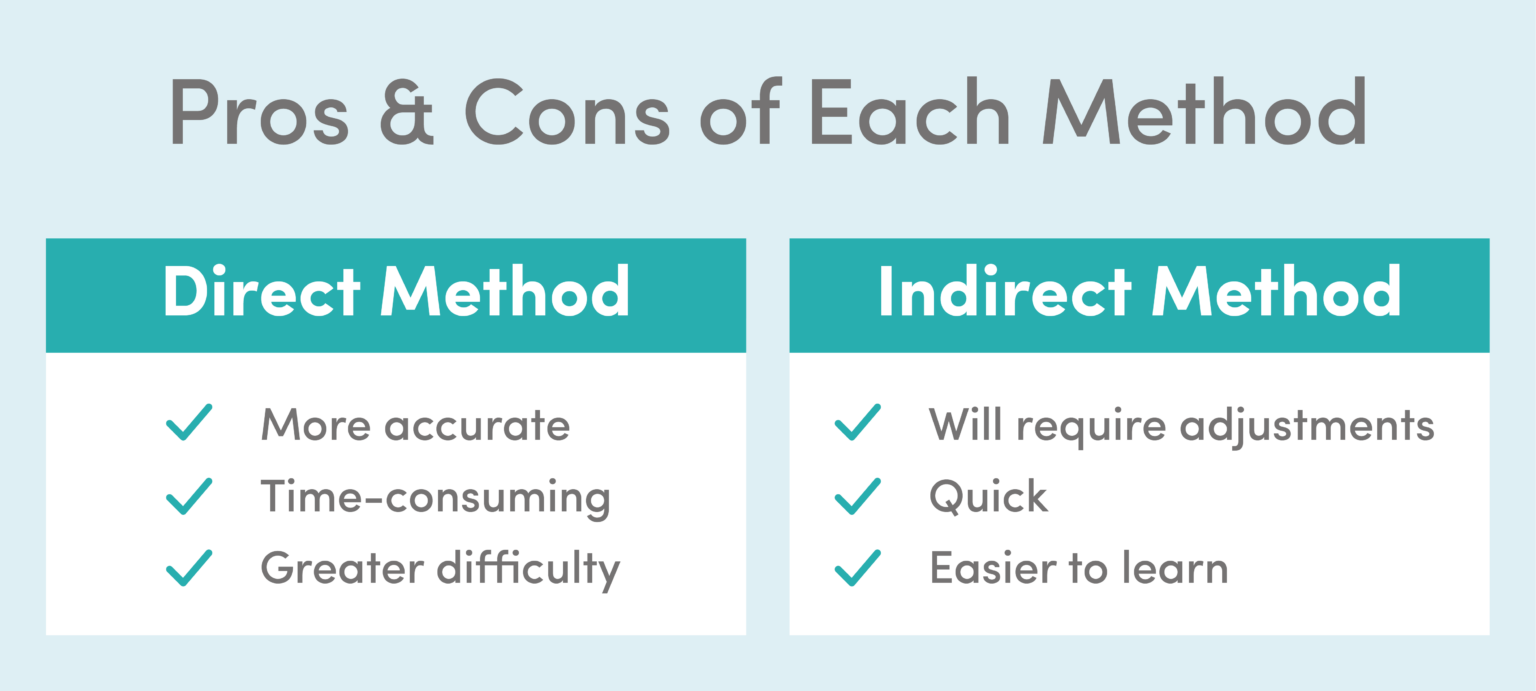

Direct cash flow method. The direct method is an accounting treatment that nets cash inflow and outflow to deduce total cash flow. Key takeaways cash flow from operations for a time period can be determined using either the direct or indirect method.

The indirect method uses net income as the base and converts the income into the cash flow through adjustments. In this article we will guide you through the process and help you understand the details and differences between the direct and indirect cash flow method. It is one of the two methods used to create a cash flow statement for a business.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)