Spectacular Tips About Prior Year Adjustment Annual Report Simple Profit And Loss Account Format

For example, the 2024 to 2025 tax year starts on 6 april 2024 and.

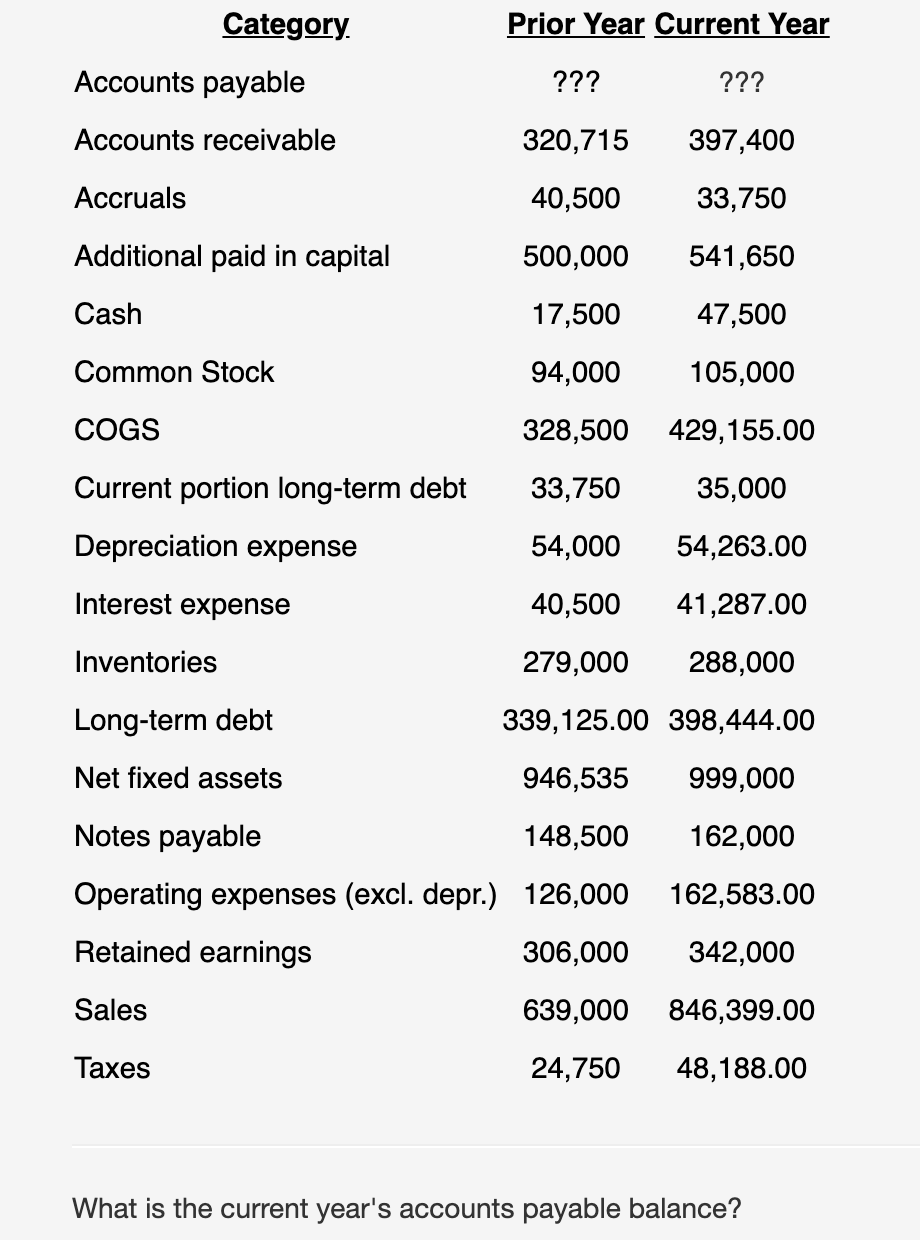

Prior year adjustment annual report. During the year 2020, the group recorded revenue of rm49.1 million and profit after taxation of rm7.8 million, representing a decrease of 27.1 % in revenue and a decrease. The ebit margin in the first three months of fiscal year 2023/24 was 9.2% (prior year: Key definitions [ias 8.5] accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting.

