Neat Info About Balance Sheet Of Final Account Assets And Liabilities Template Excel

It is not an account, hence does not have debit and credit side.

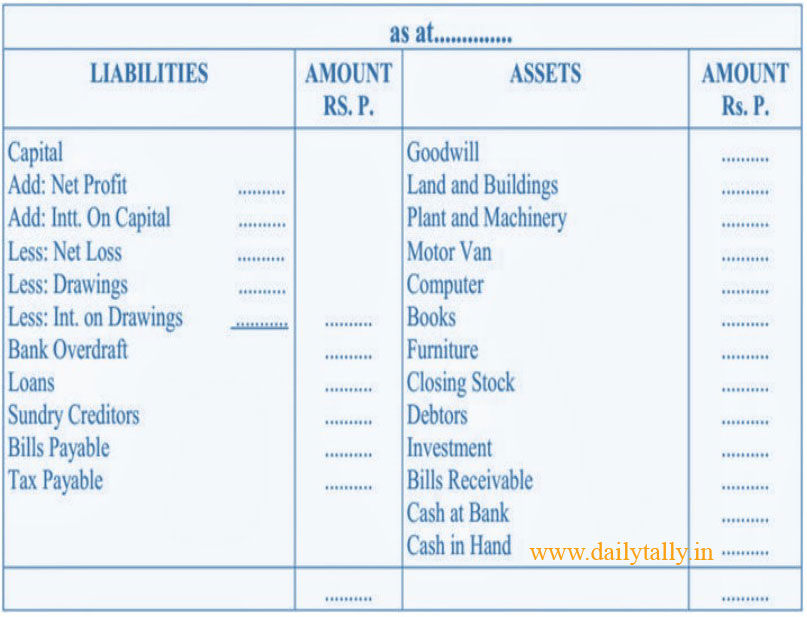

Balance sheet of final account. Make a list of trial balance items and adjustments; Final accounts consist of a profit and loss account and balance sheet. The financial position of a business is found by tabulating its assets and liabilities on a particular date.

