Ideal Info About Form 16 And 26as Not Matching Accounts Receivable On Trial Balance

Discrepancies in details and the inability to file.

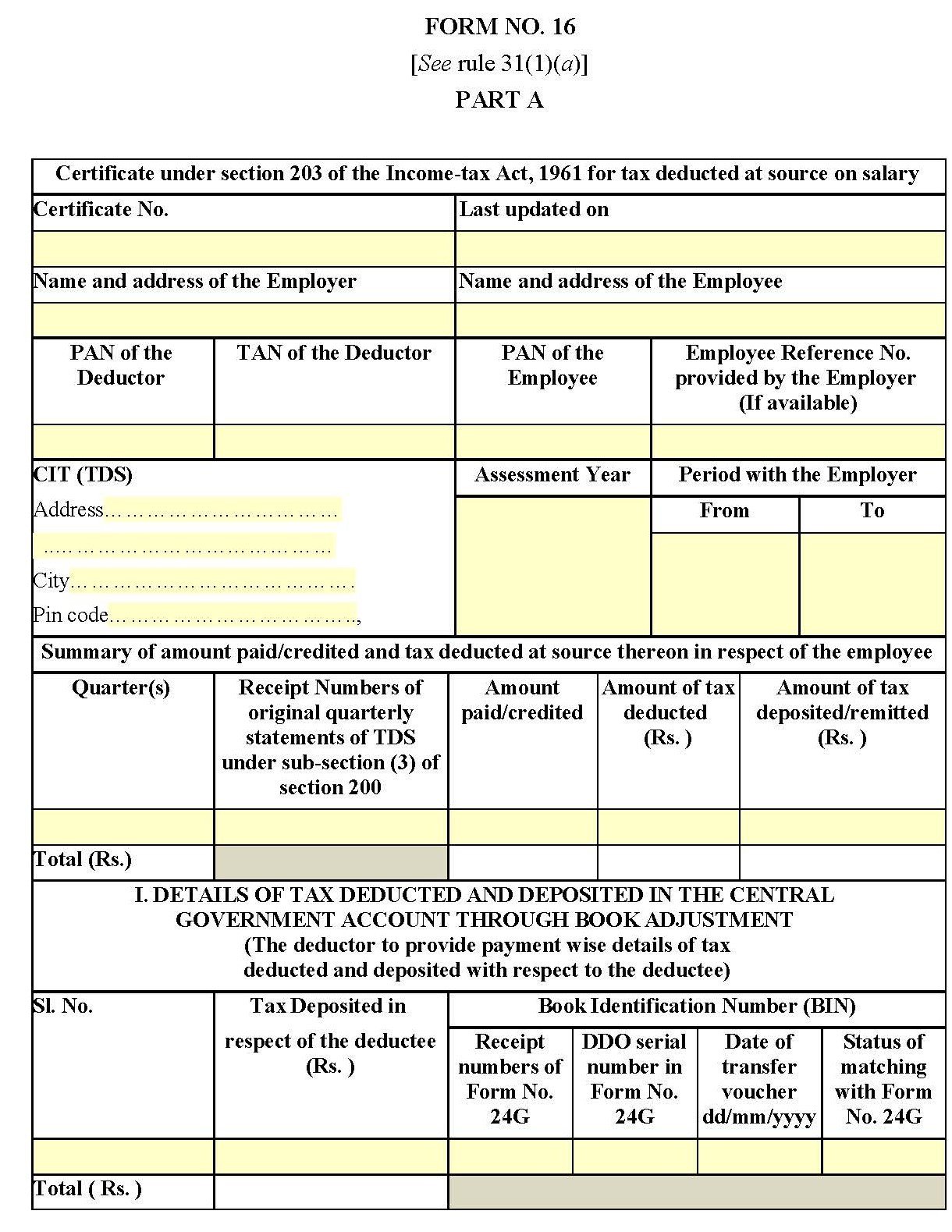

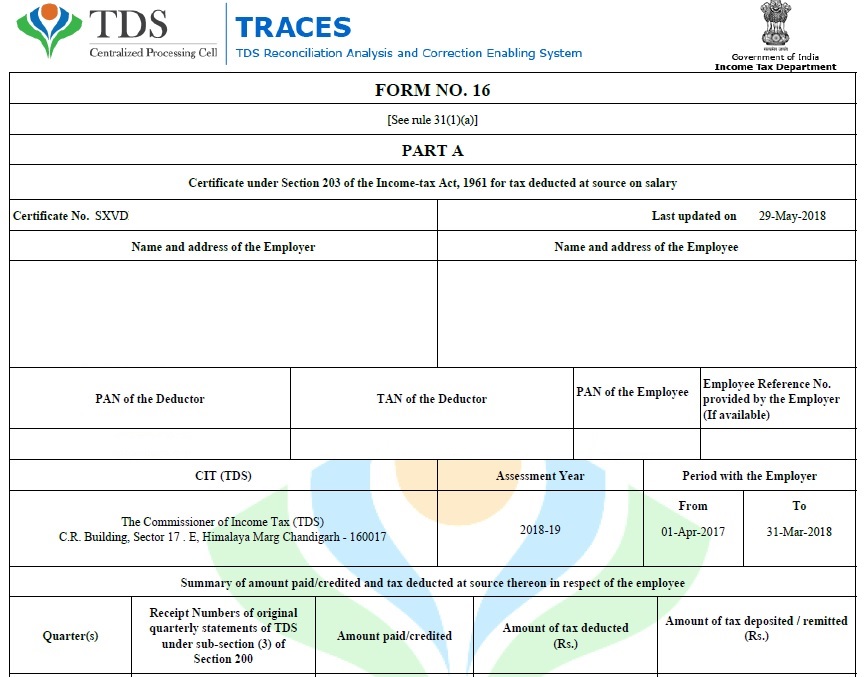

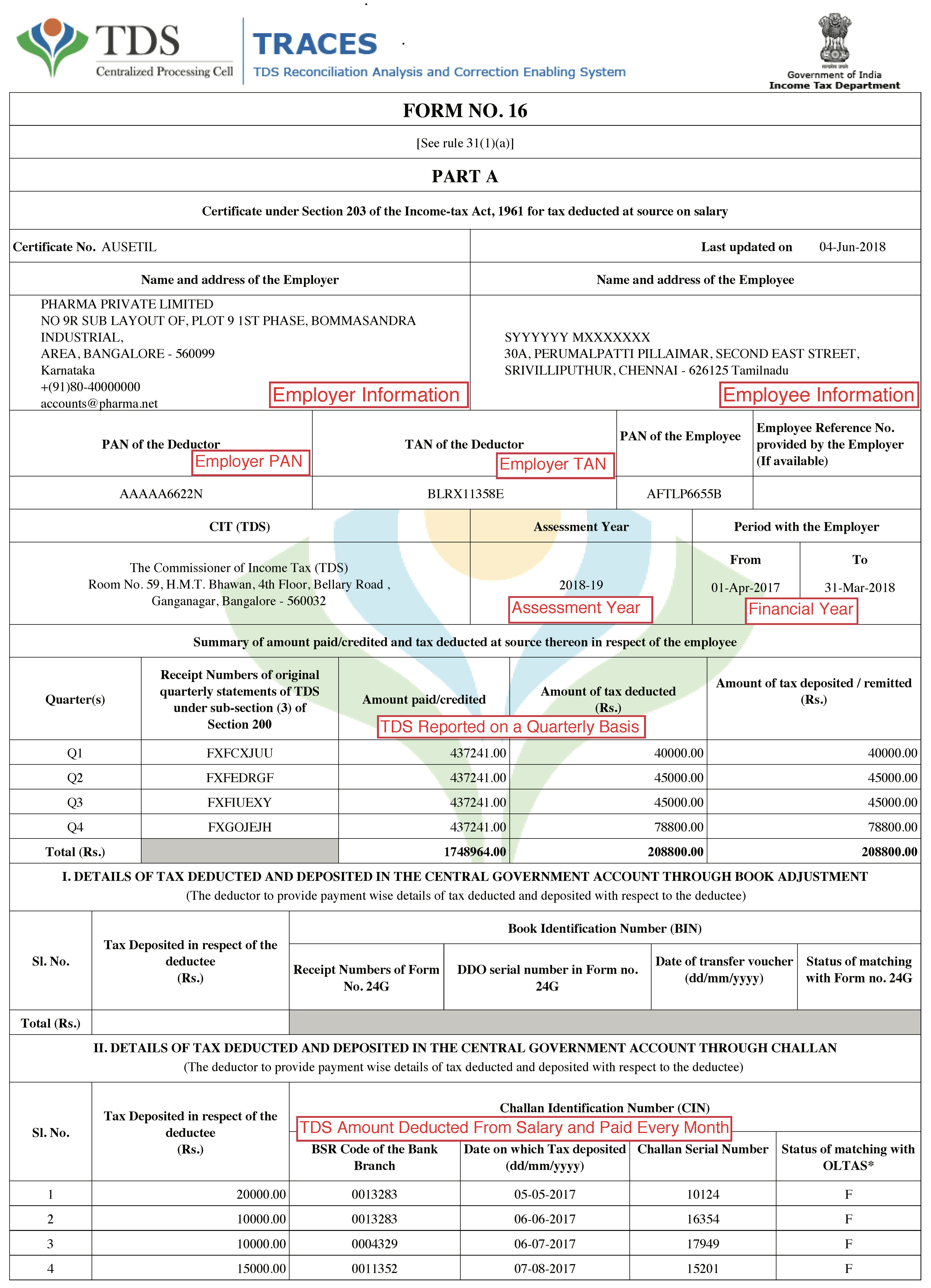

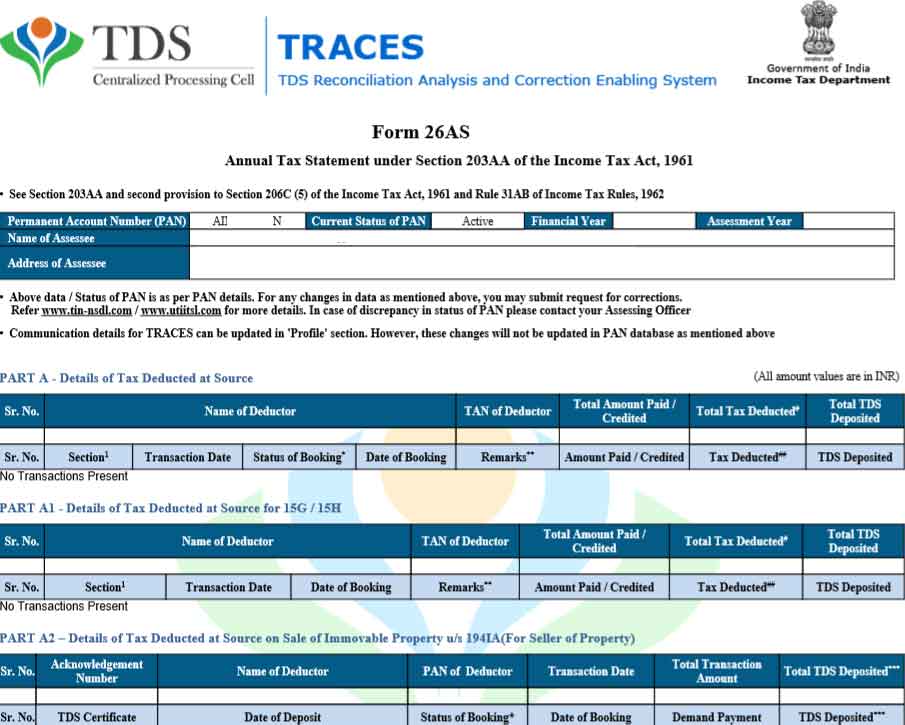

Form 16 and form 26as not matching. The provisions of section 143 (1) (vi) of the income tax act, 1961, provides that total income or loss shall be computed after making an adjustment of the addition of. Verify that the tds details mentioned in form 16. If the employer has not deposited the tds, it will not.

The first step in filing itr is to reconcile form 26as with form 16. So, tds deductions that are given in form 16 / form. If you fail to match all your actual financial transactions with form 26as and form 16 before filing income tax returns, and discrepancies are subsequently noticed,.

