Smart Tips About Purpose Of Comprehensive Income Balance Sheet With Negative Equity

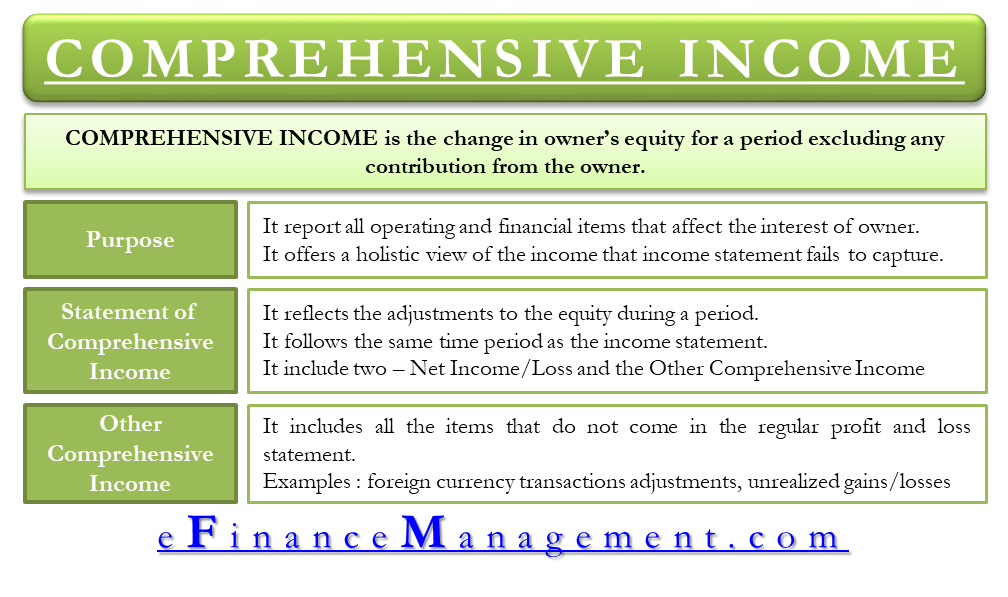

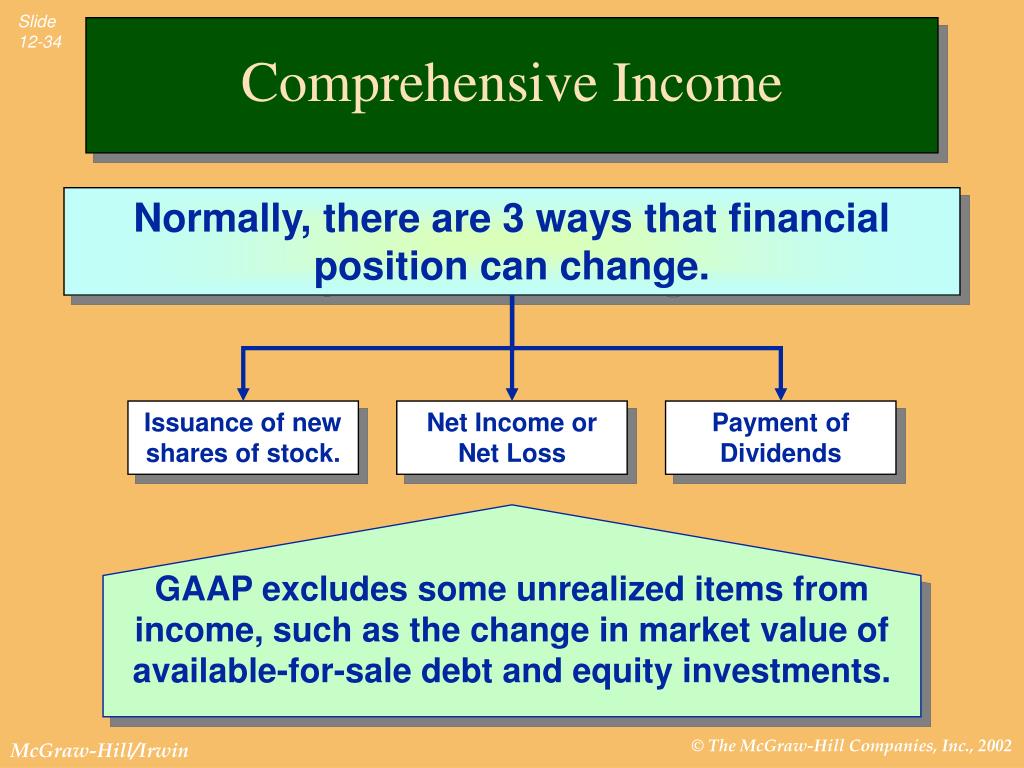

Comprehensive income is the change in owner’s equity for a period excluding any contribution from the owner.

Purpose of comprehensive income. Encourage your employees to continue their learning beyond your training program. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users. In june 2011 