Amazing Tips About Create Cash Flow Statement From Balance Sheet And Income Audited

The cfs measures how well a.

Create cash flow statement from balance sheet and income statement. Updated february 10, 2022 reviewed by margaret james fact checked by suzanne kvilhaug balance sheet vs. A copy of the company’s balance sheet for two accounting periods (previous year and current year) and a copy of the company’s income statement for the current accounting period. Plus, they’re all important to potential lenders and investors.

Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. These three financial statements are intricately linked to one another. (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return.

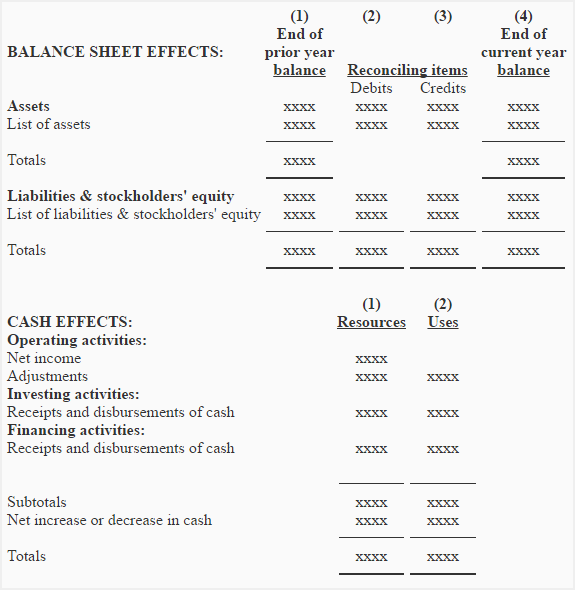

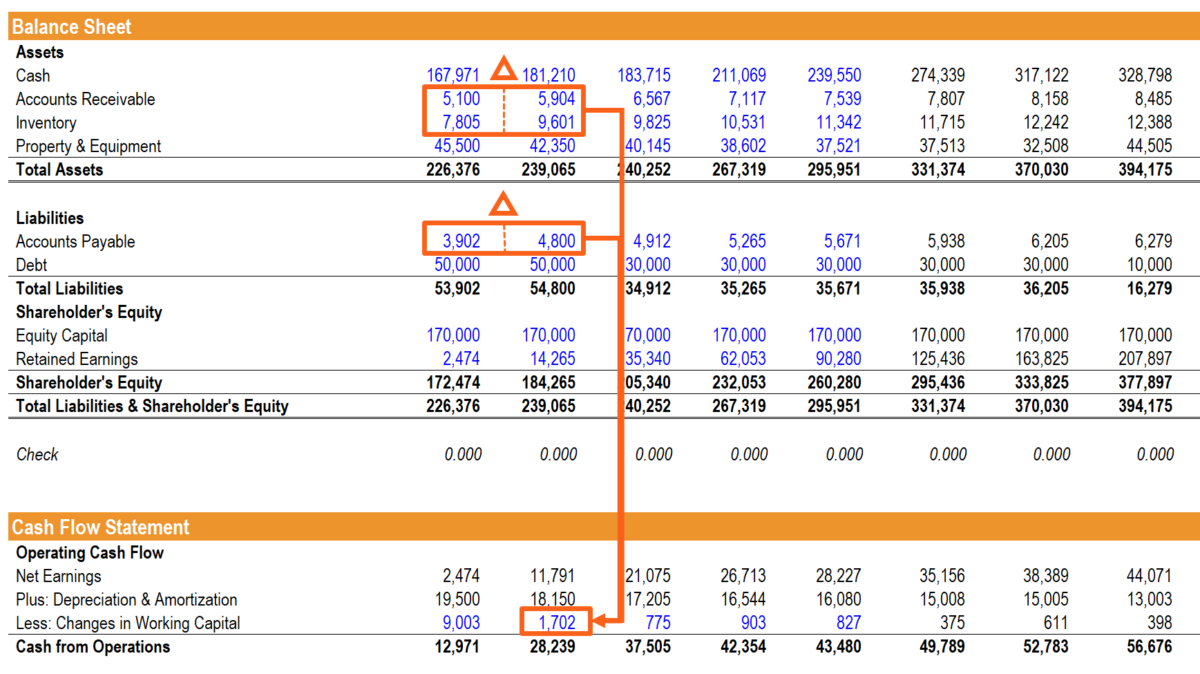

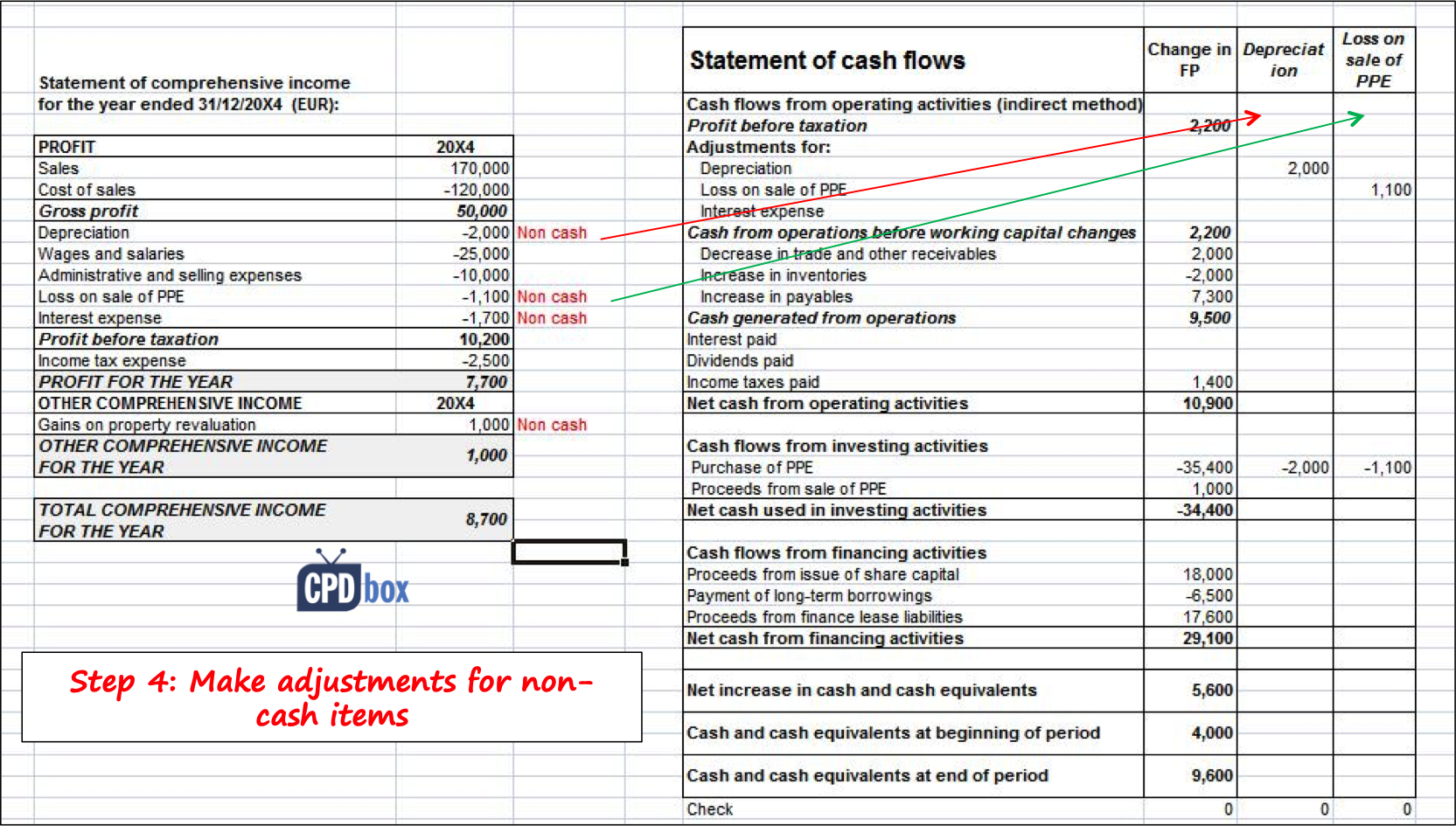

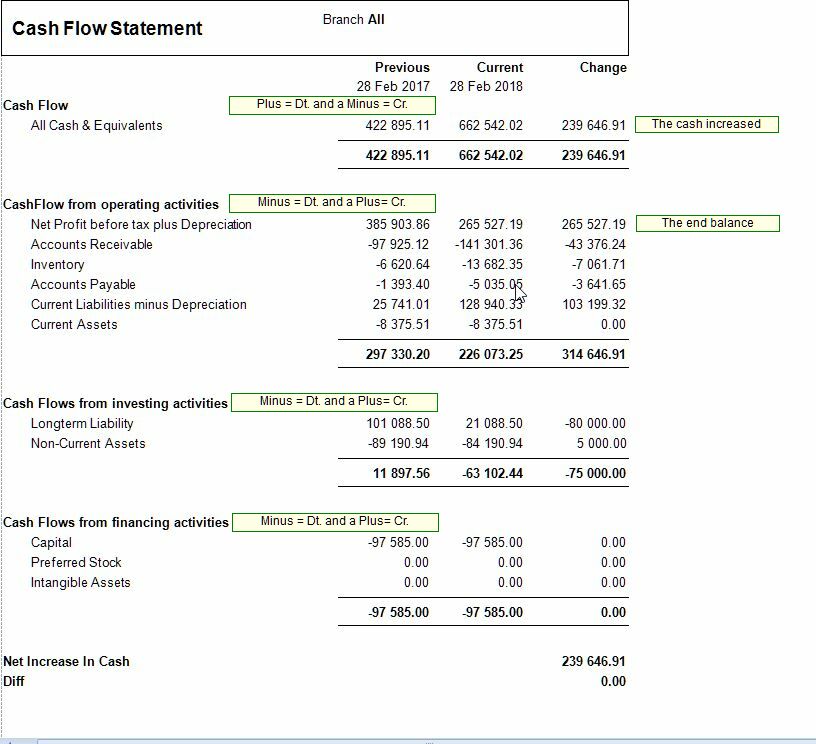

Complete the balance sheet (excluding cash) complete the cash flow statement and cash on the balance sheet; The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. You use information from your income statement and your balance sheet to create your cash flow statement.

Build financial models with correct interconnectivity between the three primary accounting statements: Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to be adjusted on the cash flow statement to reflect the actual amount of cash received or spent by the business. Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction.

The balance sheet and the. Let’s start at the end: By looking at all three documents, you can analyze the company’s performance from different angles.

In this free guide, we will break down the most important types and techniques of financial statement analysis. Why do shareholders need financial statements? The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements.

This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: Income statement, balance sheet, and p&l. What’s the difference between a cash flow statement and an income statement?

Complete the income statement; Add up all your gains then deduct your losses. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet.

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

A typical cash flow statement comprises three sections: Analyzing these three financial statements is one of the key steps when creating a financial model. Each gives insight to a business’s financial health, although income statements and balance sheets display different information, which is used to create a cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)