In some cases, certain tds entries. Now a days form 16 part. The details in form 16, form 26as, and the ais must match to prevent unwanted mistakes while filing the itr.

There could, however, be several other reasons for the. The details in form 16, form 26as, and the ais must match to prevent unwanted mistakes while filing the itr. There are several reasons for a mismatch in the amount mentioned in the form 26as and form 16, 16a.

Discrepancies in details and the inability to file. If there are discrepancies in the figures quoted in the two documents, they need to be rectified. Mismatch in the income figure may raise an inquiry from the income.

The information in form 26as should match. Validate form 16: The problem is that the 26as is everchanging.

What do i need to do now? Ensure that you have received the correct and duly signed form 16 from all your deductors. The form 26as contains details of tax deducted on behalf of the taxpayer (you) by deductors (employer, bank etc.).

This can lead to a mismatch between form 16 and 26as,” says atul sharma, founder, lex n tax. However, there can also be a mismatch in the income details as per form 16 and form 26as. Rectification of tds mismatch in form 26as & form 16/16a.

Chartered accountants advise that once you. In some cases, it has been observed that there is a tds mismatch in form 26as and in form 16/ form 16a which. Waiting for the final updates minimizes the chances of mismatches between form 16 and form 26as.

Ensure that you have received the correct and duly signed form 16 from all your deductors. The mismatch can also occur when the pan or tan details of the deductor in form 16 or form 26as do not match with the ais. Verify that the tds details mentioned in.