the board amended ias 1 to improve how items of other income comprehensive income should be presented.

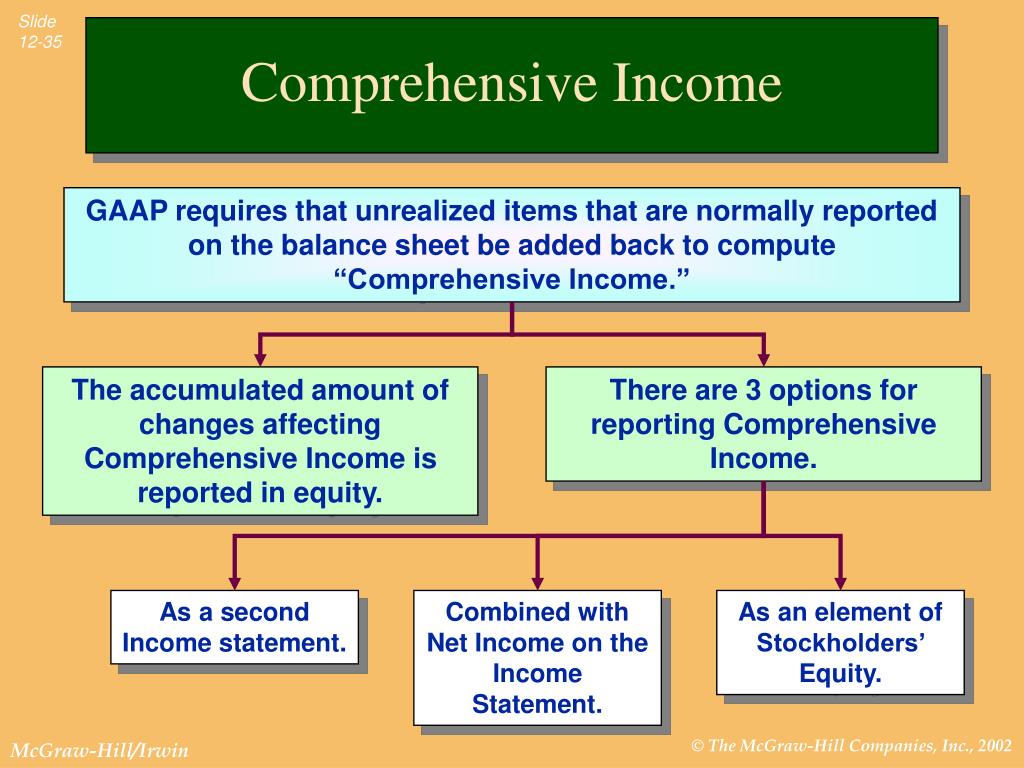

Like depreciation and amortization, regularly. Comprehensive income allows companies to report more than just their net income. The fasb's technical definition of comprehensive income is the change in equity [net assets] of a business enterprise during a period from transactions and other events and circumstances from.