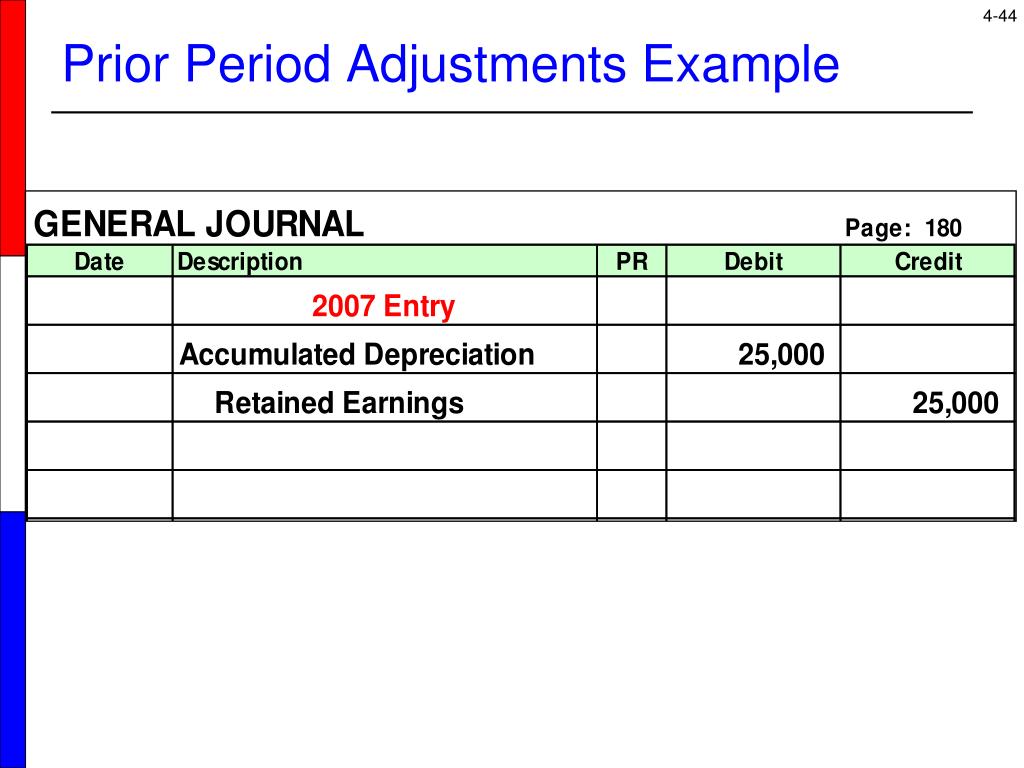

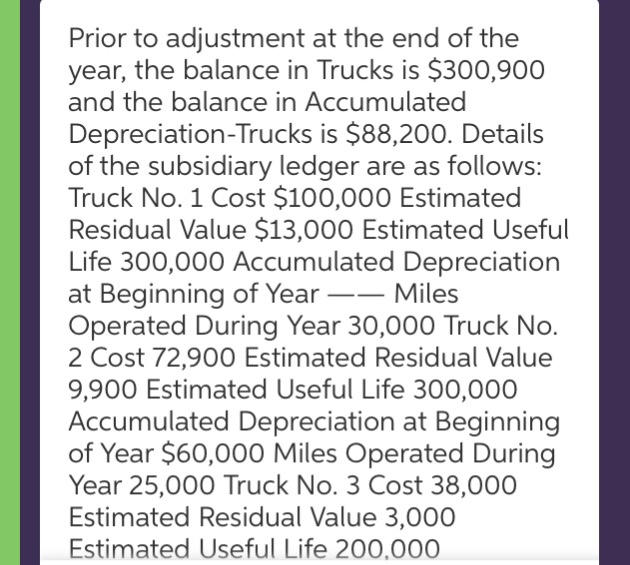

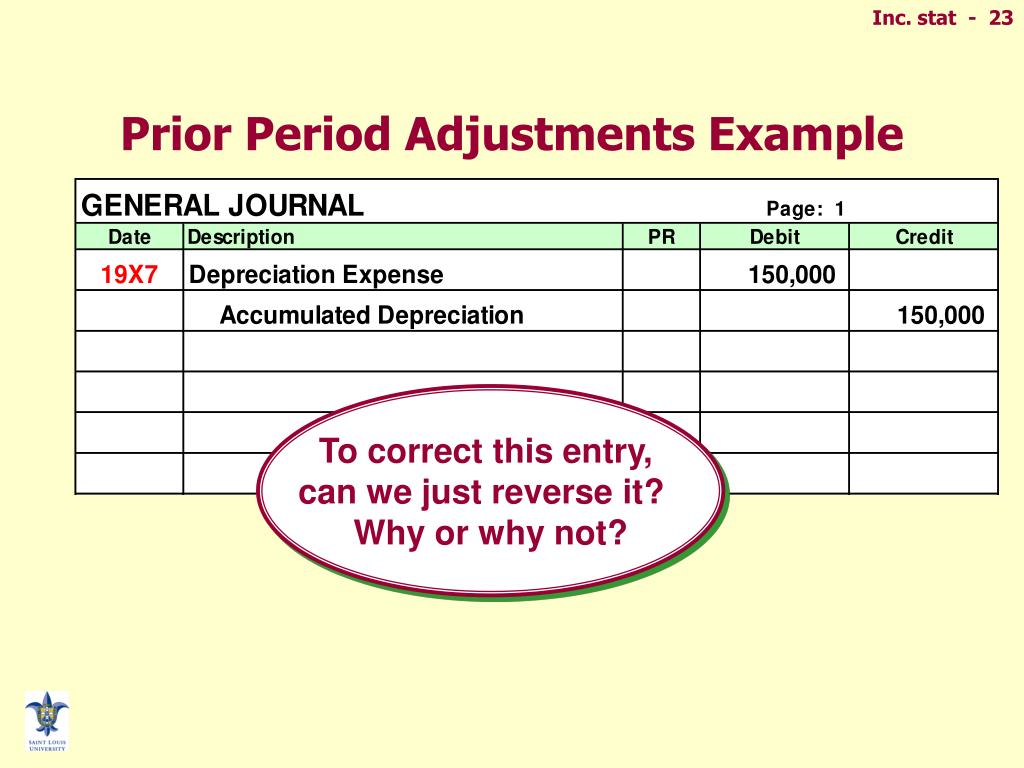

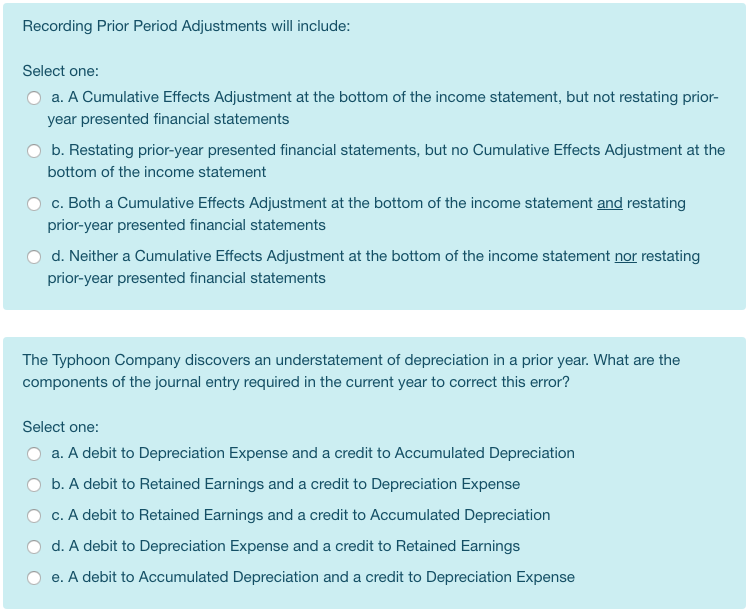

