Awesome Info About Input Vat In Balance Sheet Income Projection Sample

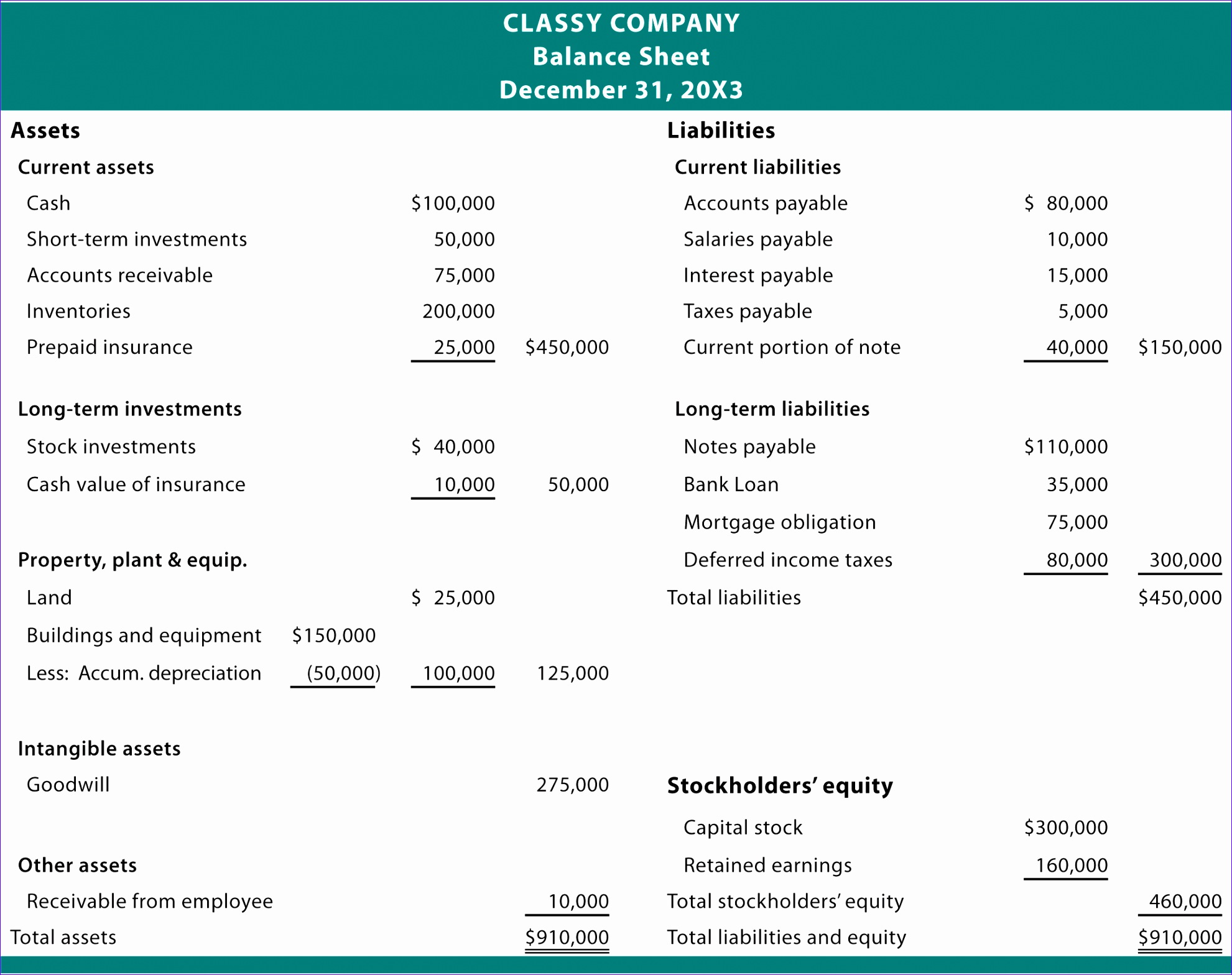

The journal entry will increase the cash balance by $ 110,000 when it receives cash from customers.

