Nice Tips About Cash Flow Fund Cisco Balance Sheet

Lure of cash poses challenges for asset managers.

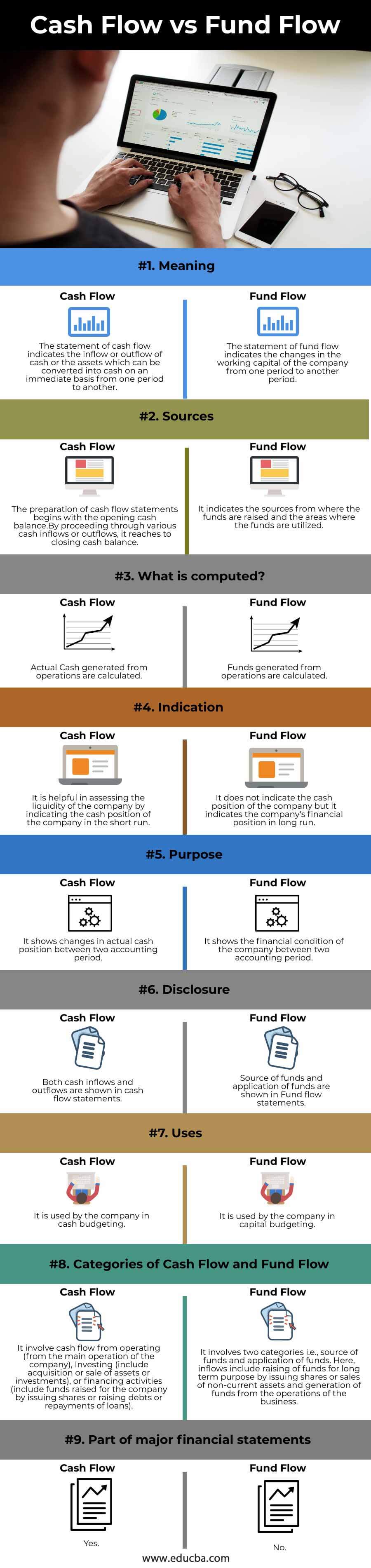

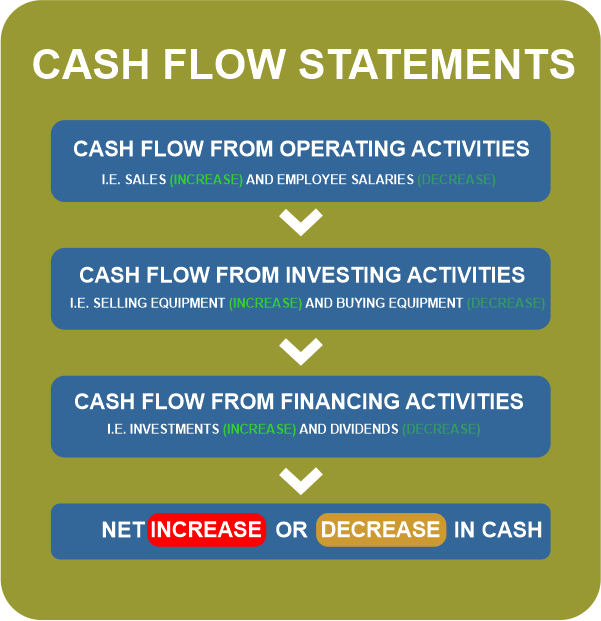

Cash flow fund. The cash flow statement’s utility is finding out the net cash flow. Cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. The fund flow records the movement of cash in and out of the company.

The fund seeks to provide regular payouts˜ by investing in a diversified portfolio. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric. A company creates value for.

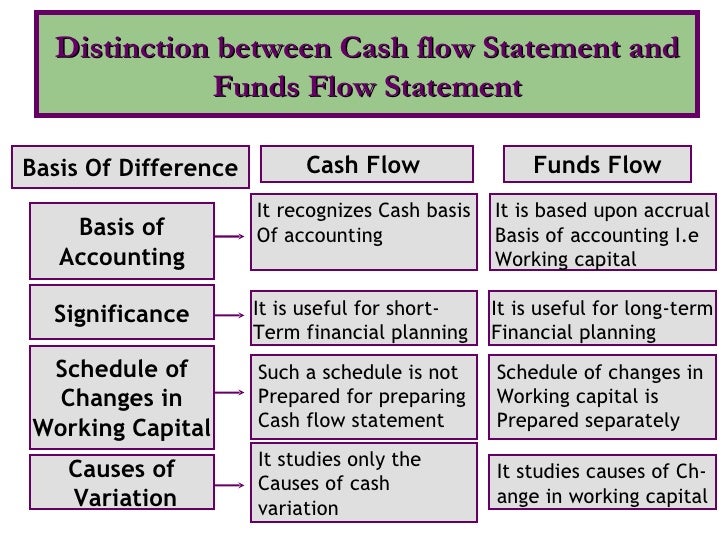

Cash flow focuses on the actual movement of money, while fund flow analysis considers the sources, uses, and changes in financial resources. Companies that exhibit high free cash flow yields, relative to the broader domestic equity market. December 29, 2022 payout rate:

Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Cash flow kings 100 etf (flow) offers exposure to u.s. The utility of fund flow is to understand the financial position of the company.

Td asset management inc. Margaret giles dec 16, 2020 what are fund flows? Analyses the inflows and outflows of cash in a particular accounting period:

Managed by eastspring investments (singapore) ltd. Accounting for cash flow is done only when liquid cash is involved in the form of currency or bank transfer. Offers a range of solutions specifically designed to help meet clients’ cash flow needs.

A specific series of funds that seek to provide cash flow consisting of earned income and return of capital (roc)1. Prulink cash flow fund plus is one of the funds in our suite of prulink funds you can invest in. 20 working days from declaration date

Cash flow is based on a narrow concept called “cash.”. Much of this cash found its way into money market funds. Take money every day.

Analyses the sources and applications of funds generated by the company in a particular period: Cash received represents inflows, while money spent represents outflows. There are many types of cf, with various important uses for running a business and performing financial analysis.

Fund flow is the cash that flows into and out of various financial assets for specific periods of time. Receive potential regular payouts˜ of up to 6% per year or up to 1.5% per quarter so you can build your wealth for the medium to long term. 02/19/2024 07:00 am est.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)