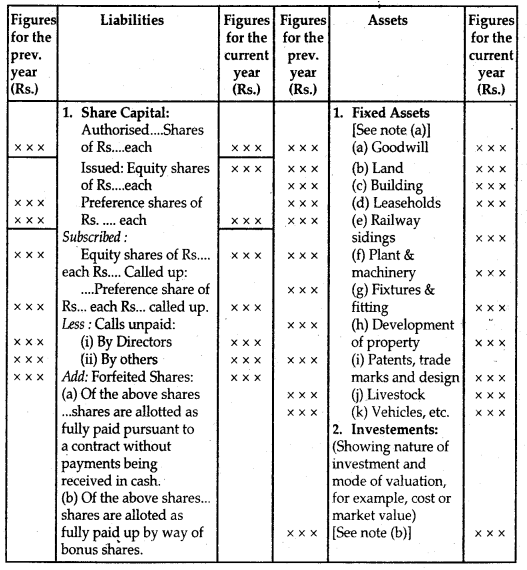

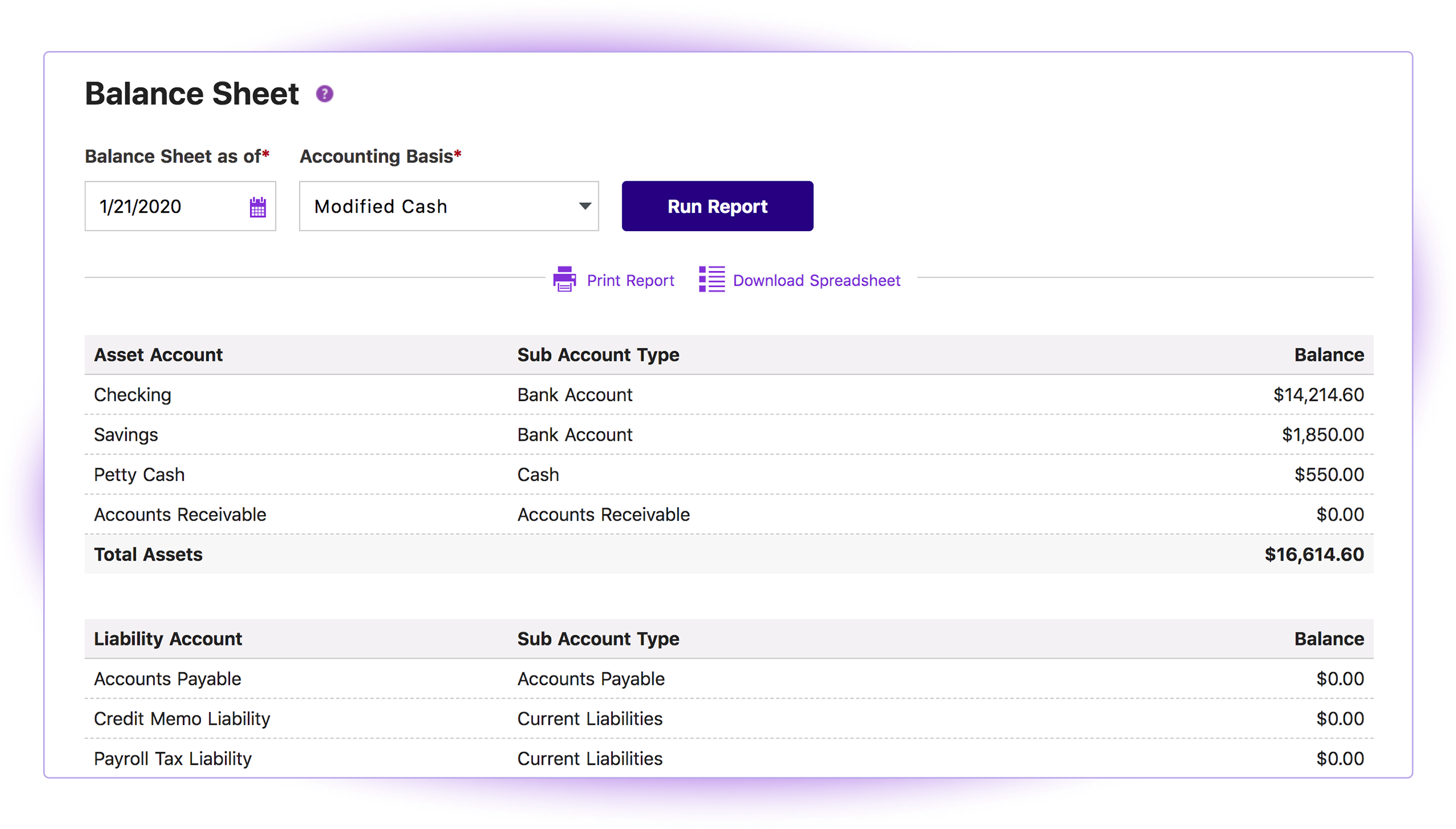

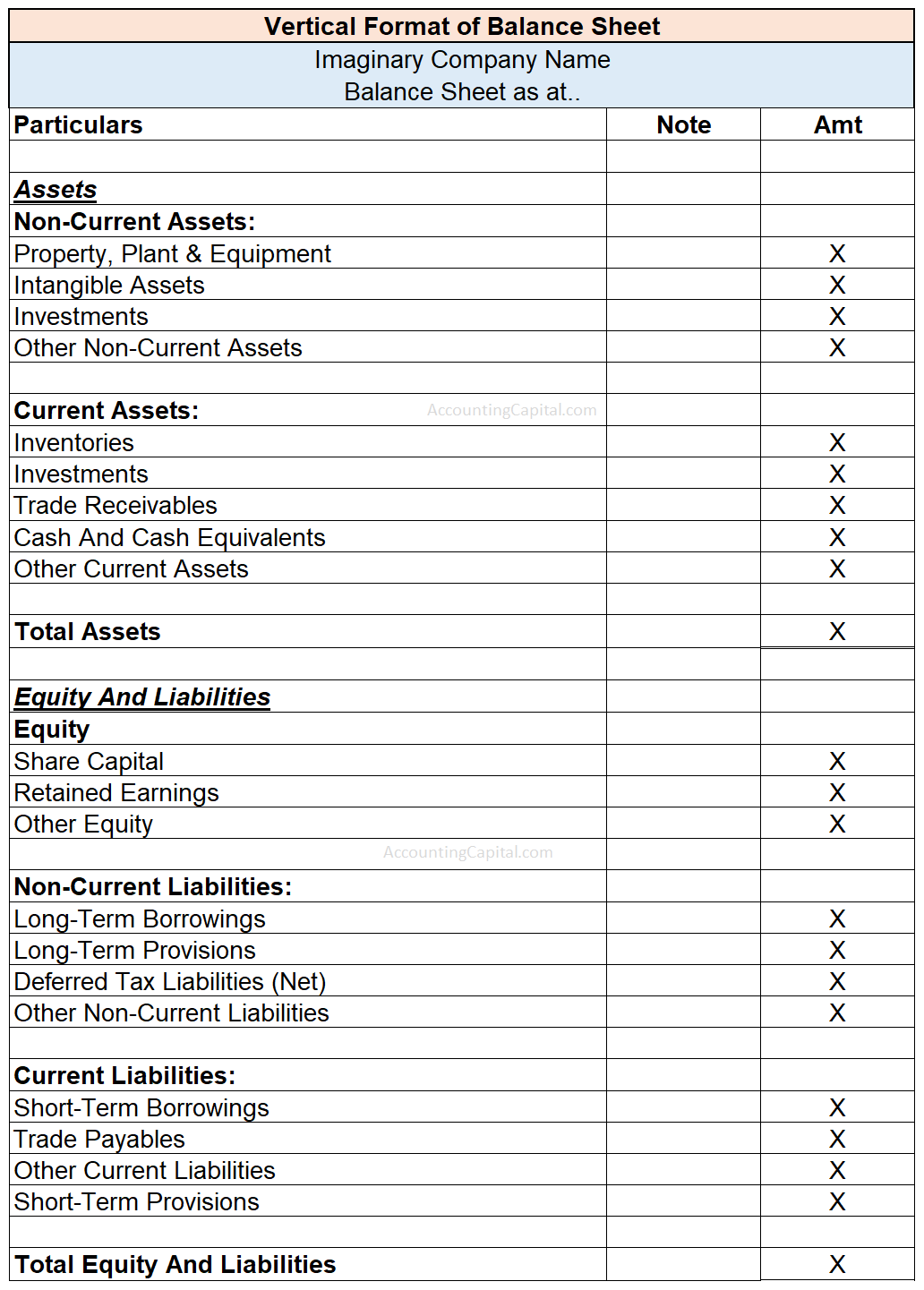

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Final accounts show both the financial position of a business along with the profitability, they are used by external and internal parties for various purposes. It lists assets (what the company owns), liabilities (what it owes), and shareholders’ equity (owners’ claim on assets), ensuring that assets equal liabilities plus equity.

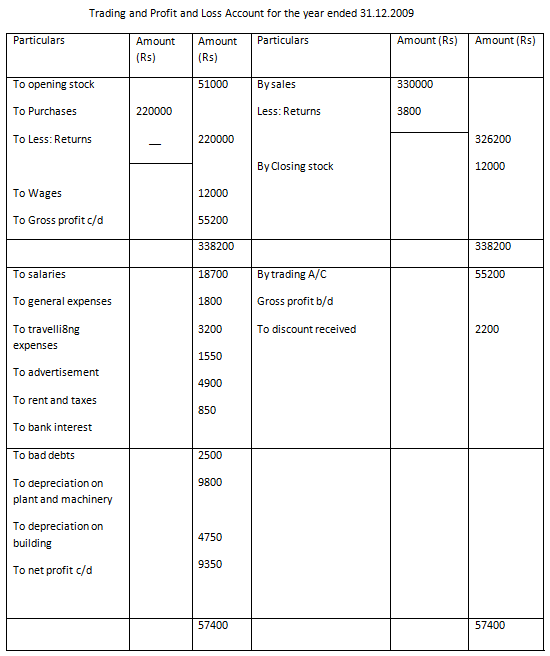

Add total liabilities to total shareholders’ equity and compare to assets. You are required to prepare trading and profit and profit and loss account / income statement for the year ended may. Popularly, the trading and profit & loss account and the balance sheet are together called the final accounts.

Balance sheet accounts an overview of the final accounts of sole proprietors can be explained with the help of the following chart : To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. It shows what and how much entity owns (i.e.

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. The final accounts of an entity consists of the following accounts: Record debit items on expense side of p and l account or assets side in balance sheet;

The balance sheet accurately depicts the company's financial status as of the report's date. Further, these are audited by the internal as well as external auditors, usually the. These are prepared at the end of the business’s accounting year after the trial balance has been completed.

By kate christobek. Final accounts is a somewhat archaic bookkeeping term that refers to the final trial balance at the end of an accounting period from which the financial statements are derived. Balance sheet shows the financial position of the entity as at a particular point of time.

We announced £3.6 billion of capital returns to shareholders, including an interim dividend of 5.5p at the half year and a proposed final dividend of 11.5p, bringing the total for 2023 to 17.0p, representing a 26% increase on 2022. Our business performance was grounded in helping customers. Final accounts can be calculated as follows:

Its assets) and how much it owes to others (i.e. The profit and loss account (the income statement) the balance sheet. The trial balance includes all the balances of the ledger accounts, including the account balances of expenses, revenue, assets, liabilities, capital, and drawings.

Its liabilities), the balance (i.e. Final accounting includes the statement of profit & loss and balance sheet balance sheet a balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.