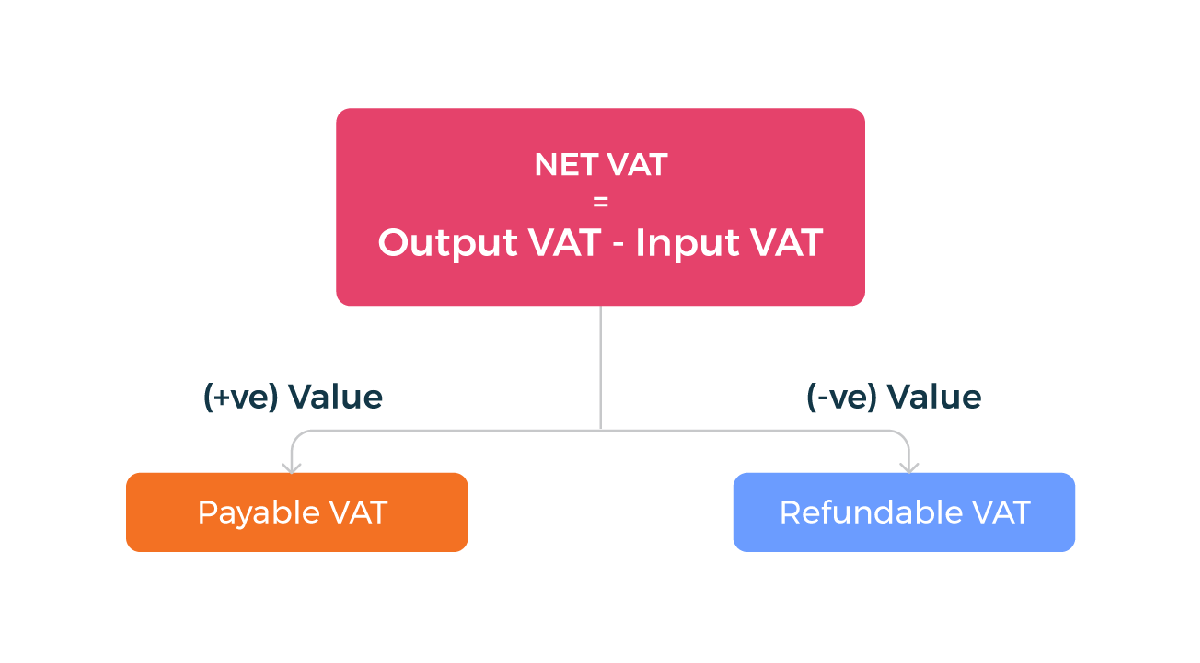

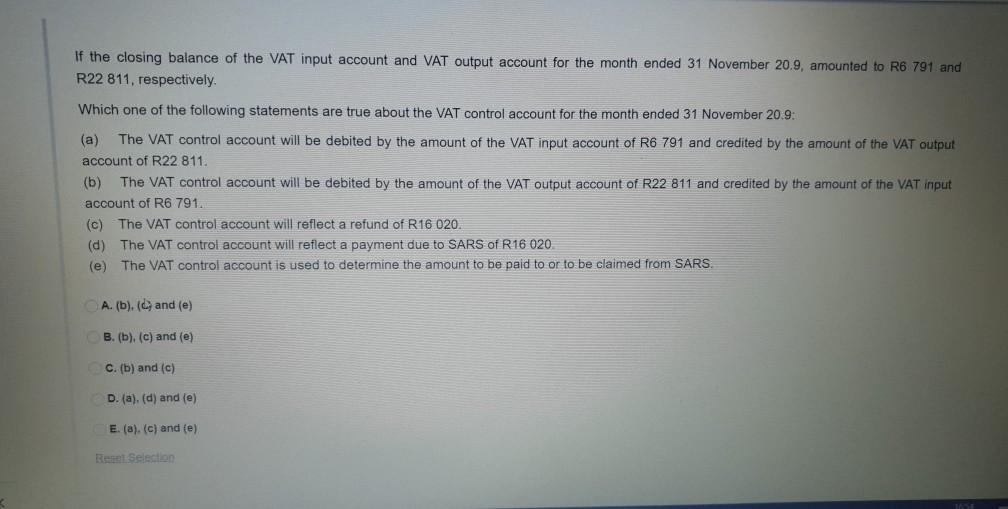

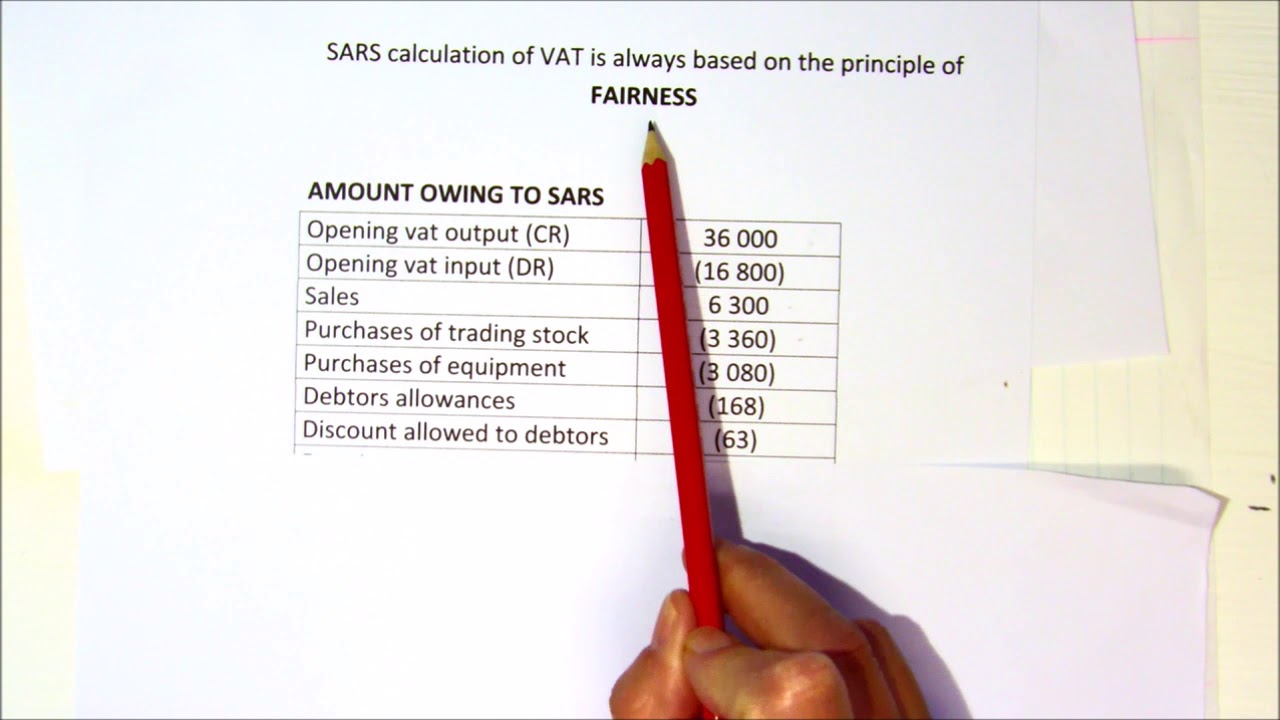

Input vat in balance sheet. Showing vat in a p & l didn't find your answer? Organisations will have a vat liability when they have collected more vat on sales/income than they have recovered on bills/costs. We must pay the difference and deduct the balance to zero.

This figure is what you’ll find in your vat ledger of transactions and should match the amount under “vat payable” in your balance sheet or trial balance. On your vat return, you will report the total input vat. 4% vat goods for rs.2,08,000 (incl.