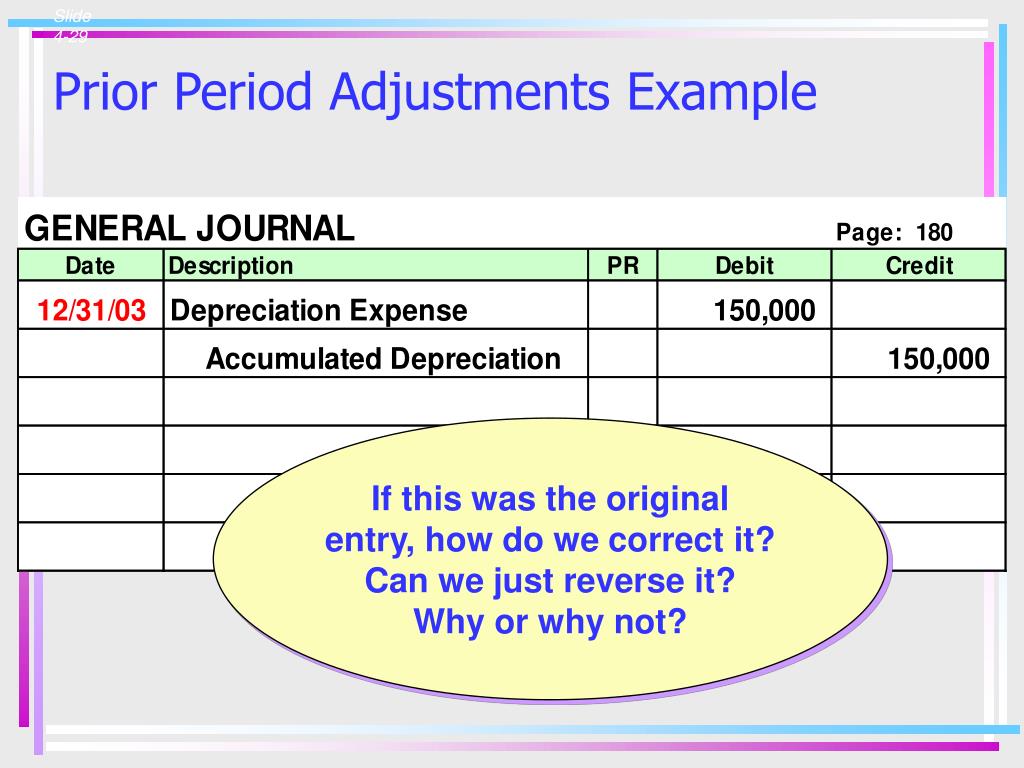

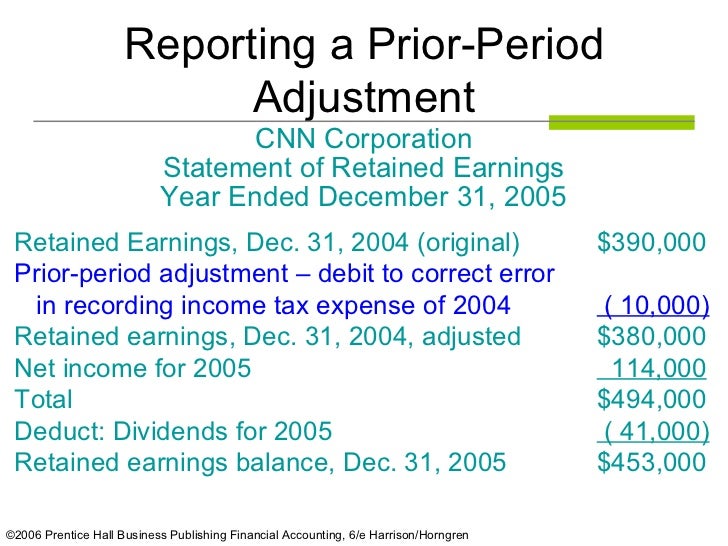

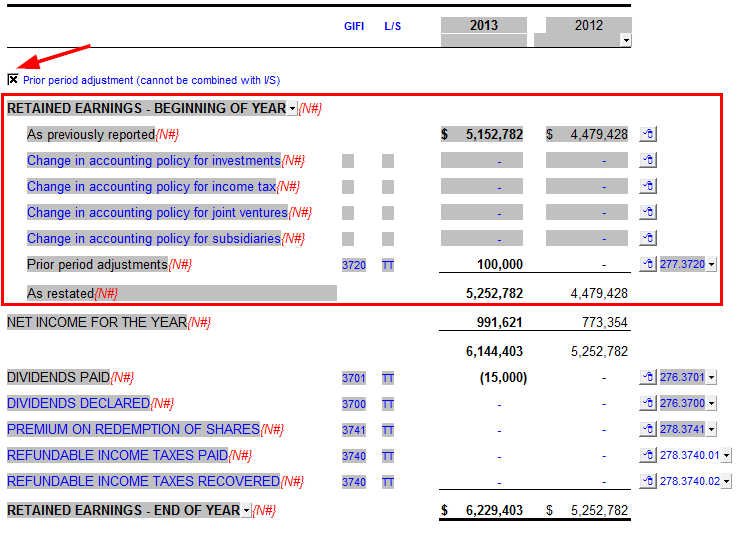