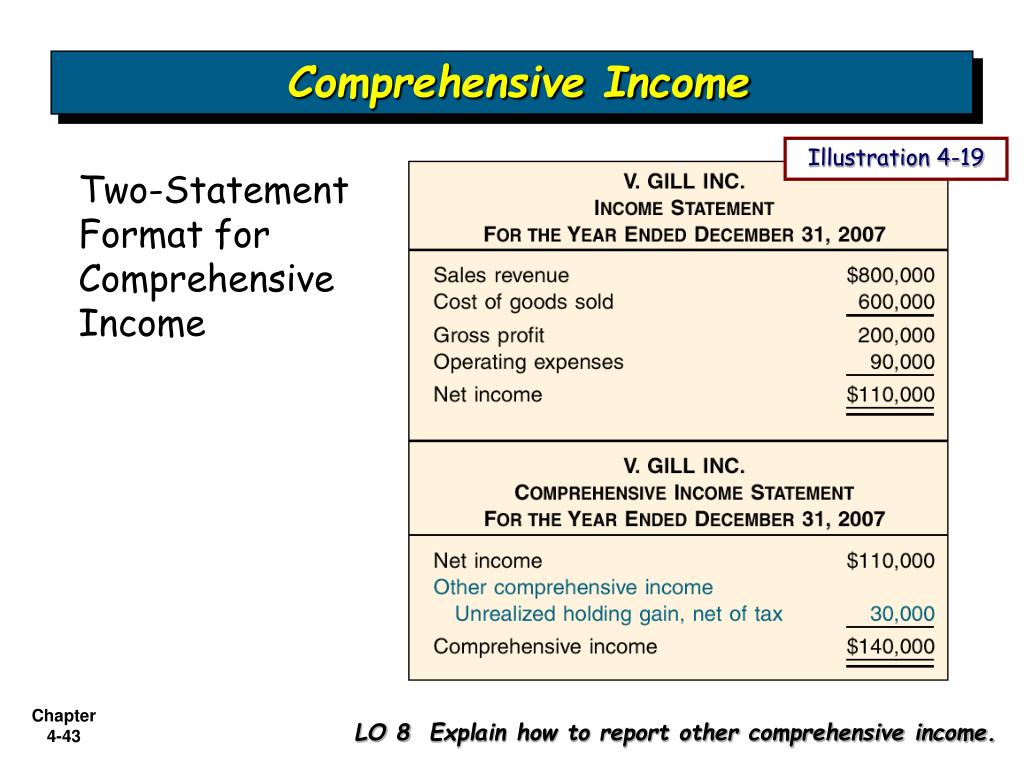

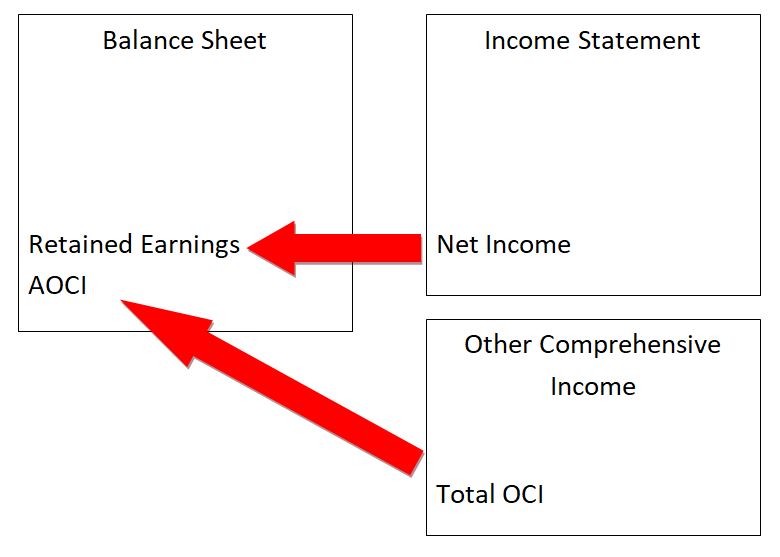

The statement of comprehensive income contains those revenue and expense items that have not yet been realized. Comprehensive income includes net income and oci. The net income is obtained from your business income statement for your accounting period.