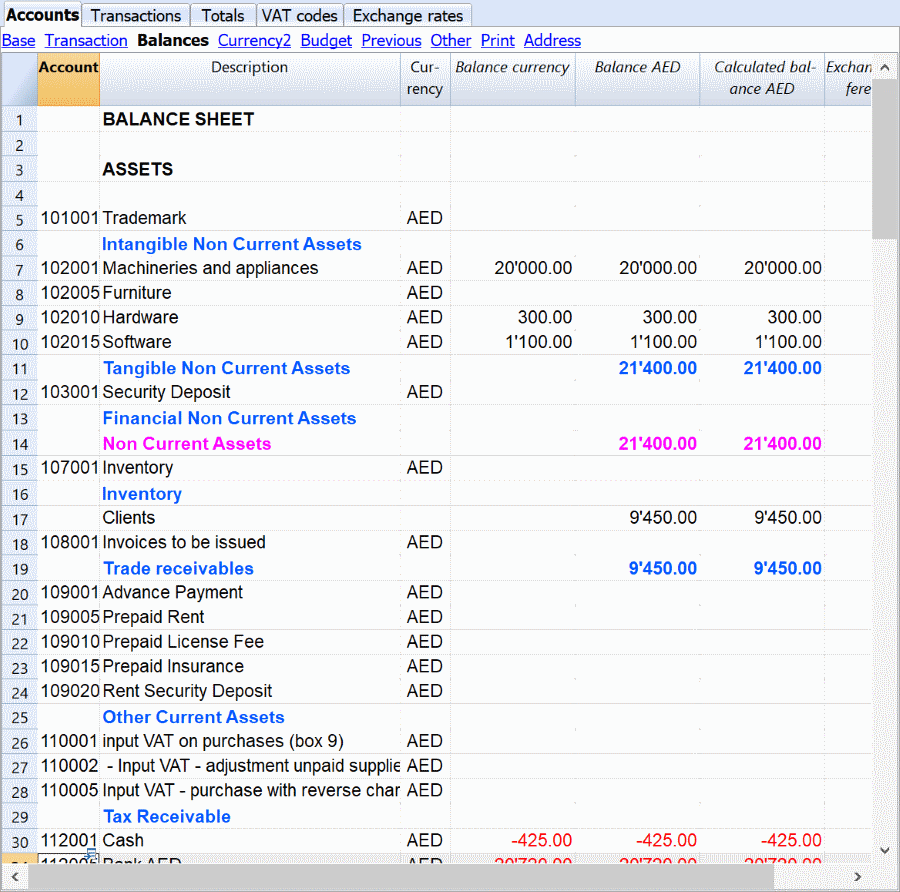

In addition to the input vat incurred during the quarter ended 31 march 2019, hedge ltd can also claim for the input vat incurred during the period 1 january 2015 to. The vat control account records all the vat on both sales (outputs) and purchases (inputs) so that the balance on the account shows the amount that should be paid to (or. 1.your chart of accounts must have a minimum of three (3) balance sheet accounts, namely:

Vat account to be clearly stated regarding total output tax, total input tax and net tax payable or excess tax credit which to be refunded or adjusted with. The difference between your input and output vat is either the amount you owe to hmrc or the amount you can reclaim. Hi all, i am finalizing the accounts of a company to whom at the end of the financial year hmrc was owing tax.

If the vat output > vat input: 8,000) 12.5% vat goods for rs. The revenue increases $ 100,000 on the income statement.