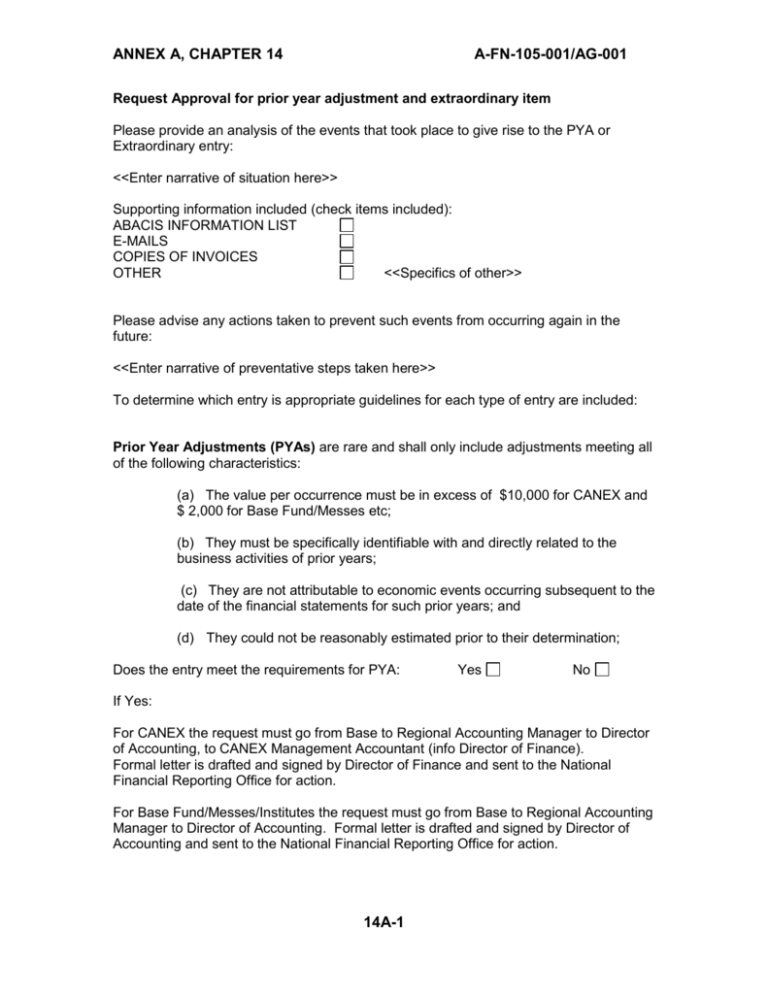

Accounting estimates and corrections of prior period errors. In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our. Prior period adjustments are discussed in sfas 16, (as amended in sfas 109 and sfas 154), and aim to separate economic events that.