The purpose of an income statement is to show a company’s financial performance over a given time period. It is supposed to complement an organization's income statement by providing a more complete view of a company's financial performance. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement.

The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of time. Comprehensive income is the sum of regular income and other comprehensive income. The use of artificial intelligence in the eu will be regulated by the ai act, the world’s first comprehensive ai law.

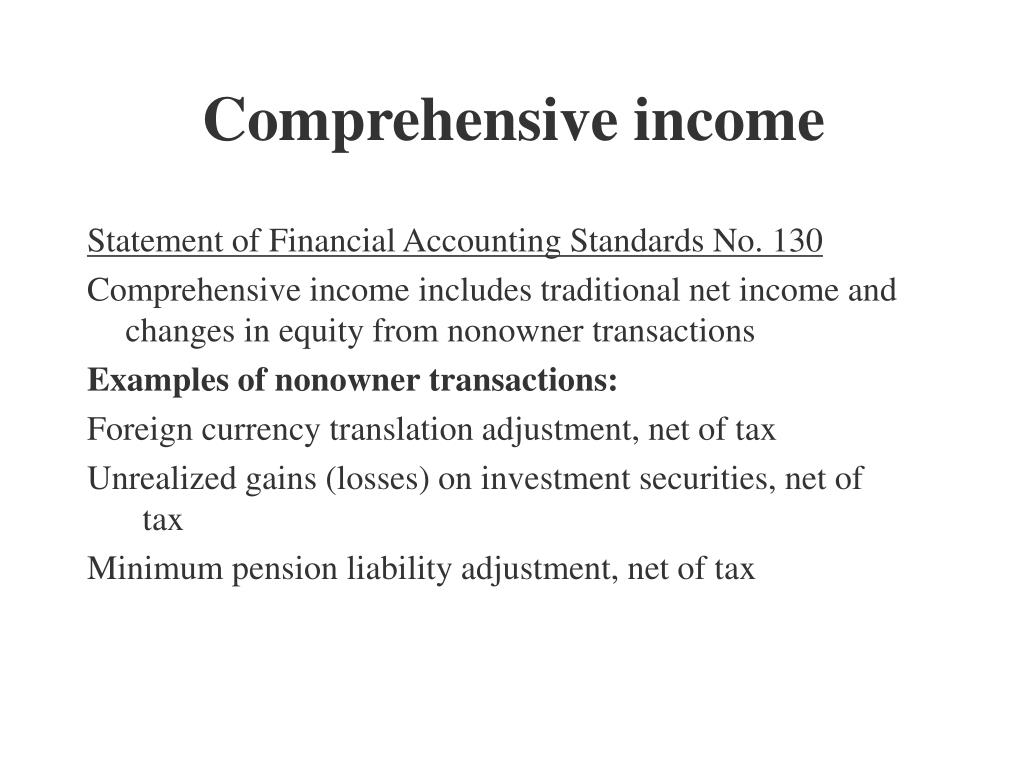

In business accounting, other comprehensive income (oci) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement. The statement of comprehensive income reports the change in net equity of a business enterprise over a given period. In simple terms, it is the total of all revenues, gains, expenses, and losses and the unrealized gains and losses resulting in a change in the equity or the net assets.

What is a statement of comprehensive income? The income and expenditure items that have not yet been recognized are included in the statement of comprehensive income. Net income, and other comprehensive income, which incorporates the items excluded from the income statement.

The statement of retained earnings includes two key parts: In comparison, oci consists of gains or losses that aren't realized in the income statement. It also allows companies to disclose noncash items.

Ensure there's a purpose behind all of your employee training. Develop a metric to help you determine if your training is successful. As well as net income, comprehensive income includes unrealized gains and.

It includes all changes in equity during a period except those resulting from investments by owners and distribution to owners. The statement should be classified and aggregated in a manner that makes it understandable and comparable. As well as net income, comprehensive income includes unrealized gains and.

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)