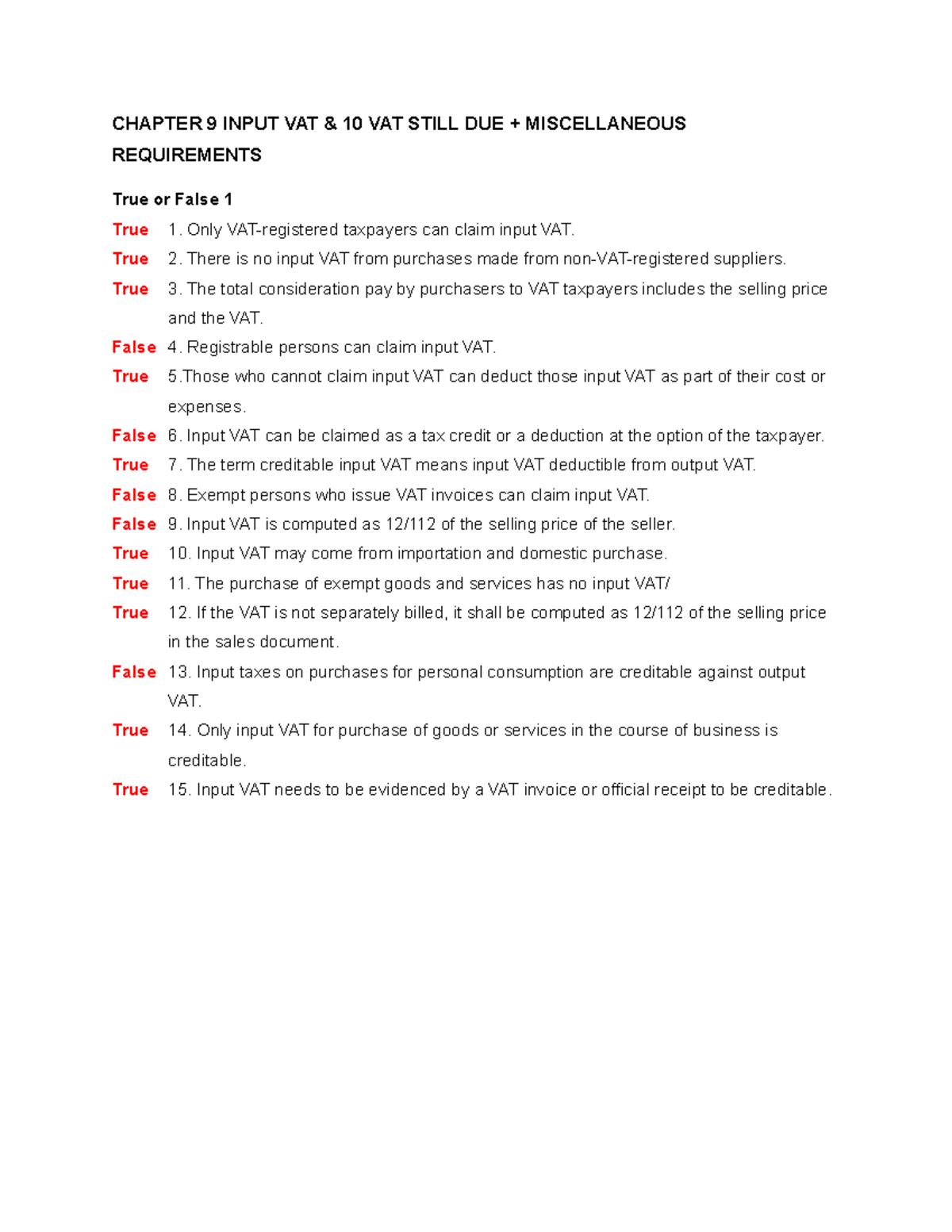

(i) input vat (tax credits, i.e. The input vat is usually deductible which means if you have more purchases than sales in a month or quarter, or whatever vat reporting period you have,. The company will require to calculate the vat pay 1.

A credit balance on the. The vat you pay on purchases is normally called “input vat”, while the vat you add on sales is normally called “output vat”. Vat collected from customers (output vat) and vat paid to suppliers (input vat) are recorded as vat receivable.

Expenses incurred in the production. What is input vat? The commissioner of internal revenue has issued revenue memorandum circular (rmc) no.

Search accountingweb advertisement latest any answers if a profit and loss is drawn up with all figures. Vat and balance sheet: In computing the vat due and payable to the.

The input vat credits are recorded as an asset on the company's balance sheet, and they are typically offset against the output vat liability when calculating the.