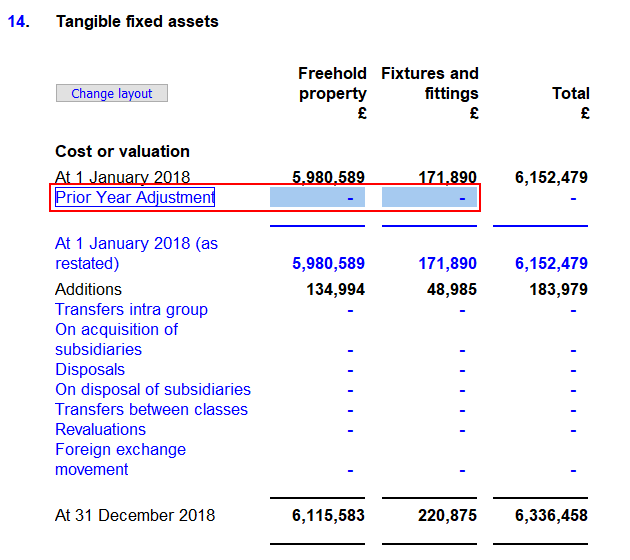

A prior period adjustment is a transaction used to modify an issue that arose in a prior reporting period. Correction of an error. A change in accounting estimate is an adjustment of the carrying amount of an asset or a liability, or the amount of the periodic consumption of an asset, that results from the.

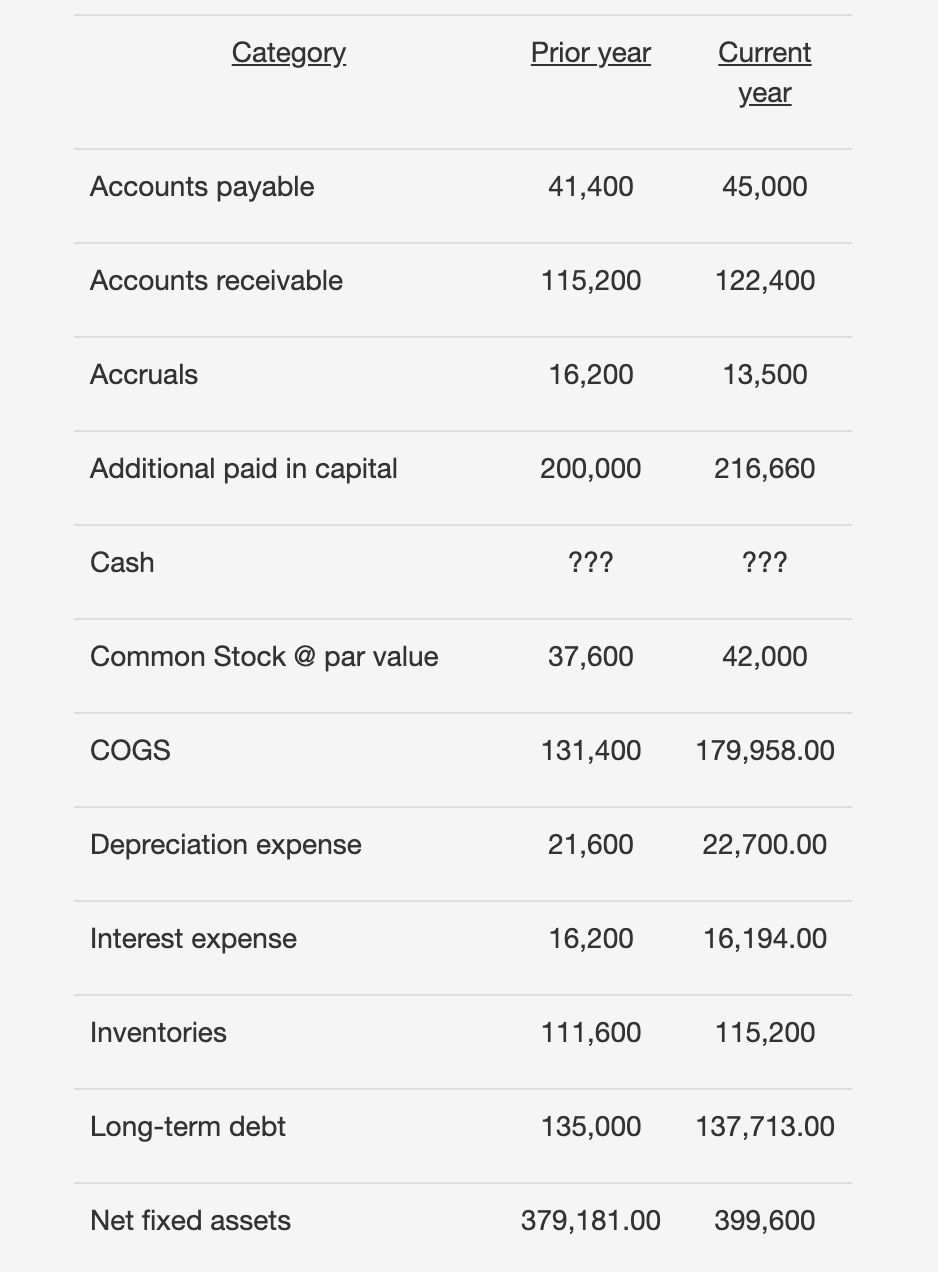

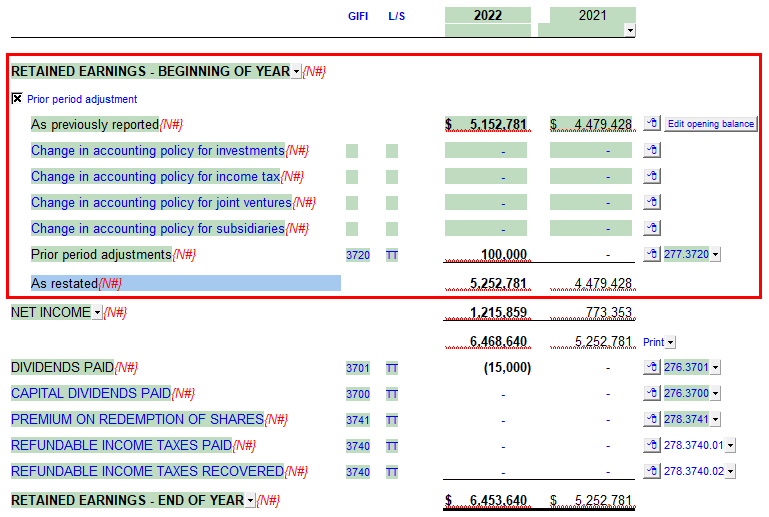

A tax year is a period starting on 6 april in one year and ending on 5 april in the following year. 15 february 2024 the following shows the announcements concerning prior period adjustments due to correction of material errors published from. At beginning of year as previously stated:

The tax effects of corrections of prior period errors and of retrospective adjustments made to apply changes in accounting policies are accounted for and disclosed in accordance. As a result of the reporting amendment, financial income. There are actually two types of prior period.

Premium on issue of shares (nominal value £7m) 13 : The tax effects of corrections of prior period errors and of retrospective adjustments made to apply changes in. Prior year were audited illustration 15 — an accountant’s review report on comparative financial statements prepared in accordance with accounting principles generally.

Adjusted for special effects, this figure was 9.7% (prior year:. In comparative statements (when two or more years are presented), the correction of a prior period error affects the prior period financial statements and.